Form ET 141199, New York State Estate Tax Domicile

What is the Form ET 141199, New York State Estate Tax Domicile

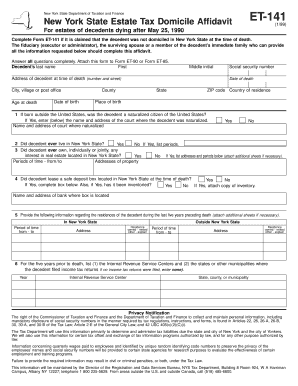

The Form ET 141199 is a crucial document used to establish the domicile of an estate for tax purposes in New York State. This form is essential for determining the estate's tax obligations, particularly in relation to the New York State Estate Tax. It helps clarify whether the decedent was a resident of New York at the time of their passing, which directly impacts the estate's tax liabilities. Understanding this form is vital for executors and administrators managing the estate, as it influences the overall tax strategy and compliance requirements.

Steps to complete the Form ET 141199, New York State Estate Tax Domicile

Completing the Form ET 141199 involves several important steps to ensure accuracy and compliance with New York State regulations. First, gather all necessary information about the decedent, including their full name, date of birth, and date of death. Next, provide details regarding the decedent's primary residence and any other properties owned. It is also essential to include information about the estate's assets and liabilities. Once all information is compiled, review the form for completeness and accuracy before signing and dating it. This thorough approach helps prevent delays in processing and potential issues with tax compliance.

How to obtain the Form ET 141199, New York State Estate Tax Domicile

The Form ET 141199 can be obtained through the New York State Department of Taxation and Finance website. It is available for download in a printable format, making it accessible for individuals managing estates. Additionally, physical copies may be available at local tax offices or through legal professionals specializing in estate planning. Ensuring you have the most current version of the form is essential, as tax regulations can change, impacting the information required.

Key elements of the Form ET 141199, New York State Estate Tax Domicile

Several key elements must be included in the Form ET 141199 to ensure its validity. These include the decedent's personal information, such as their name, address, and date of birth. The form also requires details about the estate, including the total value of assets and any outstanding liabilities. Additionally, it is crucial to provide information regarding the decedent's residency status, as this determines the estate's tax obligations. Accurate completion of these elements is vital for compliance with New York State tax laws.

Legal use of the Form ET 141199, New York State Estate Tax Domicile

The legal use of the Form ET 141199 is essential for establishing the tax domicile of an estate in New York. This form serves as an official declaration that can be used in legal proceedings if necessary. It is important for executors to understand that the information provided must be truthful and complete, as inaccuracies can lead to penalties or legal complications. Properly executed, the form supports the estate's compliance with state tax laws and helps avoid disputes regarding tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Form ET 141199 can be submitted through various methods, providing flexibility for executors and administrators. It can be filed online through the New York State Department of Taxation and Finance's e-filing system, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate tax office, ensuring it is sent via certified mail for tracking purposes. In-person submissions may also be possible at local tax offices, allowing for direct interaction with tax officials if there are questions or concerns regarding the form.

Quick guide on how to complete form et 141199 new york state estate tax domicile

Complete Form ET 141199, New York State Estate Tax Domicile effortlessly on any device

Managing documents online has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Handle Form ET 141199, New York State Estate Tax Domicile on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign Form ET 141199, New York State Estate Tax Domicile with ease

- Locate Form ET 141199, New York State Estate Tax Domicile and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools available from airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and eSign Form ET 141199, New York State Estate Tax Domicile and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form et 141199 new york state estate tax domicile

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form ET 141199, New York State Estate Tax Domicile?

Form ET 141199, New York State Estate Tax Domicile, is a form used to determine the domicile of a deceased individual for estate tax purposes in New York. This form helps clarify whether the estate is subject to New York State estate taxes based on the deceased’s residency and property locations. Understanding and properly completing Form ET 141199 is crucial for effective estate planning.

-

How can airSlate SignNow assist with Form ET 141199, New York State Estate Tax Domicile?

airSlate SignNow streamlines the process of completing and eSigning Form ET 141199, New York State Estate Tax Domicile. Our platform offers templates and easy-to-use tools that simplify document management and ensure compliance with New York State regulations. You can easily share and track the status of your forms, making the process efficient and hassle-free.

-

What are the pricing options for using airSlate SignNow for Form ET 141199?

airSlate SignNow offers competitive pricing plans to suit different business needs, starting from a basic plan to more advanced options that include additional features. Each plan provides access to full functionality for managing documents such as Form ET 141199, New York State Estate Tax Domicile. For detailed pricing, visit our website or contact our sales team.

-

Are there any specific features beneficial for managing Form ET 141199, New York State Estate Tax Domicile?

Yes, airSlate SignNow offers features like easy document editing, customizable templates, and secure eSigning, all of which are beneficial for managing Form ET 141199, New York State Estate Tax Domicile. These tools help ensure that your documents are accurate and compliant while streamlining the workflow for signing and submission.

-

What benefits does airSlate SignNow provide for my estate tax documentation needs?

airSlate SignNow provides numerous benefits for managing your estate tax documentation, including improved accuracy, faster processing times, and enhanced security measures. By leveraging our platform, users can efficiently handle Form ET 141199, New York State Estate Tax Domicile and other related documents, reducing the risk of errors and ensuring compliance with local laws.

-

Can airSlate SignNow integrate with other tools for handling Form ET 141199?

Yes, airSlate SignNow can integrate with various tools and applications that support estate planning and tax management. This includes platforms for financial management and document storage, enabling seamless workflows when completing Form ET 141199, New York State Estate Tax Domicile. Check our integration options to find the right tools for your business.

-

Is it secure to use airSlate SignNow for Form ET 141199, New York State Estate Tax Domicile?

Absolutely! airSlate SignNow prioritizes user security and maintains compliance with industry standards to protect sensitive information, including data related to Form ET 141199, New York State Estate Tax Domicile. Our platform employs encryption and multi-factor authentication to ensure that your documents remain safe throughout the entire process.

Get more for Form ET 141199, New York State Estate Tax Domicile

- Grant bargain deed 497320612 form

- Quitclaim deed for timeshare property from individuals to individual nevada form

- Notice nonresponsibility 497320614 form

- Nv surety bond form

- Quitclaim deed from individual to corporation nevada form

- Grant bargain sale deed from individual to corporation nevada form

- Nevada quitclaim deed 497320619 form

- Time share quitclaim deed from husband and wife to two individuals nevada form

Find out other Form ET 141199, New York State Estate Tax Domicile

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy