WAIVER of LIABILITY and HOLD HARMLESS AGREEMENT BUMA DOC Form

Understanding the BUMA Waiver of Liability and Hold Harmless Agreement

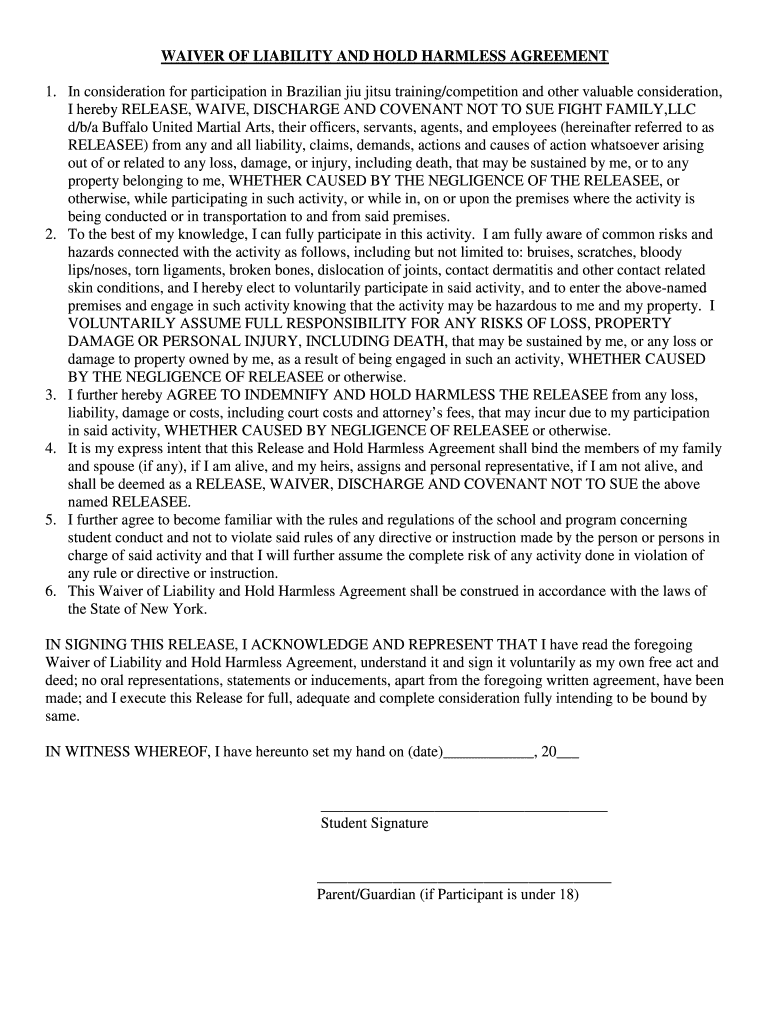

The BUMA Waiver of Liability and Hold Harmless Agreement is a legal document designed to protect organizations from liability in case of accidents or injuries that may occur during activities or events. This agreement typically outlines the responsibilities of participants and the extent to which they waive their right to hold the organization accountable for any incidents. It is essential for organizations to ensure that participants understand the implications of signing this document, as it can significantly impact their legal rights.

Steps to Complete the BUMA Waiver of Liability and Hold Harmless Agreement

Completing the BUMA Waiver of Liability involves several straightforward steps:

- Obtain the form: Access the BUMA waiver document through official channels or trusted sources.

- Fill out participant information: Include the full name, contact details, and any relevant identification of the participant.

- Read the terms: Ensure that all parties involved understand the terms outlined in the waiver, including the risks associated with the activity.

- Sign the document: Participants must provide their signature, indicating their agreement to the terms and conditions.

- Date the agreement: Include the date of signing to establish a timeline for the agreement.

Legal Use of the BUMA Waiver of Liability and Hold Harmless Agreement

The BUMA Waiver of Liability is legally binding when executed correctly. It must comply with state laws and regulations regarding liability waivers. Organizations should ensure that the document is clear, concise, and unambiguous. Legal enforceability may depend on factors such as the clarity of the language used, the understanding of the participant, and the absence of coercion during the signing process. Consulting with a legal professional can provide additional assurance of the document's validity.

Key Elements of the BUMA Waiver of Liability and Hold Harmless Agreement

Several key elements must be included in the BUMA Waiver of Liability to ensure its effectiveness:

- Identification of parties: Clearly state the names of the organization and the participant.

- Description of activities: Specify the activities covered by the waiver.

- Assumption of risk: Include a statement acknowledging that the participant understands the risks involved.

- Release of liability: A clause that releases the organization from liability for injuries or damages.

- Signature and date: Ensure that the participant's signature and the date of signing are included.

How to Use the BUMA Waiver of Liability and Hold Harmless Agreement

To effectively use the BUMA Waiver of Liability, organizations should distribute the document to participants before the commencement of any activities. It is advisable to provide a thorough explanation of the waiver's purpose and implications. Participants should be encouraged to ask questions to ensure they fully understand what they are signing. Proper use of the waiver can help mitigate risks and protect the organization from potential legal claims.

Obtaining the BUMA Waiver of Liability and Hold Harmless Agreement

The BUMA Waiver of Liability can typically be obtained from official sources, such as legal document providers, or directly from the organization conducting the activity. It is important to ensure that the version used is up-to-date and complies with current legal standards. Organizations may also consider customizing the waiver to better fit their specific activities and risk factors while maintaining its legal integrity.

