Scripps Revolving Loan Scripps College Scrippscollege Form

What is the Scripps Revolving Loan Scripps College Scrippscollege

The Scripps Revolving Loan is a financial aid program offered by Scripps College, designed to assist students in covering educational expenses. This loan is unique as it allows students to borrow funds that they will repay over time, typically with low or no interest. The program aims to provide accessible financial resources to support students in their academic journey while promoting responsible borrowing practices.

How to use the Scripps Revolving Loan Scripps College Scrippscollege

Utilizing the Scripps Revolving Loan involves several steps. First, students must determine their eligibility by reviewing the program's requirements. Once confirmed, they can complete the application process, which may include submitting necessary documentation and financial information. After approval, students can access the funds as needed, ensuring they are used for educational purposes such as tuition, books, or living expenses.

Steps to complete the Scripps Revolving Loan Scripps College Scrippscollege

Completing the Scripps Revolving Loan involves a systematic approach:

- Review eligibility criteria to ensure you qualify for the loan.

- Gather required documents, including financial statements and identification.

- Fill out the application form accurately and completely.

- Submit the application by the designated deadline.

- Await approval notification from the financial aid office.

- Once approved, follow instructions for accessing the funds.

Legal use of the Scripps Revolving Loan Scripps College Scrippscollege

The Scripps Revolving Loan is governed by specific legal guidelines to ensure its proper use. Students must use the loan funds solely for educational expenses. Misuse of funds can lead to penalties, including the requirement to repay the loan immediately. It is crucial for borrowers to understand their responsibilities and the terms associated with the loan to maintain compliance with Scripps College policies.

Eligibility Criteria

To qualify for the Scripps Revolving Loan, students must meet certain eligibility criteria. Generally, applicants need to be enrolled at Scripps College, demonstrate financial need, and maintain satisfactory academic progress. Additional requirements may include submitting a Free Application for Federal Student Aid (FAFSA) and providing documentation of income or family contributions. Understanding these criteria is vital for a successful application.

Application Process & Approval Time

The application process for the Scripps Revolving Loan is straightforward. Students begin by completing the application form and submitting it along with required documents. The financial aid office reviews applications on a rolling basis. Approval times can vary, but students can typically expect to receive a decision within a few weeks. Staying informed about the timeline helps students plan their finances accordingly.

Quick guide on how to complete scripps revolving loan scripps college scrippscollege

Effortlessly Prepare Scripps Revolving Loan Scripps College Scrippscollege on Any Device

The management of online documents has gained traction among companies and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely store it in the cloud. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle Scripps Revolving Loan Scripps College Scrippscollege on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

The Easiest Way to Modify and eSign Scripps Revolving Loan Scripps College Scrippscollege with Ease

- Obtain Scripps Revolving Loan Scripps College Scrippscollege and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact confidential information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device. Edit and eSign Scripps Revolving Loan Scripps College Scrippscollege and ensure seamless communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the scripps revolving loan scripps college scrippscollege

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Scripps Revolving Loan offered by Scripps College?

The Scripps Revolving Loan is a financial option specifically designed for students attending Scripps College. This loan provides accessible funding for educational expenses, allowing students to manage their finances while pursuing their degrees at Scripps College.

-

Who is eligible for the Scripps Revolving Loan at Scripps College?

Eligibility for the Scripps Revolving Loan at Scripps College typically includes current students enrolled in an undergraduate program. It's essential to maintain good academic standing and demonstrate financial need to qualify for this loan.

-

How can I apply for the Scripps Revolving Loan through Scripps College?

To apply for the Scripps Revolving Loan at Scripps College, students must submit a loan application along with any required documentation. This process usually involves completing forms provided by the financial aid office to determine your eligibility and funding amount.

-

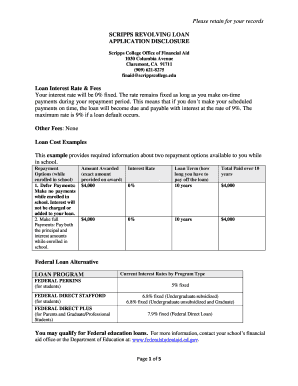

What are the interest rates for the Scripps Revolving Loan?

The interest rates for the Scripps Revolving Loan at Scripps College can vary based on current market trends and the type of loan. Students should check with the financial aid office for the most accurate and updated information regarding interest rates.

-

What are the repayment terms for the Scripps Revolving Loan?

Repayment terms for the Scripps Revolving Loan at Scripps College usually begin after graduation or when a student is no longer enrolled full-time. Students should consult the financial aid resources at Scripps College for detailed information on repayment schedules and options.

-

Can I use the Scripps Revolving Loan for study abroad programs?

Yes, students can generally use the Scripps Revolving Loan for approved study abroad programs through Scripps College. This includes tuition and related expenses, helping students to take advantage of international educational opportunities.

-

Are there any benefits to taking the Scripps Revolving Loan?

The Scripps Revolving Loan offers several benefits, including the flexibility to cover educational costs and potentially lower interest rates compared to private loans. It helps students focus on their studies without the immediate burden of financial stress while enrolled at Scripps College.

Get more for Scripps Revolving Loan Scripps College Scrippscollege

- Brick township opra request form

- Travel agency transfer form royal caribbean

- Hornady 11th edition pdf download form

- Vestibular rehabilitation book pdf form

- Ship inspection checklist form

- Complaint handling registration form

- New york insurance regulation 79 form

- Mrs messina 6th if you add fertilizer to the plant then form

Find out other Scripps Revolving Loan Scripps College Scrippscollege

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement