Cp575 Form

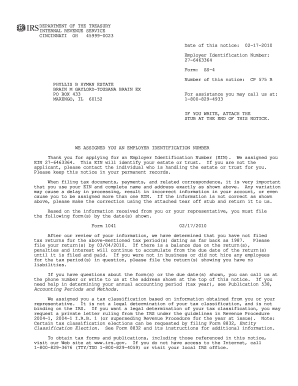

What is the CP575?

The CP575 is an IRS notice that serves as confirmation of an employer's identification number (EIN). This form is essential for businesses and organizations that need to report taxes and other financial information to the IRS. The CP575 letter is typically issued after an EIN application has been processed, providing the taxpayer with their unique identification number. Understanding the significance of the CP575 is crucial for compliance with federal tax regulations.

How to Obtain the CP575

To obtain the CP575, businesses must first apply for an EIN through the IRS. This can be done online, by mail, or by fax. Once the application is processed, the IRS will send the CP575 notice to the address provided in the application. If a business does not receive the CP575 within a few weeks of applying, it is advisable to contact the IRS directly to ensure the application was processed correctly.

Steps to Complete the CP575

Completing the CP575 involves several key steps:

- Review the information on the CP575 to ensure it is accurate.

- Use the EIN provided in the notice for all tax-related documents and filings.

- Keep the CP575 in a secure location, as it serves as proof of your EIN.

- If corrections are needed, follow the IRS guidelines for amending your EIN application.

Legal Use of the CP575

The CP575 is legally recognized as proof of an EIN, which is required for various business activities, including filing taxes, opening bank accounts, and applying for business licenses. It is important to ensure that the information on the CP575 is accurate and up-to-date, as discrepancies can lead to compliance issues with the IRS.

Filing Deadlines / Important Dates

While the CP575 itself does not have specific filing deadlines, it is important to be aware of the deadlines for tax filings that require the EIN. Businesses should ensure they file their tax returns on time to avoid penalties. Additionally, any updates or changes to the business structure that might require a new EIN should be reported to the IRS promptly.

Required Documents

When applying for an EIN and subsequently receiving the CP575, certain documents may be required. These typically include:

- Form SS-4, the application for an EIN.

- Identification documents for the responsible party, such as a driver's license or passport.

- Business formation documents, if applicable, such as articles of incorporation or partnership agreements.

IRS Guidelines

The IRS provides specific guidelines regarding the use and maintenance of the CP575. It is essential for businesses to follow these guidelines to ensure compliance. This includes keeping the CP575 secure, using the EIN for all tax-related matters, and understanding when a new EIN may be necessary, such as in the case of a change in business structure.

Quick guide on how to complete cp575

Easily Prepare Cp575 on Any Device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and efficiently. Manage Cp575 on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The Easiest Way to Modify and eSign Cp575 Effortlessly

- Find Cp575 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you want to send your form, whether via email, SMS, invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Cp575 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp575

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cp575 and how does it work with airSlate SignNow?

The cp575 is a vital form used by the IRS for various tax-related processes. With airSlate SignNow, users can effortlessly upload, sign, and send cp575 documents electronically, ensuring compliance and minimizing paper usage. This streamlined process signNowly enhances efficiency and reduces the time spent on handling paperwork.

-

What features does airSlate SignNow offer for managing cp575 documents?

airSlate SignNow provides powerful features tailored for cp575 documents, including customizable templates, secure eSignature capabilities, and real-time document tracking. Users can easily integrate fields for signing, dates, and other necessary information directly on the cp575 form. These features simplify the management of important tax documents.

-

Is airSlate SignNow cost-effective for users needing to handle cp575 forms?

Yes, airSlate SignNow offers competitive pricing plans that are particularly cost-effective for businesses that frequently handle cp575 forms. The subscription allows unlimited users and document signing, making it an economical choice for teams needing to manage multiple cp575 documents without extensive overhead costs.

-

Can I integrate airSlate SignNow with other software to manage cp575 documents?

Absolutely! airSlate SignNow supports integrations with numerous popular applications such as Google Drive, Salesforce, and Dropbox. This means you can manage your cp575 documents seamlessly alongside your existing software, improving workflow and efficiency.

-

What are the benefits of using airSlate SignNow for signing cp575 forms?

Using airSlate SignNow to sign cp575 forms offers several benefits, such as increased security, faster transaction times, and enhanced accessibility. The platform ensures that your documents are securely signed and stored, minimizing the risk of loss or fraud while allowing users to access them anytime, anywhere.

-

How does airSlate SignNow ensure the security of cp575 documents?

airSlate SignNow implements advanced security measures to protect cp575 documents, including encryption, multi-factor authentication, and secure cloud storage. These features ensure that your sensitive tax documents remain private and secure throughout the signing and storage process.

-

What support options are available for users of airSlate SignNow handling cp575?

Users of airSlate SignNow can access a variety of support options when managing cp575 documents, including a comprehensive knowledge base, live chat, and email support. This ensures that any questions or issues related to cp575 forms can be resolved quickly and effectively.

Get more for Cp575

- Notices resolutions simple stock ledger and certificate michigan form

- Minutes for organizational meeting michigan michigan form

- Michigan file form

- Js 44 civil cover sheet federal district court michigan form

- Paint disclosure form

- Lead based paint disclosure for rental transaction michigan form

- Notice of lease for recording michigan form

- Sample cover letter for filing of llc articles or certificate with secretary of state michigan form

Find out other Cp575

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form