Quick guide on how to complete waiver of liability and hold harmless agreement bumadoc

Learn how to effortlessly navigate the WAIVER OF LIABILITY AND HOLD HARMLESS AGREEMENT BUMA document execution with this simple guide

Electronic filing and certification of forms online is gaining popularity and has become the preferred choice for various clients. It offers numerous benefits over outdated printed documents, such as ease of use, time-saving, improved precision, and enhanced security.

With tools like airSlate SignNow, you can find, modify, sign, enhance, and send your WAIVER OF LIABILITY AND HOLD HARMLESS AGREEMENT BUMA doc without getting bogged down by endless printing and scanning. Follow this brief guide to begin and complete your document.

Follow these steps to obtain and complete WAIVER OF LIABILITY AND HOLD HARMLESS AGREEMENT BUMA doc

- Begin by clicking the Access Form button to open your document in our editor.

- Pay attention to the green label on the left that indicates required fields so you don’t miss any.

- Utilize our premium features to comment, modify, sign, protect, and improve your document.

- Protect your document or convert it into a fillable format using the tools in the right panel.

- Review your document for errors or inconsistencies.

- Hit FINISHED to complete your edits.

- Alter the name of your document or leave it unchanged.

- Select the storage option you prefer to save your document, send it via USPS, or click the Download Now button to save your form.

If WAIVER OF LIABILITY AND HOLD HARMLESS AGREEMENT BUMA doc isn’t what you were looking for, you can explore our extensive library of pre-prepared templates that you can fill out with ease. Discover our solution today!

Create this form in 5 minutes or less

FAQs

-

A friend's US VISA was revoked on the basis of false information supplied while filling an application form and he was being told that he is permanently banned from US unless a waiver is applied for him? How long does it take to apply for a waiver?

Your friend can apply for a waiver whenever he/she has the finances to pay for it, however; there’s no guarantee it will be approved by USCIS. Even with an approved waiver he/she isn’t out of the woods yet because the material misrepresentation is now part of his/her immigration record and will always be a negative factor when used to adjudicate a visa application.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the waiver of liability and hold harmless agreement bumadoc

How to make an electronic signature for the Waiver Of Liability And Hold Harmless Agreement Bumadoc in the online mode

How to generate an eSignature for the Waiver Of Liability And Hold Harmless Agreement Bumadoc in Chrome

How to make an electronic signature for putting it on the Waiver Of Liability And Hold Harmless Agreement Bumadoc in Gmail

How to create an electronic signature for the Waiver Of Liability And Hold Harmless Agreement Bumadoc straight from your mobile device

How to generate an eSignature for the Waiver Of Liability And Hold Harmless Agreement Bumadoc on iOS devices

How to generate an electronic signature for the Waiver Of Liability And Hold Harmless Agreement Bumadoc on Android OS

People also ask

-

What is a buma waiver liability template?

A buma waiver liability template is a crucial document that releases one party from liability in case of accidents or damages. It is commonly used in conjunction with activities that involve inherent risks. Utilizing a comprehensive buma waiver liability template can protect your business from unforeseen liabilities.

-

How can airSlate SignNow help me with a buma waiver liability template?

airSlate SignNow simplifies the process of creating, sending, and signing a buma waiver liability template. Our platform offers customizable templates that you can adapt to your specific needs. Additionally, the eSigning feature ensures that all parties can sign securely and quickly, speeding up your workflow.

-

Is there a cost associated with using the buma waiver liability template through airSlate SignNow?

Yes, there is a nominal fee associated with using airSlate SignNow for your buma waiver liability template. However, our pricing is competitive and offers various plans to suit the needs of businesses of any size. You'll find that the value provided in terms of time saved and efficiency gained is well worth the investment.

-

Are there any features specifically for the buma waiver liability template?

Absolutely! airSlate SignNow offers features tailored for your buma waiver liability template, including unlimited document uploads, user-friendly editing tools, and the ability to collect electronic signatures. Additionally, you can track the status of your document in real-time, ensuring a smooth process from start to finish.

-

Can I integrate airSlate SignNow with other tools when using a buma waiver liability template?

Yes, airSlate SignNow provides seamless integrations with popular applications such as Google Drive, Dropbox, and CRM systems. This allows you to streamline your workflow when managing your buma waiver liability template. With these integrations, you can easily store and share your documents without hassle.

-

What are the benefits of using airSlate SignNow for a buma waiver liability template?

Using airSlate SignNow for your buma waiver liability template offers numerous benefits, including faster turnaround times, enhanced security, and reduced paperwork hassles. The electronic signature feature not only speeds up the signing process but also ensures that your documents are legally binding. Furthermore, our intuitive interface makes it user-friendly for everyone involved.

-

How does airSlate SignNow ensure the security of my buma waiver liability template?

airSlate SignNow prioritizes security by providing robust encryption and ensuring compliance with electronic signature laws. Each buma waiver liability template you send is secured through our advanced security protocols, protecting sensitive information throughout the signing process. You can feel confident that your documents are safe and secure.

Get more for WAIVER OF LIABILITY AND HOLD HARMLESS AGREEMENT BUMA doc

Find out other WAIVER OF LIABILITY AND HOLD HARMLESS AGREEMENT BUMA doc

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP