Transient Room Tax Collection Return City of Gearhart Form

What is the Transient Room Tax Collection Return City Of Gearhart

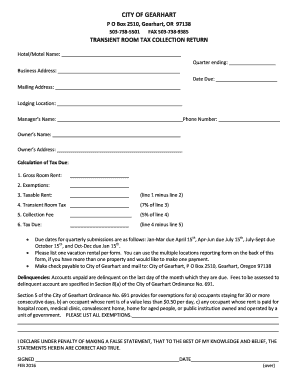

The Transient Room Tax Collection Return City Of Gearhart is a form used by lodging providers in Gearhart, Oregon, to report and remit the transient room tax. This tax is typically applied to short-term rentals, hotels, and motels, ensuring that local governments receive revenue from visitors. The form captures essential information about the rental income, the number of rooms rented, and the total tax owed. It is crucial for compliance with local tax regulations and for supporting community services funded by these taxes.

Steps to complete the Transient Room Tax Collection Return City Of Gearhart

Completing the Transient Room Tax Collection Return requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including rental records and previous tax returns.

- Fill in the required information on the form, such as your business name, address, and tax identification number.

- Report the total number of rooms rented and the total rental income for the reporting period.

- Calculate the transient room tax owed based on the applicable tax rate.

- Review the completed form for accuracy before submission.

How to use the Transient Room Tax Collection Return City Of Gearhart

Using the Transient Room Tax Collection Return involves accurately filling out the form and submitting it to the City of Gearhart. Ensure that you understand the specific requirements for reporting periods and payment deadlines. The form can be filled out digitally, allowing for easy tracking and submission. It is essential to keep a copy for your records and to provide any additional documentation if requested by local authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Transient Room Tax Collection Return are typically set by the City of Gearhart. Generally, these returns are due monthly or quarterly, depending on the volume of rentals. It is important to be aware of these deadlines to avoid penalties and ensure timely compliance. Check with local tax authorities for the most current dates and any changes to the filing schedule.

Penalties for Non-Compliance

Failure to file the Transient Room Tax Collection Return on time or accurately can result in penalties. These may include fines or interest on unpaid taxes. The City of Gearhart may also take further action for repeated non-compliance, which could affect your ability to operate a lodging business in the area. It is crucial to stay informed about your obligations to avoid these consequences.

Legal use of the Transient Room Tax Collection Return City Of Gearhart

The legal use of the Transient Room Tax Collection Return is governed by local tax laws. This form must be completed and submitted in accordance with the regulations set forth by the City of Gearhart. Accurate reporting and timely submission are essential for compliance. The information provided on the form is used to assess tax liabilities and ensure that local services funded by these taxes are maintained.

Quick guide on how to complete transient room tax collection return city of gearhart

Complete Transient Room Tax Collection Return City Of Gearhart effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Transient Room Tax Collection Return City Of Gearhart on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Transient Room Tax Collection Return City Of Gearhart with ease

- Locate Transient Room Tax Collection Return City Of Gearhart and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Transient Room Tax Collection Return City Of Gearhart to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transient room tax collection return city of gearhart

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Transient Room Tax Collection Return for the City of Gearhart?

The Transient Room Tax Collection Return for the City of Gearhart is a required document that lodging providers must submit to report the collections of transient room taxes. This report ensures that local authorities receive the appropriate tax revenue from short-term rentals and accommodations. Understanding this process is crucial for complying with local regulations.

-

How can airSlate SignNow assist in completing the Transient Room Tax Collection Return for the City of Gearhart?

airSlate SignNow streamlines the process of completing your Transient Room Tax Collection Return for the City of Gearhart by providing customizable templates and eSigning capabilities. This allows you to easily fill out and submit your forms without the hassle of paper documentation. The user-friendly platform ensures compliance and timely submissions.

-

Are there any fees associated with filing the Transient Room Tax Collection Return for the City of Gearhart?

Filing the Transient Room Tax Collection Return for the City of Gearhart may involve some fees based on local regulations or administrative costs. However, using airSlate SignNow can save you on costs associated with printing and mailing documents. It's advisable to check with local authorities for specific fee structures.

-

What features does airSlate SignNow offer for managing the Transient Room Tax Collection Return for the City of Gearhart?

airSlate SignNow offers a variety of features such as document templates, eSignature capabilities, and integration options to simplify your Transient Room Tax Collection Return for the City of Gearhart. These tools help manage your tax documents efficiently, ensuring you can focus more on your business rather than paperwork.

-

How does airSlate SignNow ensure the security of my Transient Room Tax Collection Return for the City of Gearhart?

Security is a top priority at airSlate SignNow, and we utilize industry-standard encryption to protect your Transient Room Tax Collection Return for the City of Gearhart. With secure cloud storage and protected access, you can trust that your sensitive information remains confidential and safe from unauthorized access.

-

Can I integrate airSlate SignNow with other software when handling the Transient Room Tax Collection Return for the City of Gearhart?

Yes, airSlate SignNow offers seamless integrations with a variety of popular software applications to enhance your workflow when managing the Transient Room Tax Collection Return for the City of Gearhart. This means you can easily connect your existing systems and streamline data transfer, reducing the risk of errors.

-

What benefits can I expect when using airSlate SignNow for the Transient Room Tax Collection Return for the City of Gearhart?

Using airSlate SignNow for the Transient Room Tax Collection Return for the City of Gearhart offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. Our user-friendly platform provides tools that save you time and resources, allowing you to focus on running your business while ensuring tax obligations are met.

Get more for Transient Room Tax Collection Return City Of Gearhart

- Single member limited liability company llc operating agreement south dakota form

- Sd limited company form

- South dakota property search form

- South dakota form

- Quitclaim deed from individual to husband and wife south dakota form

- Warranty deed from individual to husband and wife south dakota form

- Warranty deed from corporation to husband and wife south dakota form

- Quitclaim deed from corporation to individual south dakota form

Find out other Transient Room Tax Collection Return City Of Gearhart

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast