H 4 Model Form for Credit Score Disclosure Exception for Loans Not Secured by Residential Real Property Federalreserve

What is the H-4 model form for credit score disclosure exception for loans not secured by residential real property?

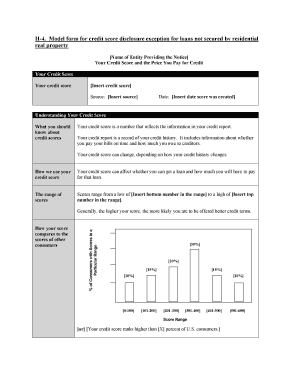

The H-4 model form is a specific document used in the context of credit score disclosure exceptions for certain loans. This form is particularly relevant for loans that are not secured by residential real property. It serves to inform borrowers about their credit scores and any exceptions that may apply to the standard disclosure requirements. Understanding this form is crucial for both lenders and borrowers, as it ensures compliance with federal regulations while protecting consumer rights.

Key elements of the H-4 model form for credit score disclosure exception

The H-4 model form includes several vital components that must be accurately filled out. Key elements typically consist of:

- Borrower Information: This section requires the personal details of the borrower, including name and contact information.

- Loan Details: Information about the loan, such as the loan amount and type, must be provided.

- Credit Score Information: This includes the credit score being disclosed and any relevant exceptions to the disclosure requirements.

- Signature Section: A designated area for the borrower’s signature, confirming receipt and understanding of the information provided.

Steps to complete the H-4 model form for credit score disclosure exception

Completing the H-4 model form involves several straightforward steps:

- Gather necessary information, including personal and loan details.

- Carefully fill out each section of the form, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Sign and date the form in the designated section.

- Submit the form to the lender or relevant financial institution as instructed.

Legal use of the H-4 model form for credit score disclosure exception

The H-4 model form is legally recognized under federal regulations regarding credit score disclosures. Its proper use ensures compliance with the Fair Credit Reporting Act (FCRA) and other relevant laws. By utilizing this form, lenders can provide borrowers with necessary information while adhering to legal requirements. It is essential that both parties understand the implications of the form and its role in the lending process.

How to obtain the H-4 model form for credit score disclosure exception

Obtaining the H-4 model form can be done through various channels. Lenders typically provide this form directly to borrowers during the loan application process. Additionally, financial institutions may have the form available on their websites or upon request. It is advisable for borrowers to inquire with their lender to ensure they have the most current version of the form.

Examples of using the H-4 model form for credit score disclosure exception

The H-4 model form can be utilized in various scenarios. For instance, if a borrower applies for a personal loan that is not secured by residential property, the lender may issue the H-4 form to disclose the borrower's credit score. Another example includes situations where a borrower is seeking refinancing options. In both cases, the form serves to inform the borrower of their credit standing and any exceptions that may apply.

Quick guide on how to complete h 4 model form for credit score disclosure exception for loans not secured by residential real property federalreserve

Complete H 4 Model Form For Credit Score Disclosure Exception For Loans Not Secured By Residential Real Property Federalreserve seamlessly on any device

Web-based document management has gained traction among organizations and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage H 4 Model Form For Credit Score Disclosure Exception For Loans Not Secured By Residential Real Property Federalreserve on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to alter and eSign H 4 Model Form For Credit Score Disclosure Exception For Loans Not Secured By Residential Real Property Federalreserve effortlessly

- Locate H 4 Model Form For Credit Score Disclosure Exception For Loans Not Secured By Residential Real Property Federalreserve and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or missing documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign H 4 Model Form For Credit Score Disclosure Exception For Loans Not Secured By Residential Real Property Federalreserve and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the h 4 model form for credit score disclosure exception for loans not secured by residential real property federalreserve

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit score disclosure exception notice?

A credit score disclosure exception notice is a notification provided under specific circumstances, informing consumers about their credit scores and any exceptions to the standard disclosure requirements. These exceptions could occur if the score was not used for a credit decision. It's important to understand these nuances as they impact your financial transparency and rights.

-

How does airSlate SignNow help with credit score disclosure exception notices?

airSlate SignNow offers a seamless way to manage and send credit score disclosure exception notices, ensuring compliance with applicable regulations. The platform allows users to create, sign, and store documents securely, enhancing your operational efficiency. By utilizing our solution, businesses can simplify the process of notifying customers while maintaining transparency.

-

Are there any costs associated with sending a credit score disclosure exception notice through airSlate SignNow?

Using airSlate SignNow to send credit score disclosure exception notices is part of our subscription plans, which are designed to be cost-effective for businesses of all sizes. Our pricing structure is transparent, with no hidden fees, making it easy to budget for compliance-related document management. You can choose a plan that suits your volume of documents and organizational needs.

-

What features does airSlate SignNow offer for managing credit score disclosure exception notices?

airSlate SignNow includes a variety of features specifically for handling credit score disclosure exception notices, including customizable templates, electronic signatures, and secure document storage. Additionally, the platform provides tracking and reminders to ensure timely delivery. These features streamline the process and help maintain compliance with legal requirements.

-

Can I customize the credit score disclosure exception notice using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your credit score disclosure exception notices according to your brand and specific regulatory requirements. You can edit templates to include necessary details and personalize the format. This customization capability ensures your notices are informative and reflect your organization's identity.

-

How does airSlate SignNow integrate with other tools for credit score disclosure management?

airSlate SignNow offers integrations with a variety of business tools, enhancing your ability to manage credit score disclosure exception notices efficiently. Whether you use CRM systems or financial software, our platform can connect seamlessly to streamline your workflows. This interoperability ensures a more fluid document management experience.

-

Is there customer support available for issues related to credit score disclosure exception notices?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any questions or issues regarding credit score disclosure exception notices. Whether you need help with sending documents or understanding compliance, our support team is ready to help ensure your business operates smoothly.

Get more for H 4 Model Form For Credit Score Disclosure Exception For Loans Not Secured By Residential Real Property Federalreserve

- Llc notices resolutions and other operations forms package mississippi

- Notice of dishonored check civil keywords bad check bounced check mississippi form

- Check bad form 497313914

- Ms trust form

- Mississippi certificate trust form

- Mutual wills containing last will and testaments for man and woman living together not married with no children mississippi form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children mississippi form

- Mutual wills or last will and testaments for man and woman living together not married with minor children mississippi form

Find out other H 4 Model Form For Credit Score Disclosure Exception For Loans Not Secured By Residential Real Property Federalreserve

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now