T 72 Rhode Island Division of Taxation Tax State Ri Form

What is the T 72 Rhode Island Division Of Taxation Tax State Ri?

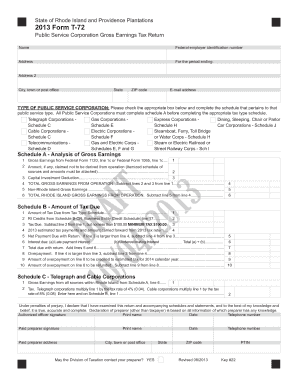

The T 72 Rhode Island Division Of Taxation Tax State Ri form is a specific tax document used by residents and businesses in Rhode Island for various tax reporting purposes. This form is essential for ensuring compliance with state tax regulations and is utilized to report income, deductions, and other relevant financial information to the Rhode Island Division of Taxation. Understanding the purpose of this form is crucial for accurate tax filing and to avoid potential penalties.

Steps to complete the T 72 Rhode Island Division Of Taxation Tax State Ri

Completing the T 72 form involves several key steps that ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and deduction records. Next, carefully fill out the form, ensuring that all information is accurate and up-to-date. Pay special attention to sections that require specific details, such as taxpayer identification numbers and income sources. Once completed, review the form for any errors before submission.

Legal use of the T 72 Rhode Island Division Of Taxation Tax State Ri

The T 72 form holds legal significance as it serves as an official record of tax reporting to the state. To be considered legally valid, the form must be completed accurately and submitted by the designated deadlines. Additionally, it must comply with state tax laws and regulations. Utilizing a reliable electronic signature solution can enhance the legal standing of the submitted form, ensuring it meets all necessary legal requirements.

Filing Deadlines / Important Dates

Timely submission of the T 72 form is critical to avoid penalties. The filing deadlines may vary depending on whether the taxpayer is an individual or a business entity. Generally, personal income tax returns are due on April fifteenth, while corporate tax returns may have different deadlines. It is advisable to check the Rhode Island Division of Taxation’s official calendar for specific dates and any updates regarding extensions or changes in filing requirements.

Required Documents

To successfully complete the T 72 form, certain documents are required. These typically include proof of income, such as W-2 forms or 1099 statements, as well as documentation for any deductions or credits being claimed. It is important to have these documents organized and readily available to ensure a smooth filing process. Missing or incorrect documents can lead to delays or complications in the tax filing process.

Who Issues the Form

The T 72 Rhode Island Division Of Taxation Tax State Ri form is issued by the Rhode Island Division of Taxation. This state agency is responsible for overseeing tax compliance and administration within Rhode Island. They provide the necessary forms and guidance for taxpayers to fulfill their state tax obligations. For any questions or clarifications regarding the form, taxpayers can reach out directly to the Division of Taxation.

Penalties for Non-Compliance

Failure to file the T 72 form on time or inaccuracies in the submitted information can result in penalties. These may include fines, interest on unpaid taxes, or additional legal repercussions. It is essential for taxpayers to understand the implications of non-compliance and to take proactive steps to ensure that their tax filings are accurate and submitted on time. Consulting with a tax professional can help mitigate risks associated with penalties.

Quick guide on how to complete t 72 rhode island division of taxation tax state ri

Easily Prepare T 72 Rhode Island Division Of Taxation Tax State Ri on Any Device

Online document management has become increasingly popular among enterprises and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage T 72 Rhode Island Division Of Taxation Tax State Ri on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

Effortlessly Edit and eSign T 72 Rhode Island Division Of Taxation Tax State Ri

- Find T 72 Rhode Island Division Of Taxation Tax State Ri and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, either via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your requirements for document management in just a few clicks from any device you prefer. Edit and electronically sign T 72 Rhode Island Division Of Taxation Tax State Ri and ensure exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t 72 rhode island division of taxation tax state ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the T 72 Rhode Island Division Of Taxation Tax State Ri form?

The T 72 Rhode Island Division Of Taxation Tax State Ri form is used for reporting various tax obligations to the Rhode Island Division of Taxation. This form provides essential information for businesses to comply with state tax regulations. Understanding and correctly submitting the T 72 is crucial to avoid penalties and ensure smooth operations.

-

How can airSlate SignNow help with the T 72 Rhode Island Division Of Taxation Tax State Ri?

airSlate SignNow simplifies the process of preparing, signing, and sending the T 72 Rhode Island Division Of Taxation Tax State Ri form. Our platform allows users to easily eSign documents which can expedite the submission process. With airSlate SignNow, you can ensure that your tax forms are accurately completed and submitted on time.

-

What are the pricing options for using airSlate SignNow for the T 72 Rhode Island Division Of Taxation Tax State Ri?

airSlate SignNow offers various pricing plans tailored to meet different business needs, including options for those specifically dealing with the T 72 Rhode Island Division Of Taxation Tax State Ri. Our pricing is competitive and provides excellent value, ensuring that businesses can manage their document signing efficiently without breaking the bank.

-

Is airSlate SignNow secure for handling the T 72 Rhode Island Division Of Taxation Tax State Ri documents?

Yes, airSlate SignNow is highly secure for handling all documents, including the T 72 Rhode Island Division Of Taxation Tax State Ri. Our platform uses advanced encryption and compliance protocols to protect sensitive tax information. You can trust airSlate SignNow to keep your documents safe and secure.

-

What features does airSlate SignNow offer to improve document management for T 72 Rhode Island Division Of Taxation Tax State Ri?

airSlate SignNow provides a variety of features that enhance document management for the T 72 Rhode Island Division Of Taxation Tax State Ri form, such as customizable templates, automated workflows, and real-time tracking. These features empower users to manage their documentation efficiently while ensuring adherence to deadlines and compliance requirements.

-

Can I integrate airSlate SignNow with other software for T 72 Rhode Island Division Of Taxation Tax State Ri processing?

Absolutely! airSlate SignNow offers integration capabilities with various software tools that can enhance your processing of the T 72 Rhode Island Division Of Taxation Tax State Ri. This means you can seamlessly connect with your existing systems to streamline workflows and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for filing the T 72 Rhode Island Division Of Taxation Tax State Ri?

Using airSlate SignNow for filing the T 72 Rhode Island Division Of Taxation Tax State Ri offers numerous benefits, including increased efficiency, reduced errors, and faster turnaround times. Our platform simplifies the signing process and enables instant document management. This ultimately aids in staying compliant with Rhode Island tax regulations.

Get more for T 72 Rhode Island Division Of Taxation Tax State Ri

Find out other T 72 Rhode Island Division Of Taxation Tax State Ri

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free