Verification of Deposit Form

What is the verification of deposit form?

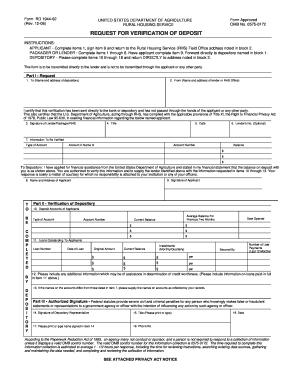

The verification of deposit form is a document used primarily by financial institutions to confirm an individual's account balance and transaction history. This form is often required when applying for loans, mortgages, or other financial services. It serves as an official statement from the bank, providing assurance to lenders or other entities that the applicant has the necessary funds available. The form typically includes pertinent details such as the account holder's name, account number, and the financial institution's contact information.

How to use the verification of deposit form

Using the verification of deposit form involves several straightforward steps. First, the account holder must request the form from their financial institution, which can often be done online or in person. Once received, the account holder should fill in any required personal details, ensuring accuracy to avoid delays. After completing the form, it should be submitted to the requesting party, such as a lender. Digital submission is increasingly common, allowing for quicker processing times.

Steps to complete the verification of deposit form

Completing the verification of deposit form requires careful attention to detail. Here are the key steps:

- Obtain the form from your bank or financial institution.

- Fill in your personal information, including your name and account number.

- Provide the requested account balance and transaction history, if applicable.

- Review the form for accuracy and completeness.

- Submit the form to the requesting entity, ensuring it is done securely.

Legal use of the verification of deposit form

The verification of deposit form is legally binding when filled out correctly and submitted to authorized parties. It acts as a formal declaration of an account holder's financial status. To ensure its legality, the form must be completed with accurate information and signed by a representative of the financial institution. Compliance with relevant regulations, such as the Electronic Signatures in Global and National Commerce (ESIGN) Act, is essential for digital submissions.

Key elements of the verification of deposit form

Several key elements must be included in the verification of deposit form to ensure its effectiveness. These elements typically consist of:

- The account holder's full name and contact information.

- The account number and type of account.

- The balance as of a specific date.

- A statement of account activity, if required.

- The bank's official seal or signature for verification.

Examples of using the verification of deposit form

The verification of deposit form is commonly used in various scenarios. For instance, when applying for a mortgage, lenders may request this form to assess an applicant's financial stability. Similarly, landlords may require it during the rental application process to verify that potential tenants have sufficient funds. Additionally, businesses may use it to confirm the financial status of clients or partners before entering into contracts.

Quick guide on how to complete verification of deposit form 11717723

Effortlessly Prepare Verification Of Deposit Form on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed forms, as you can easily find the correct template and securely store it online. airSlate SignNow supplies all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Verification Of Deposit Form on any device using airSlate SignNow applications for Android or iOS and streamline any document-related operation today.

How to Edit and Electronically Sign Verification Of Deposit Form with Ease

- Find Verification Of Deposit Form and click Get Form to start.

- Utilize the tools we offer to fill out your document.

- Emphasize essential sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method of sending the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Verification Of Deposit Form while ensuring excellent communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the verification of deposit form 11717723

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a verification of deposit form?

A verification of deposit form is a document used by lenders to confirm the funds available in a bank account. This form plays a crucial role in mortgage applications and other financial institutions' assessments. It allows them to verify that you have the required savings or funds needed.

-

How does airSlate SignNow assist with the verification of deposit form?

airSlate SignNow simplifies the process of creating and signing a verification of deposit form. With its intuitive platform, users can easily fill out the form, add electronic signatures, and send it securely to banks or financial institutions. This streamlines the verification process signNowly.

-

Is there a cost associated with using the verification of deposit form on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include the ability to create and manage verification of deposit forms. Depending on the plan you choose, there may be different features available, but there are no hidden fees. You can review the pricing options on our website for more details.

-

What features are included with the verification of deposit form service?

When using airSlate SignNow for a verification of deposit form, you gain access to various features such as customizable templates, secure eSigning, cloud storage, and document tracking. These features help ensure that your form is completed efficiently and securely, meeting all necessary documentation requirements.

-

Can I integrate airSlate SignNow with other applications for the verification of deposit form?

Yes, airSlate SignNow offers integrations with various applications that facilitate workflow management and document handling. You can easily connect it with tools like CRM systems or cloud storage solutions, enhancing your ability to manage verification of deposit forms and other documents seamlessly.

-

How long does it take to complete a verification of deposit form on airSlate SignNow?

Completing a verification of deposit form on airSlate SignNow can take just a few minutes, especially with the user-friendly interface. Once the necessary information is filled out, you can quickly send it for signatures or further processing. This efficiency helps speed up your financial transactions.

-

What benefits do I get from using airSlate SignNow for verification of deposit forms?

Using airSlate SignNow for your verification of deposit forms comes with numerous benefits, including ease of use, cost-effectiveness, and enhanced security for sensitive financial information. This solution also ensures compliance with legal standards, which is essential when submitting documents to banks.

Get more for Verification Of Deposit Form

Find out other Verification Of Deposit Form

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document