Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable

What is the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable

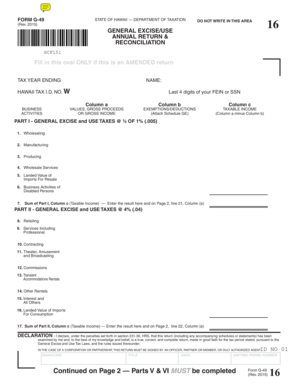

The Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable is a crucial document used for reporting general excise tax in the United States. This form is designed for businesses to reconcile their annual general excise tax obligations. It allows for the electronic submission of information, making it easier for taxpayers to comply with state regulations. The form captures essential details regarding gross income, deductions, and tax liabilities, ensuring that businesses accurately report their financial activities over the year.

Steps to complete the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable

Completing the Form G 49 Rev involves several steps to ensure accurate reporting. First, gather all necessary financial records, including income statements and expense reports. Next, access the fillable form online. Begin by entering your business information, including the name, address, and taxpayer identification number. Then, input the gross income figures and any applicable deductions. Carefully review each section for accuracy before submitting. Finally, ensure that you electronically sign the document to validate your submission.

Legal use of the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable

The legal use of the Form G 49 Rev is governed by state tax laws that outline the requirements for filing general excise tax returns. When completed correctly, the form serves as a legally binding document. It is essential to adhere to the guidelines established by the state to avoid penalties. The electronic signature provided during the submission process must comply with the relevant eSignature laws, ensuring that the form is recognized as valid in legal contexts.

Filing Deadlines / Important Dates

Filing deadlines for the Form G 49 Rev vary by state and are typically set annually. It is crucial for businesses to be aware of these deadlines to avoid late fees or penalties. Generally, the form must be submitted by the end of the fiscal year, but specific dates may differ based on local regulations. Keeping track of these important dates helps ensure timely compliance with tax obligations.

Key elements of the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable

The key elements of the Form G 49 Rev include sections for reporting gross income, deductions, and tax calculations. It typically requires detailed information about the nature of the business, including the types of goods or services provided. Additionally, the form includes a section for claiming any credits or exemptions that may apply. Accurate completion of these sections is vital for determining the correct tax liability and ensuring compliance with state tax laws.

Examples of using the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable

Businesses across various industries utilize the Form G 49 Rev to report their general excise tax. For instance, a retail store would report total sales revenue, including any applicable deductions for returns or discounts. Similarly, a service provider would detail income generated from services rendered. These examples illustrate the form's versatility in accommodating different business models while ensuring compliance with tax regulations.

Quick guide on how to complete form g 49 rev general exciseuse annual return reconciliation forms web fillable

Effortlessly Prepare Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable on Any Device

Online document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the correct format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without interruptions. Manage Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The Easiest Way to Edit and Electronically Sign Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable

- Locate Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable and then click Get Form to begin.

- Use the tools we provide to finalize your document.

- Mark relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Modify and electronically sign Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form g 49 rev general exciseuse annual return reconciliation forms web fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable?

The Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable is an electronic version of the traditional form required for reporting General Excise Tax in Hawaii. It simplifies the filing process, enabling users to easily complete and submit the form online, ensuring accuracy and compliance with the state's tax requirements.

-

How do I access the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable?

You can access the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable directly through the airSlate SignNow platform. Once registered, you can fill out the form online, saving time and eliminating the need for paper forms or manual submissions.

-

Is there a cost associated with using the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable?

While access to the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable is part of the airSlate SignNow service, pricing may vary based on the subscription plan you choose. We offer various pricing tiers that provide flexibility and cater to different business needs, ensuring you only pay for what you use.

-

What features are included with the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable?

The Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable includes features such as eSignature capabilities, real-time collaboration, and secure document storage. This ensures that your tax filings are not only easy to complete but also securely managed throughout the process.

-

How can I ensure my Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable is accurate?

To ensure accuracy when using the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable, double-check all entered information and utilize the platform's validation features. These tools help catch common errors before submission, reducing the likelihood of issues with the Hawaii Department of Taxation.

-

Can I integrate the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable with other software?

Yes, the airSlate SignNow platform allows integration with various accounting and business software. This means you can seamlessly incorporate data from your existing systems into the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable, thus streamlining your workflow.

-

What are the benefits of using the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable?

Using the Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable offers numerous benefits, including increased efficiency, reduced paperwork, and simplified submission processes. This electronic solution helps businesses stay compliant while saving valuable time and resources.

Get more for Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable

- 5 day notice 497325150 form

- Rhode island notice 497325151 form

- Ri 30 day form

- Rhode island lease form

- Ri 20 day form

- 20 day notice to remedy reoccurring breach or lease terminates for residential property rhode island form

- Assignment of mortgage by individual mortgage holder rhode island form

- Assignment of mortgage by corporate mortgage holder rhode island form

Find out other Form G 49 Rev General ExciseUse Annual Return Reconciliation Forms WEB Fillable

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT