Ca De4 Form

What is the Ca De4

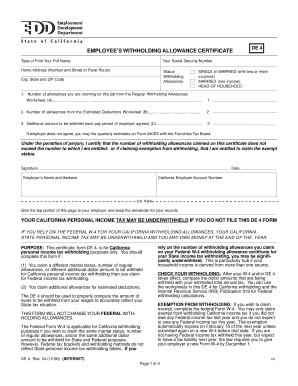

The Ca De4 form is a crucial document used for specific legal and administrative purposes. It is often required in various transactions and agreements, particularly in the context of compliance and verification processes. Understanding the Ca De4 form is essential for individuals and businesses alike, as it ensures that the necessary information is accurately captured and submitted in accordance with applicable regulations.

How to use the Ca De4

Using the Ca De4 form involves several straightforward steps. First, ensure that you have the correct version of the form, as variations may exist based on your specific needs. Next, gather all necessary information and documents required to complete the form accurately. Once you have all the information, fill out the form carefully, ensuring that all fields are completed as required. Finally, submit the form through the designated method, whether online, by mail, or in person, depending on the requirements set forth by the issuing authority.

Steps to complete the Ca De4

Completing the Ca De4 form requires attention to detail. Follow these steps for a successful submission:

- Obtain the latest version of the Ca De4 form from a reliable source.

- Read the instructions carefully to understand what information is required.

- Gather supporting documents that may be needed for reference.

- Fill out the form, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form as directed, ensuring you keep a copy for your records.

Legal use of the Ca De4

The Ca De4 form has specific legal implications, making it important to understand its proper use. When completed correctly, it serves as a legally binding document that can be used in various legal contexts. Compliance with relevant laws and regulations is essential to ensure that the form holds up in legal proceedings. This includes adhering to signature requirements and ensuring that all information provided is truthful and accurate.

Key elements of the Ca De4

Several key elements are essential to the Ca De4 form. These include:

- Identification details of the parties involved.

- Specific information pertaining to the purpose of the form.

- Signature lines for all required parties.

- Date of completion and submission.

- Any additional documentation or information that may be required.

Examples of using the Ca De4

The Ca De4 form can be utilized in various scenarios. For instance, it may be required in real estate transactions, where parties must verify their identities and intentions. Additionally, businesses may need to use the Ca De4 form for compliance with regulatory requirements or when entering into contracts with other entities. Understanding these examples can help clarify when and how to use the form effectively.

Quick guide on how to complete ca de4

Complete Ca De4 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents promptly without holdups. Handle Ca De4 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign Ca De4 without hassle

- Find Ca De4 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ca De4 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca de4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ca de4?

airSlate SignNow is an innovative electronic signature platform that simplifies document signing processes. With ca de4, businesses can easily create, send, and manage documents, ensuring compliance and efficiency in their workflows.

-

How much does airSlate SignNow cost for users interested in ca de4?

airSlate SignNow offers various pricing tiers to accommodate different business needs. Users looking for ca de4 solutions can choose from flexible monthly or yearly subscription plans that provide access to essential features and integrations.

-

What are the key features of airSlate SignNow for ca de4?

The key features of airSlate SignNow include easy document generation, secure electronic signatures, and advanced tracking capabilities. For ca de4, it also provides the ability to integrate seamlessly with other applications, enhancing productivity and collaboration.

-

How can airSlate SignNow benefit my business when using ca de4?

By using airSlate SignNow alongside ca de4, businesses can streamline their document workflows, reduce turnaround times, and save on costs related to printing and postal services. Overall, this leads to increased efficiency and a better customer experience.

-

Is airSlate SignNow secure for handling sensitive documents related to ca de4?

Yes, airSlate SignNow prioritizes security and compliance, utilizing robust encryption and secure data storage. This ensures that documents related to ca de4 are handled safely, adhering to necessary regulatory standards.

-

Can airSlate SignNow integrate with other software when using ca de4?

Absolutely! airSlate SignNow offers numerous integrations with popular software solutions to enhance user experience. When utilizing ca de4, you can connect with tools like CRM systems, payment processors, and cloud storage services for increased functionality.

-

What types of documents can I sign with airSlate SignNow in the context of ca de4?

With airSlate SignNow, you can sign a wide variety of documents including contracts, agreements, and forms. The support for ca de4 means that you can efficiently manage all types of documentation your business requires.

Get more for Ca De4

- Tx corporation search 497327207 form

- Texas corporation 497327208 form

- Professional corporation package for texas texas form

- Texas pre incorporation agreement shareholders agreement and confidentiality agreement texas form

- Domestic for profit corporation texas form

- Texas bylaws for corporation texas form

- Texas corporate form

- Articles incorporation corporation 497327214 form

Find out other Ca De4

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter