Form 70 001 10 8 1 000 Rev

What is the Form 70 001 10 8 1 000 Rev

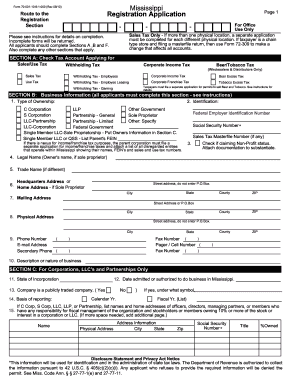

The Form 70 001 10 8 1 000 Rev is a specific document used within certain administrative processes in the United States. This form serves various purposes depending on the context in which it is utilized. It is essential for individuals and businesses to understand its function to ensure proper compliance with applicable regulations. The form may be required for legal, financial, or administrative procedures, making it a vital part of many official transactions.

How to use the Form 70 001 10 8 1 000 Rev

Using the Form 70 001 10 8 1 000 Rev involves several key steps. First, ensure that you have the most current version of the form, as outdated versions may not be accepted. Next, carefully read the instructions provided with the form to understand the specific requirements for completion. Fill out the necessary fields accurately, providing all requested information. Once completed, you may need to sign the form, either electronically or in ink, depending on the submission method. Finally, submit the form according to the guidelines outlined in the instructions.

Steps to complete the Form 70 001 10 8 1 000 Rev

Completing the Form 70 001 10 8 1 000 Rev requires attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the form from a reliable source.

- Review the instructions carefully to understand all requirements.

- Fill in your personal or business information as required.

- Double-check all entries for accuracy and completeness.

- Sign the form, ensuring that your signature meets the necessary legal standards.

- Submit the form via the designated method, whether online, by mail, or in person.

Legal use of the Form 70 001 10 8 1 000 Rev

The legal use of the Form 70 001 10 8 1 000 Rev hinges on compliance with relevant laws and regulations. When properly completed and submitted, this form can serve as a legally binding document. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal repercussions. Understanding the legal implications of the form is crucial for both individuals and businesses to avoid potential issues.

Key elements of the Form 70 001 10 8 1 000 Rev

The Form 70 001 10 8 1 000 Rev contains several key elements that are essential for its validity. These include:

- Identification Information: Personal or business details that identify the submitter.

- Signature Section: A designated area for the required signature, which may need to be notarized.

- Submission Instructions: Clear guidelines on how and where to submit the form.

- Compliance Statements: Information regarding the legal obligations associated with the form.

Form Submission Methods (Online / Mail / In-Person)

The Form 70 001 10 8 1 000 Rev can typically be submitted through various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online Submission: Many forms can be submitted electronically through official websites, ensuring faster processing.

- Mail Submission: Forms may be printed and sent via postal service to the designated address.

- In-Person Submission: Some situations may require the form to be submitted directly at a specified office.

Quick guide on how to complete form 70 001 10 8 1 000 rev

Effortlessly prepare Form 70 001 10 8 1 000 Rev on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 70 001 10 8 1 000 Rev on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Form 70 001 10 8 1 000 Rev with minimal effort

- Obtain Form 70 001 10 8 1 000 Rev and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which requires just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Adjust and eSign Form 70 001 10 8 1 000 Rev to ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 70 001 10 8 1 000 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 70 001 10 8 1 000 Rev. used for?

Form 70 001 10 8 1 000 Rev. is typically used for specific documentation needs such as contract agreements or applications within various industries. Using airSlate SignNow, you can efficiently prepare and send this form for electronic signatures, streamlining your workflow.

-

How does airSlate SignNow support Form 70 001 10 8 1 000 Rev.?

airSlate SignNow supports Form 70 001 10 8 1 000 Rev. by providing a user-friendly platform for creating, customizing, and electronically signing the document. Our solution ensures that your forms are secure, compliant, and easily accessible, making the signing process seamless.

-

What are the pricing options for using airSlate SignNow with Form 70 001 10 8 1 000 Rev.?

airSlate SignNow offers various pricing plans to accommodate different business needs when managing documents like Form 70 001 10 8 1 000 Rev. You can choose from a free trial for basic features or opt for premium plans that unlock advanced functionalities to enhance your document management.

-

Can I integrate airSlate SignNow with other applications for Form 70 001 10 8 1 000 Rev. management?

Yes, airSlate SignNow offers seamless integration with various applications, improving the management of Form 70 001 10 8 1 000 Rev. You can connect with popular tools like Google Drive, Salesforce, and many more, ensuring an efficient workflow across your existing systems.

-

What benefits does airSlate SignNow provide for processing Form 70 001 10 8 1 000 Rev.?

Using airSlate SignNow for processing Form 70 001 10 8 1 000 Rev. offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced tracking of document status. Our platform also fosters better team collaboration and minimizes the risk of errors common with traditional paperwork.

-

Is airSlate SignNow secure for signing Form 70 001 10 8 1 000 Rev.?

Absolutely! airSlate SignNow prioritizes the security of your documents, including Form 70 001 10 8 1 000 Rev. Our advanced encryption and authentication measures ensure that your sensitive information remains safe throughout the signing process.

-

Can I access and manage Form 70 001 10 8 1 000 Rev. documents on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to access and manage Form 70 001 10 8 1 000 Rev. documents from your smartphone or tablet. This mobile capability ensures that you can sign and send documents anytime, anywhere, enhancing your flexibility.

Get more for Form 70 001 10 8 1 000 Rev

- Tax free exchange package montana form

- Landlord tenant sublease package montana form

- Buy sell agreement package montana form

- Option to purchase package montana form

- Amendment of lease package montana form

- Annual financial checkup package montana form

- Montana bill sale form

- Living wills and health care package montana form

Find out other Form 70 001 10 8 1 000 Rev

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document