Form 945

What is the Form 945

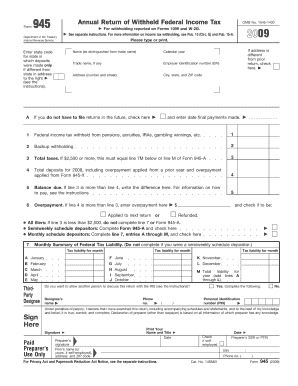

The Form 945 is an annual return used by employers to report withheld federal income tax from nonpayroll payments. This includes payments made to independent contractors, freelancers, and other non-employees. The form is essential for ensuring compliance with federal tax regulations and helps the IRS track tax liabilities associated with these payments.

How to use the Form 945

To use the Form 945, employers must accurately report the total amount of federal income tax withheld throughout the year. This form is typically filed once a year, and it is crucial for businesses to maintain accurate records of all nonpayroll payments made during the tax year. Employers should also ensure that they are aware of the filing deadlines to avoid penalties.

Steps to complete the Form 945

Completing the Form 945 involves several key steps:

- Gather all necessary information regarding nonpayroll payments made throughout the year.

- Calculate the total federal income tax withheld from these payments.

- Fill out the form with the appropriate details, including your business information and the total withholding amount.

- Review the completed form for accuracy before submission.

- Submit the form to the IRS by the designated deadline.

Legal use of the Form 945

The legal use of the Form 945 is governed by IRS regulations. Employers must ensure that they file this form accurately and on time to comply with federal tax laws. Failure to do so can result in penalties and interest on unpaid taxes. It is important for employers to understand their obligations regarding withholding and reporting to avoid legal complications.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Form 945 to ensure compliance. The form is typically due by January 31 of the following year for the previous tax year. If January 31 falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable for employers to mark their calendars to avoid missing these important dates.

Form Submission Methods (Online / Mail / In-Person)

The Form 945 can be submitted to the IRS through various methods. Employers have the option to file electronically using approved e-filing software or by mailing a paper form to the appropriate IRS address. In-person submissions are generally not available for this form. Choosing the right submission method can help streamline the filing process and ensure timely delivery.

Quick guide on how to complete form 945 1652412

Effortlessly Prepare Form 945 on Any Device

Online document management has gained signNow popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Form 945 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign Form 945 with Ease

- Find Form 945 and hit Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form 945 and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 945 1652412

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 945 and how does it function?

Form 945 is a tax form used for reporting annual withholding on non-payroll payments. With airSlate SignNow, you can easily fill out and eSign Form 945, ensuring accurate and timely submissions to the IRS. Our platform streamlines the process, making it user-friendly for businesses of all sizes.

-

How can airSlate SignNow help with completing Form 945?

airSlate SignNow offers a range of tools that simplify the completion of Form 945. Users can easily fill out the form, add signatures, and store it securely within the app. This ensures compliance and reduces errors, providing peace of mind to businesses managing their tax obligations.

-

Are there any costs associated with using airSlate SignNow for Form 945?

airSlate SignNow provides flexible pricing options tailored to different business needs. While there are costs associated with our services, the investment facilitates efficient document management, particularly for critical forms like Form 945. Sign up today to explore our free trial and see the value for yourself.

-

What features does airSlate SignNow offer for Form 945?

With airSlate SignNow, users have access to features like eSigning, document tracking, and secure cloud storage for Form 945. These features enhance productivity and ensure that important tax documents are managed efficiently. Additionally, our platform supports collaboration among multiple signers.

-

Can I integrate airSlate SignNow with other software for Form 945?

Yes, airSlate SignNow offers integrations with various software tools, making it easier to manage Form 945 and other documents. Whether you use accounting software or customer relationship management systems, our seamless integrations enhance workflow and efficiency. Discover how we can connect with your existing tools.

-

What benefits does using airSlate SignNow for Form 945 offer?

Using airSlate SignNow to handle Form 945 improves the efficiency of your documentation process. It reduces the time spent on paperwork, minimizes errors, and ensures compliance with IRS regulations. Our platform also allows for easy access and organization, leading to an overall better business experience.

-

Is airSlate SignNow secure for handling Form 945?

Absolutely, airSlate SignNow prioritizes security for all documents, including Form 945. With advanced encryption and compliance with industry standards, your sensitive information remains protected. Trust our platform to provide a secure environment for all your document-signing needs.

Get more for Form 945

- Correction statement and agreement south dakota form

- Closing statement south dakota form

- Flood zone statement and authorization south dakota form

- Name affidavit of buyer south dakota form

- Name affidavit of seller south dakota form

- Non foreign affidavit under irc 1445 south dakota form

- Owners or sellers affidavit of no liens south dakota form

- Sd affidavit form

Find out other Form 945

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free