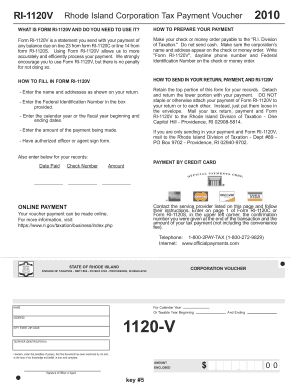

Ri 1120v Form

What is the Ri 1120v Form

The Ri 1120v Form is a tax document used by corporations in the United States to report their income, deductions, and tax liability. This form is specifically designed for certain types of business entities, including C corporations, and is an essential part of the annual tax filing process. By completing the Ri 1120v Form, corporations provide the Internal Revenue Service (IRS) with detailed information about their financial activities for the tax year. This ensures compliance with federal tax laws and helps determine the amount of tax owed or any potential refunds.

How to use the Ri 1120v Form

Using the Ri 1120v Form involves several steps to ensure accurate reporting of corporate income and expenses. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, fill out the form by entering the required information, such as total revenue, cost of goods sold, and operating expenses. Be sure to follow the instructions provided by the IRS to avoid errors. Once completed, the form can be submitted electronically or by mail, depending on the preferred method of filing.

Steps to complete the Ri 1120v Form

Completing the Ri 1120v Form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial records, including income and expense statements.

- Begin filling out the form by entering the corporation's name, address, and Employer Identification Number (EIN).

- Report total income, including sales and other revenue sources.

- Deduct allowable expenses, such as salaries, rent, and utilities, to determine taxable income.

- Calculate the tax liability based on the applicable corporate tax rate.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the designated deadline.

Legal use of the Ri 1120v Form

The Ri 1120v Form is legally binding when completed and submitted according to IRS regulations. To ensure its legal standing, corporations must provide accurate financial information and adhere to deadlines. Electronic submissions of the form are recognized as valid under the Electronic Signatures in Global and National Commerce (ESIGN) Act, provided that the electronic signature meets specific requirements. This makes it crucial for businesses to use trusted platforms for electronic filing to maintain compliance and legal integrity.

Filing Deadlines / Important Dates

Filing deadlines for the Ri 1120v Form are crucial for compliance with IRS regulations. Generally, corporations must file their tax returns by the fifteenth day of the fourth month following the end of their fiscal year. For corporations operating on a calendar year, this means the deadline is typically April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also apply for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods

The Ri 1120v Form can be submitted through various methods, allowing corporations flexibility in how they file their taxes. Options include:

- Electronic submission through IRS-approved e-filing systems, which is often faster and more secure.

- Mailing a paper copy of the completed form to the appropriate IRS address, ensuring it is postmarked by the filing deadline.

- In-person submission at designated IRS offices, although this option may be less common.

Quick guide on how to complete ri 1120v form

Effortlessly Prepare Ri 1120v Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents swiftly without complications. Manage Ri 1120v Form seamlessly on any device using the airSlate SignNow Android or iOS applications, and streamline any document-related task today.

The Simplest Way to Edit and Electronically Sign Ri 1120v Form Effortlessly

- Find Ri 1120v Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or conceal sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Ri 1120v Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri 1120v form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ri 1120v Form?

The Ri 1120v Form is a tax form used by businesses in Rhode Island to report and pay income tax. Understanding this form is crucial for compliance and to avoid penalties. Using airSlate SignNow, you can easily manage and eSign your Ri 1120v Form for convenient submission.

-

How can airSlate SignNow help with the Ri 1120v Form?

airSlate SignNow simplifies the process of completing and submitting the Ri 1120v Form with its user-friendly document management tools. You can securely eSign the form and send it directly to the relevant tax authorities. This streamlines your tax preparation process, saving you time and effort.

-

What are the pricing options for using airSlate SignNow for the Ri 1120v Form?

airSlate SignNow offers various subscription plans to cater to different business needs, all providing access to features useful for preparing the Ri 1120v Form. You can choose from monthly or annual plans, ensuring that you only pay for what you need. Check our pricing page for detailed options and select a plan that fits your business budget.

-

Is airSlate SignNow secure for handling the Ri 1120v Form?

Yes, airSlate SignNow takes data security seriously, ensuring that all information related to your Ri 1120v Form is protected. We utilize advanced encryption and secure access protocols, so you can be confident that your financial data remains safe and confidential during the eSigning process.

-

Can I integrate airSlate SignNow with my accounting software for the Ri 1120v Form?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software platforms, enabling you to easily pull in data for the Ri 1120v Form. This integration helps streamline your tax documentation process, ensuring accuracy and reducing manual entry errors.

-

What features does airSlate SignNow offer for completing the Ri 1120v Form?

airSlate SignNow provides features such as customizable templates, collaborative editing, and secure eSigning specifically for forms like the Ri 1120v Form. These tools enhance your document management and ensure all involved parties can review and sign the document efficiently.

-

How long does it take to complete the Ri 1120v Form using airSlate SignNow?

Using airSlate SignNow, completing the Ri 1120v Form can be done in a matter of minutes, depending on the complexity of your information. The streamlined interface and automation reduce the time you spend on paperwork, allowing you to focus on other vital tasks in your business.

Get more for Ri 1120v Form

- Nomination form for election sample 368716706

- Admissionstheater tax return the south carolina sctax form

- Dupage medical group medical records form

- Huntington mortgage group form

- Mylicensesite 240966655 form

- Hal survival certificate 23 form

- Ug i year prospectus 15 dr br ambedkar open university form

- Vertex formula worksheet

Find out other Ri 1120v Form

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure