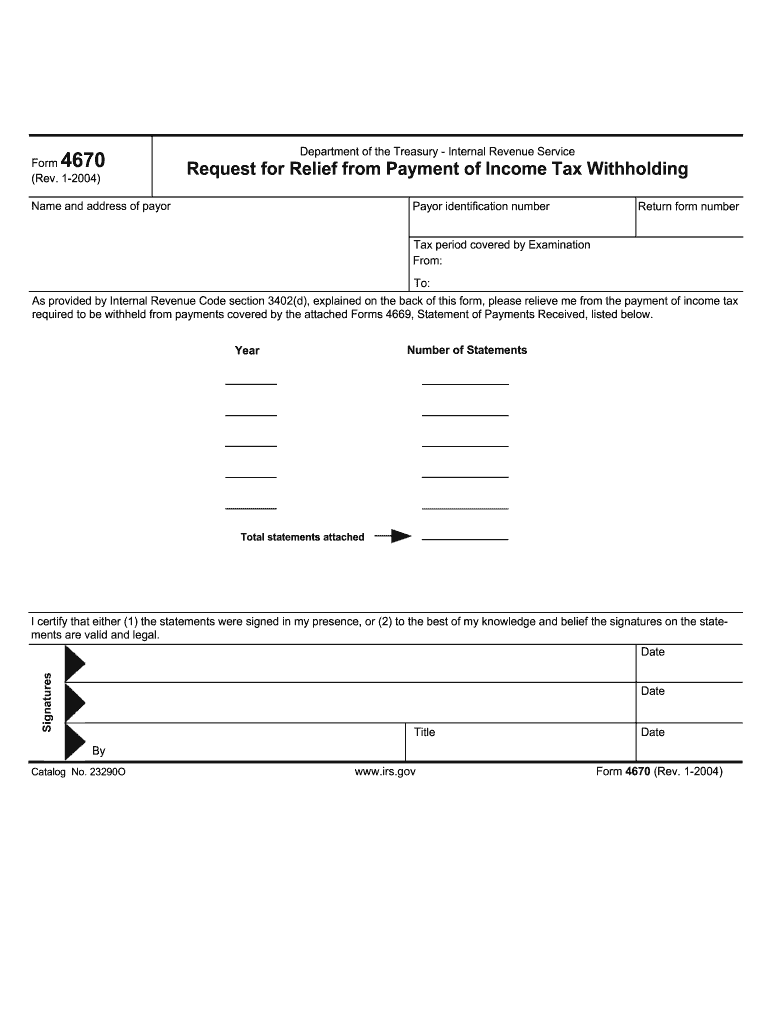

Form 4670

What is the Form 4670

The Form 4670 is an IRS document used primarily for reporting certain tax-related information. It is essential for taxpayers who need to provide specific details regarding their income or deductions. This form helps in maintaining compliance with federal tax regulations and ensures accurate reporting of financial data.

How to use the Form 4670

Using the Form 4670 involves several steps to ensure proper completion and submission. First, gather all necessary financial documents that pertain to the information required on the form. Next, carefully fill out the form, ensuring that all entries are accurate and complete. Once the form is filled, it can be submitted electronically or via mail, depending on the specific instructions provided by the IRS.

Steps to complete the Form 4670

Completing the Form 4670 requires attention to detail. Follow these steps:

- Review the instructions provided with the form to understand the requirements.

- Collect relevant financial documents, such as income statements and receipts.

- Fill out the form accurately, ensuring all sections are completed.

- Double-check the information for any errors or omissions.

- Submit the form according to the IRS guidelines, either online or by mail.

Legal use of the Form 4670

The legal use of the Form 4670 hinges on its compliance with IRS regulations. For the form to be considered valid, it must be filled out accurately and submitted within the designated time frame. Failure to comply with these requirements can result in penalties or delays in processing. Utilizing a reliable eSignature solution can enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4670 are crucial for taxpayers to adhere to in order to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. It's important to stay updated on any changes to these dates, as they can vary from year to year, especially in response to federal regulations or emergencies.

Required Documents

To complete the Form 4670, certain documents are necessary. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Any previous tax returns that may provide relevant information.

Having these documents organized will facilitate a smoother completion process of the form.

Quick guide on how to complete form 4670

Effortlessly Complete Form 4670 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents quickly without any delays. Manage Form 4670 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to Modify and Electronically Sign Form 4670 with Ease

- Obtain Form 4670 and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 4670 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4670

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4670 and how is it used?

Form 4670 is a crucial document for various business processes, facilitating effective communication and compliance. It serves as a standard form that can be easily customized and electronically signed using airSlate SignNow, streamlining your workflow.

-

How can airSlate SignNow help me complete form 4670?

With airSlate SignNow, you can easily fill out and eSign form 4670 while ensuring that all necessary fields are completed accurately. The platform's intuitive interface simplifies document management, making it easy to collect signatures and track the progress of your form.

-

What are the pricing options for using airSlate SignNow for form 4670?

airSlate SignNow offers various pricing plans, allowing you to choose one that best fits your needs when managing form 4670. Each plan provides access to essential features like eSigning, document editing, and integration capabilities, ensuring you get the most value.

-

Are there any features specifically for form 4670 in airSlate SignNow?

Yes, airSlate SignNow offers features tailored for form 4670, such as customizable templates and automated workflows. These capabilities enhance the efficiency of filling out and transitioning your form through different stages, from initiation to final approval.

-

Can I integrate airSlate SignNow with other software for managing form 4670?

Absolutely! airSlate SignNow allows seamless integration with numerous applications, enhancing how you manage form 4670. Whether you use CRM systems, cloud storage, or project management tools, you can easily link them for a more streamlined experience.

-

What security measures does airSlate SignNow provide for form 4670?

airSlate SignNow prioritizes the security of your documents, including form 4670. The platform employs industry-standard encryption, secure access controls, and compliance with legal regulations to ensure your information remains safe and confidential.

-

How long does it take to get form 4670 signed using airSlate SignNow?

Using airSlate SignNow, getting form 4670 signed can often be completed within minutes. The quick eSigning process ensures that your documents are executed efficiently, signNowly reducing the turnaround time compared to traditional methods.

Get more for Form 4670

Find out other Form 4670

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement