Hawaii Bfs Rp P 3 Form

What is the Hawaii BFS RP P 3

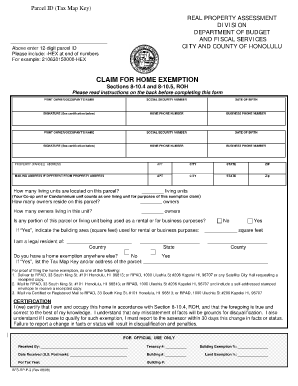

The Hawaii BFS RP P 3 form is a specific document utilized for various administrative purposes within the state of Hawaii. It is essential for businesses and individuals who need to report specific information to state agencies. This form is often required for compliance with local regulations and can play a crucial role in maintaining accurate records for tax and legal purposes.

How to use the Hawaii BFS RP P 3

Using the Hawaii BFS RP P 3 form involves several straightforward steps. First, ensure that you have the correct version of the form, as updates may occur. Next, gather all necessary information, which typically includes personal details, business identification, and any relevant financial data. Once you have completed the form, it can be submitted either electronically or via traditional mail, depending on the specific requirements set by the issuing agency.

Steps to complete the Hawaii BFS RP P 3

Completing the Hawaii BFS RP P 3 form requires careful attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the form from the appropriate state agency.

- Fill in all required fields accurately, ensuring that all information is up to date.

- Review the form for any errors or omissions.

- Sign and date the form, if required.

- Submit the completed form according to the guidelines provided, either online or by mail.

Legal use of the Hawaii BFS RP P 3

The legal use of the Hawaii BFS RP P 3 form is governed by state regulations. It is important to ensure that the form is filled out correctly and submitted on time to avoid any legal complications. Failure to comply with the requirements associated with this form can lead to penalties or other legal repercussions. Therefore, understanding the legal framework surrounding the use of this form is essential for all users.

State-specific rules for the Hawaii BFS RP P 3

Hawaii has specific rules that govern the use of the BFS RP P 3 form. These rules may include deadlines for submission, specific information that must be disclosed, and the consequences of non-compliance. It is crucial for individuals and businesses to familiarize themselves with these regulations to ensure compliance and avoid potential issues.

Examples of using the Hawaii BFS RP P 3

There are various scenarios in which the Hawaii BFS RP P 3 form may be utilized. For instance, a business may need to submit this form to report changes in ownership or to update its business status with the state. Additionally, individuals may use the form to provide necessary information for tax purposes or to comply with state regulations. Understanding these examples can help users recognize when and how to effectively use the form.

Quick guide on how to complete hawaii bfs rp p 3

Execute Hawaii Bfs Rp P 3 seamlessly on any gadget

Managing documents online has become increasingly favored by businesses and individuals. It presents an ideal eco-friendly solution to conventional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Hawaii Bfs Rp P 3 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to adjust and electronically sign Hawaii Bfs Rp P 3 effortlessly

- Locate Hawaii Bfs Rp P 3 and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced paperwork, monotonous form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your preference. Edit and electronically sign Hawaii Bfs Rp P 3 and ensure outstanding communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hawaii bfs rp p 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is hawaii bfs rp p 3?

Hawaii bfs rp p 3 refers to a specific pricing plan and features offered by airSlate SignNow aimed at businesses in Hawaii. This solution enables organizations to manage their electronic signatures and document workflows efficiently. By choosing this plan, businesses can streamline their operations while staying compliant with local regulations.

-

How does hawaii bfs rp p 3 improve document management?

The hawaii bfs rp p 3 plan enhances document management by providing users with intuitive tools for creating, sending, and tracking documents. With features like real-time notifications and comprehensive signing workflows, businesses can ensure that all documents are processed efficiently. This ultimately leads to better productivity and reduced turnaround times.

-

What are the pricing options for hawaii bfs rp p 3?

The pricing for hawaii bfs rp p 3 is designed to be affordable for businesses of all sizes in Hawaii. It includes various tiers based on the number of users and features required. Customers can choose from monthly or annual billing options to find the plan that best fits their needs.

-

Can hawaii bfs rp p 3 integrate with other software I use?

Yes, the hawaii bfs rp p 3 plan offers several integration options with popular business applications such as Google Workspace, Microsoft Office 365, and various CRM systems. This flexibility allows businesses to incorporate electronic signature functionalities seamlessly into their existing workflows. Integrations enhance overall efficiency and user experience.

-

What benefits does hawaii bfs rp p 3 offer for small businesses?

Hawaii bfs rp p 3 offers numerous benefits tailored for small businesses, including cost-effectiveness and ease of use. Users can quickly manage their document signing needs without heavy investments in complex software. This plan enables small businesses to enhance their credibility and customer satisfaction with professional electronic signatures.

-

Is there a trial period for hawaii bfs rp p 3?

Yes, airSlate SignNow typically offers a free trial period for the hawaii bfs rp p 3 plan. During this trial, businesses can explore the features and capabilities of the platform without any financial commitment. This allows potential customers to evaluate how well it meets their document management needs.

-

What security measures are included in hawaii bfs rp p 3?

The hawaii bfs rp p 3 plan includes robust security measures to protect sensitive data and ensure compliance with electronic signature regulations. AirSlate SignNow implements encryption, secure data storage, and user authentication processes. This ensures that all documents signed through the platform are secure and reliable.

Get more for Hawaii Bfs Rp P 3

- California independent review form

- California agent form

- Ca benefits workers compensation form

- Statement of decline of vocational rehabilitation for workers compensation california form

- Order show cause 497299497 form

- Order injunction form

- Order restraining form

- California preliminary injunction form

Find out other Hawaii Bfs Rp P 3

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy