Amended Income Tax Return MI 1040X 12 State of Michigan Michigan Form

What is the Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan

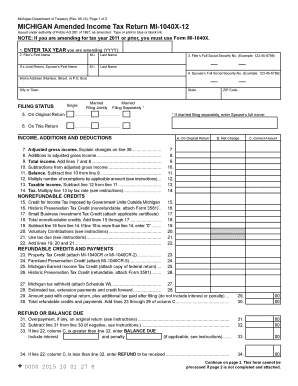

The Amended Income Tax Return MI 1040X is a specific form used by residents of Michigan to correct errors on their previously filed state income tax returns. This form allows taxpayers to make adjustments related to income, deductions, or credits that may have been inaccurately reported. It is essential for ensuring that your tax records are accurate and up to date, which can affect your tax liability and potential refunds.

Steps to Complete the Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan

Completing the Amended Income Tax Return MI 1040X involves several key steps:

- Gather all relevant documents, including your original tax return and any supporting documentation for the changes you wish to make.

- Clearly indicate the changes on the form, providing detailed explanations for each adjustment.

- Calculate any new tax amounts owed or refunds due based on the amended figures.

- Sign and date the form to validate your submission.

- Submit the completed form to the Michigan Department of Treasury, either electronically or by mail.

How to Obtain the Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan

The Amended Income Tax Return MI 1040X can be obtained from the Michigan Department of Treasury's official website. It is available as a downloadable PDF file, which you can print and fill out by hand. Additionally, many tax preparation software programs also include this form, allowing for easier completion and submission.

Legal Use of the Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan

The Amended Income Tax Return MI 1040X is legally binding when completed and submitted according to Michigan tax laws. It must be signed by the taxpayer, and any changes must be supported by appropriate documentation. Failure to accurately complete this form or to submit it within the designated time frame may result in penalties or additional tax liabilities.

Filing Deadlines / Important Dates

When filing the Amended Income Tax Return MI 1040X, it is crucial to be aware of the deadlines. Typically, amended returns must be filed within three years from the original due date of the tax return or within one year from the date of any tax payment made, whichever is later. Staying informed about these deadlines ensures compliance and helps avoid unnecessary penalties.

Form Submission Methods (Online / Mail / In-Person)

The Amended Income Tax Return MI 1040X can be submitted in several ways. Taxpayers have the option to file electronically through approved tax software that supports Michigan forms. Alternatively, you can print the completed form and mail it to the appropriate address provided by the Michigan Department of Treasury. In-person submission is generally not available for amended returns.

Quick guide on how to complete amended income tax return mi 1040x 12 state of michigan michigan

Complete Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and eSign Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan with ease

- Find Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Modify and eSign Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the amended income tax return mi 1040x 12 state of michigan michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan?

An Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan is a form used to correct errors or make changes to a previously filed Michigan income tax return. This form allows taxpayers to claim additional deductions, change filing status, or adjust income if necessary. Using airSlate SignNow, you can easily eSign and submit this document securely and quickly.

-

How can airSlate SignNow help with filing an Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan?

airSlate SignNow simplifies the process of filing your Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan by allowing you to eSign documents online. Our user-friendly platform ensures that you can fill out, sign, and distribute your amended tax return without hassle. This efficiency helps save time and ensures all documentation is correctly managed.

-

What are the pricing options for using airSlate SignNow for Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan?

airSlate SignNow offers competitive pricing plans to fit various budgets, allowing you to choose the best option for your business needs. Whether you're an individual or a large organization, our pricing structure is tailored to ensure cost-effectiveness, especially when dealing with crucial documents like the Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan.

-

Can I integrate airSlate SignNow with other software for my Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan?

Yes, airSlate SignNow seamlessly integrates with various software, enhancing your productivity while filing documents such as the Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan. You can connect our platform with popular applications like Google Drive, Dropbox, and more, ensuring your documents are easily accessible and manageable.

-

What features does airSlate SignNow offer for eSigning the Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan?

Our platform offers robust features like secure eSigning, document templates, and real-time collaboration for your Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan. These tools ensure that your signing process is not only fast but also secure, providing you with peace of mind throughout the process.

-

Are there any benefits to using airSlate SignNow for my Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan?

Using airSlate SignNow for your Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan offers numerous benefits, including faster processing, enhanced security, and reduced paperwork. Our digital solution streamlines the filing process, allowing you to complete your amended return with ease and efficiency.

-

What types of documents can I eSign using airSlate SignNow for my amended tax return?

With airSlate SignNow, you can eSign a variety of documents related to your Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan, including W-2 forms, schedules, and any additional documentation required by the state. Our platform is versatile, making it ideal for managing all aspects of your tax filing needs.

Get more for Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan

- Residential rental lease agreement new hampshire form

- Tenant welcome letter new hampshire form

- Warning of default on commercial lease new hampshire form

- Warning of default on residential lease new hampshire form

- New hampshire cases form

- Nh personal data sheet form

- New hampshire custody form

- New hampshire divorce contract form

Find out other Amended Income Tax Return MI 1040X 12 State Of Michigan Michigan

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement