Olmsted County Homestead Application Form

What is the Olmsted County Homestead Application

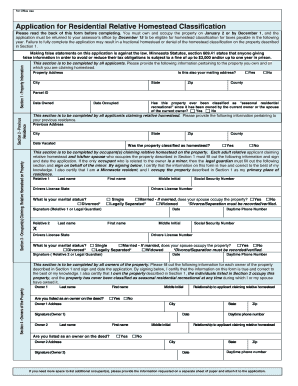

The Olmsted County Homestead Application is a formal request submitted by property owners to obtain homestead status for their residential property. This designation can provide significant tax benefits, including reductions in property taxes. Homestead status is typically granted to properties that serve as the primary residence of the owner, and the application process ensures that only eligible properties receive these advantages. Understanding the criteria for eligibility is essential for homeowners looking to maximize their tax savings.

Steps to complete the Olmsted County Homestead Application

Completing the Olmsted County Homestead Application involves several key steps. First, gather all necessary information about the property, including the address, parcel number, and ownership details. Next, ensure you meet the eligibility criteria, which typically include residency requirements and ownership status. Fill out the application form accurately, providing all required information. Once completed, review the application for any errors before submission. Finally, submit the application through the designated method, whether online, by mail, or in person, ensuring that it is submitted before the deadline for maximum benefit.

Required Documents

When applying for the Olmsted County Homestead Application, specific documents are necessary to support your request. These may include:

- Proof of ownership, such as a deed or property tax statement

- Identification documents, like a driver's license or state ID

- Evidence of residency, which can be shown through utility bills or lease agreements

- Any additional documentation requested by the county assessor's office

Having these documents ready will streamline the application process and help ensure a successful submission.

Eligibility Criteria

To qualify for the Olmsted County Homestead Application, applicants must meet specific eligibility criteria. Generally, the property must be the primary residence of the owner, and the owner must occupy the home for a significant portion of the year. Additionally, the applicant should not claim homestead status on any other property. It is important to verify that all conditions are met before submitting the application to avoid delays or denials.

Form Submission Methods

The Olmsted County Homestead Application can be submitted through various methods to accommodate different preferences. Homeowners may choose to apply online through the county's official website, which often provides a streamlined process. Alternatively, applications can be mailed directly to the county assessor's office or submitted in person during business hours. Each method has its advantages, so it is essential to select the one that best fits your needs and timeline.

Legal use of the Olmsted County Homestead Application

The legal use of the Olmsted County Homestead Application is governed by state and local laws that outline the requirements and processes for obtaining homestead status. Proper completion and submission of the application are crucial for ensuring compliance with these regulations. Failing to adhere to legal guidelines may result in penalties or denial of benefits. Understanding the legal framework surrounding the application can help homeowners navigate the process more effectively.

Quick guide on how to complete olmsted county homestead application

Complete Olmsted County Homestead Application effortlessly on any device

Online document management has become favored by businesses and individuals alike. It offers a perfect environmentally friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your files swiftly without delays. Handle Olmsted County Homestead Application on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to adjust and electronically sign Olmsted County Homestead Application without hassle

- Obtain Olmsted County Homestead Application and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign Olmsted County Homestead Application and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the olmsted county homestead application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the olmsted county homestead application?

The olmsted county homestead application is a form used by property owners to apply for homestead classification, which may reduce property taxes. Submitting this application allows homeowners to benefit from tax breaks depending on their eligibility and property usage. It’s important to complete the application correctly to maximize these benefits.

-

How can airSlate SignNow assist with the olmsted county homestead application process?

airSlate SignNow simplifies the olmsted county homestead application process by allowing users to easily prepare, sign, and send their application documents electronically. This streamlines communication and reduces turnaround time, ensuring that your application is submitted promptly. The platform's user-friendly interface enhances the overall experience.

-

What features does airSlate SignNow offer for the olmsted county homestead application?

airSlate SignNow offers features such as eSigning, document templates, and collaborative tools to facilitate the olmsted county homestead application process. Users can create and customize their applications, gather necessary signatures, and track document status in real-time. These features help ensure that all requirements are met efficiently.

-

Is there a cost associated with using airSlate SignNow for the olmsted county homestead application?

Yes, there is a subscription fee for using airSlate SignNow; however, it is designed to be cost-effective for individuals and businesses. By utilizing the platform for the olmsted county homestead application, users often save money in the long run by avoiding paper and postage costs. The pricing plans are flexible to accommodate various user needs.

-

Can I access airSlate SignNow from any device while completing the olmsted county homestead application?

Absolutely! airSlate SignNow is accessible on multiple devices including desktops, tablets, and smartphones. This convenient access allows users to complete and manage their olmsted county homestead application from anywhere, ensuring that they can submit their applications at their convenience.

-

How secure is the information submitted through airSlate SignNow for the olmsted county homestead application?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and security protocols to protect all information related to the olmsted county homestead application. Users can rest assured that their sensitive data is safe throughout the entire signing process.

-

What integrations does airSlate SignNow offer that can help with the olmsted county homestead application?

airSlate SignNow integrates seamlessly with various applications including CRM systems and cloud storage services. These integrations enhance the overall efficiency of managing the olmsted county homestead application process, enabling users to pull necessary information easily and organize their documents effectively.

Get more for Olmsted County Homestead Application

Find out other Olmsted County Homestead Application

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online