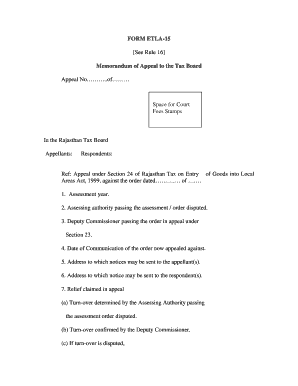

FORM ETLA 15 See Rule 16 Memorandum of Appeal to the Tax Board Appeal No Rajtax Gov

What is the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov

The FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov is a formal document used in tax-related disputes in the United States. This memorandum allows taxpayers to appeal decisions made by tax authorities, providing them with a structured way to present their case. It is essential for individuals and businesses seeking to contest tax assessments or penalties imposed by the state tax board. Understanding this form is crucial for ensuring that appeals are filed correctly and within the stipulated guidelines.

How to use the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov

Using the FORM ETLA 15 involves several steps to ensure proper submission and compliance with legal requirements. First, gather all relevant information, including the details of the tax decision being appealed. Next, fill out the form accurately, ensuring that all sections are complete. It is advisable to review the form for any errors before submission. Once completed, the form must be submitted to the appropriate tax board, either electronically or via mail, depending on the specific requirements outlined by the state.

Steps to complete the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov

Completing the FORM ETLA 15 requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including name, address, and taxpayer identification number.

- Provide a clear description of the tax issue you are appealing, including any relevant dates and amounts.

- Attach any supporting documents that substantiate your appeal, such as previous correspondence with the tax authority.

- Review the completed form for accuracy and completeness.

- Sign and date the form to validate your submission.

Legal use of the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov

The legal use of the FORM ETLA 15 is governed by specific regulations that ensure its validity as a formal appeal document. To be legally binding, the form must be filled out correctly and submitted within the deadlines set by the tax authority. It is also important to comply with any additional state-specific regulations regarding tax appeals. Utilizing a reliable electronic signature platform can enhance the legal standing of the document, ensuring compliance with eSignature laws in the United States.

Key elements of the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov

Key elements of the FORM ETLA 15 include:

- Taxpayer identification information.

- Details of the tax decision being appealed.

- Grounds for the appeal, clearly stated.

- Supporting documentation that backs your claims.

- Signature of the taxpayer or authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the FORM ETLA 15 are critical to the appeal process. Typically, taxpayers must submit their appeal within a specified period following the notification of the tax decision. This period can vary by state, so it is essential to check the specific deadlines applicable to your jurisdiction. Missing the deadline may result in the forfeiture of your right to appeal, making timely submission vital for a successful outcome.

Quick guide on how to complete form etla 15 see rule 16 memorandum of appeal to the tax board appeal no rajtax gov

Complete FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov effortlessly on any device

Online document administration has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed forms, allowing you to obtain the necessary document and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents rapidly and without issues. Manage FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to edit and eSign FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov effortlessly

- Find FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for this task.

- Generate your signature using the Sign feature, which only takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and then click the Done button to preserve your modifications.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and eSign FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form etla 15 see rule 16 memorandum of appeal to the tax board appeal no rajtax gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov?

The FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov is a formal document used to appeal decisions made by tax authorities. It outlines the grounds of your appeal and is essential for taxpayers seeking to contest tax assessments.

-

How can airSlate SignNow assist with the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov?

With airSlate SignNow, you can easily prepare, send, and eSign your FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov. Our platform streamlines the document process, ensuring that you can manage your appeals efficiently and securely.

-

Are there any costs associated with using airSlate SignNow for the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov?

Yes, airSlate SignNow offers various pricing plans to fit your needs, whether you're an individual or a business. Each plan provides access to features that can help you manage your FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov effectively.

-

What features does airSlate SignNow provide for managing the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov?

Our platform includes features like document templates, eSignature capabilities, and audit trails, all tailored for documents such as the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov. These tools enhance your workflow and ensure compliance.

-

Can airSlate SignNow integrate with other tools for processing the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov?

Yes, airSlate SignNow offers integrations with various applications, allowing seamless transfer of data and documents. You can easily connect your favorite tools to improve the management of the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov.

-

What are the benefits of using airSlate SignNow for the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov?

Using airSlate SignNow provides quick turnaround times, improved accuracy, and enhanced security for your FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov. Our platform simplifies complex processes, ensuring that your appeals are handled flawlessly.

-

Is it easy to use airSlate SignNow for the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to prepare and manage the FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov. Our intuitive interface helps you navigate through the process effortlessly.

Get more for FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov

Find out other FORM ETLA 15 See Rule 16 Memorandum Of Appeal To The Tax Board Appeal No Rajtax Gov

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter