Sample W4 Form

What is the Sample W-4?

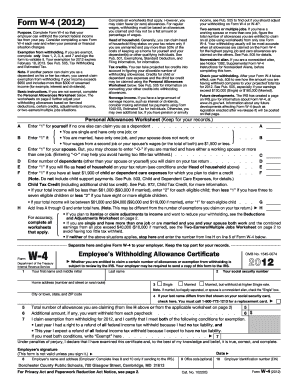

The Sample W-4, officially known as the Employee's Withholding Certificate, is a crucial tax form used in the United States. It allows employees to indicate their tax withholding preferences to their employers. By completing this form, employees can ensure that the correct amount of federal income tax is withheld from their paychecks. This helps in avoiding overpayment or underpayment of taxes throughout the year.

How to Use the Sample W-4

Using the Sample W-4 involves several steps to accurately reflect your tax situation. First, gather your personal information, including your filing status and the number of dependents you claim. Next, complete the form by following the instructions provided on the document. It is important to review your entries to ensure they are correct, as this will affect your tax withholding. Once completed, submit the form to your employer, who will use it to adjust your tax withholdings accordingly.

Steps to Complete the Sample W-4

Completing the Sample W-4 requires careful attention to detail. Follow these steps for accurate completion:

- Provide your name, address, Social Security number, and filing status.

- Indicate the number of allowances you are claiming based on your personal and financial situation.

- Consider any additional amount you wish to withhold from each paycheck.

- Sign and date the form to validate it.

After filling out the form, submit it to your employer's payroll department for processing.

Legal Use of the Sample W-4

The Sample W-4 is legally binding when completed accurately and submitted to your employer. It is essential to understand that any discrepancies or false information can lead to penalties or adjustments by the IRS. Employers are required to maintain these forms for their records and must ensure that the withholdings align with the information provided by their employees. Using an electronic signature on the W-4 is permissible, provided it complies with federal regulations regarding eSignatures.

IRS Guidelines

The IRS provides specific guidelines for completing the Sample W-4. These guidelines include instructions on how to determine your filing status, how to calculate the number of allowances, and how to adjust your withholdings based on changes in your personal circumstances. It is important to consult the latest IRS publications or the official IRS website for any updates or changes to the form or its instructions.

Form Submission Methods

The Sample W-4 can be submitted to your employer using various methods. While traditionally, it was submitted in paper format, electronic submission is now widely accepted. Employees can fill out the form digitally and send it via email or through a secure employee portal. Employers must ensure that they have the necessary systems in place to accept and store electronic submissions securely.

Quick guide on how to complete sample w4

Effortlessly Prepare Sample W4 on Any Device

Online document handling has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Sample W4 on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Modify and eSign Sample W4 with Ease

- Find Sample W4 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Decide how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Sample W4 and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample w4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W4 electronic signature?

A W4 electronic signature is a digital representation of your signature that can be used to sign the IRS Form W-4 electronically. Using airSlate SignNow, you can efficiently create and apply your W4 electronic signature, ensuring the document is legally binding and secure.

-

How does airSlate SignNow support W4 electronic signatures?

airSlate SignNow provides a user-friendly platform where you can easily create, manage, and sign your W4 form with an electronic signature. This not only speeds up the process but also ensures compliance with legal standards for electronic signatures.

-

Is using a W4 electronic signature secure?

Yes, using a W4 electronic signature with airSlate SignNow is secure. The platform employs advanced encryption and authentication methods to protect your documents and ensure that your W4 electronic signature is safe from tampering.

-

Can I use airSlate SignNow for multiple W4 electronic signature requests?

Absolutely! airSlate SignNow allows you to send multiple W4 electronic signature requests to different recipients, making it easy for businesses to collect signatures from multiple employees in a streamlined manner.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to fit different business needs, making it cost-effective for users looking to utilize W4 electronic signatures. You can choose from monthly or annual subscriptions, which include features tailored for your electronic signature needs.

-

What features does airSlate SignNow offer for W4 electronic signatures?

airSlate SignNow includes features such as real-time tracking, customizable templates, and mobile access, all designed to enhance your W4 electronic signature experience. These features help you stay organized and ensure efficient document management.

-

Can I integrate airSlate SignNow with other software for W4 electronic signature management?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to easily manage your W4 electronic signatures within your existing systems. This ensures a seamless workflow, making document signing and management more efficient.

Get more for Sample W4

- New hampshire landlord notice form

- New hampshire letter 497318659 form

- Temporary lease agreement to prospective buyer of residence prior to closing new hampshire form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction new form

- Letter from landlord to tenant returning security deposit less deductions new hampshire form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return new hampshire form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return new form

- Letter from tenant to landlord containing request for permission to sublease new hampshire form

Find out other Sample W4

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors