How to Get a State Tax Exemption Form If You Have Your Number 2011-2026

Understanding the State Tax Exemption Form

The state tax exemption form is a crucial document for individuals and organizations seeking to qualify for tax-exempt status in the United States. This form allows eligible entities, such as non-profits or certain businesses, to avoid paying sales tax on purchases related to their exempt purpose. It is essential to understand the specific requirements and eligibility criteria for your state, as these can vary significantly. Generally, the form requires details about the organization, including its legal name, tax identification number, and a description of its activities. Ensuring accurate and complete information is vital for the approval process.

Steps to Obtain the State Tax Exemption Form

To obtain the state tax exemption form, follow these steps:

- Visit your state’s Department of Revenue website or contact their office directly.

- Look for the section dedicated to tax-exempt organizations or sales tax exemptions.

- Download the appropriate form or request a physical copy if necessary.

- Review the instructions carefully to ensure you understand the requirements.

Once you have the form, gather any necessary documentation, such as your tax ID number and proof of your organization’s exempt status, if applicable.

Key Elements of the State Tax Exemption Form

The state tax exemption form typically includes several key elements that must be completed accurately:

- Organization Name: The legal name of the entity applying for exemption.

- Tax Identification Number: The unique number assigned by the IRS.

- Type of Exemption: The specific reason for seeking tax-exempt status.

- Contact Information: Details of a responsible individual for correspondence.

- Signature: An authorized representative must sign the form to validate it.

Filing Deadlines and Important Dates

Filing deadlines for the state tax exemption form can vary by state. It is crucial to be aware of these dates to avoid penalties or delays in processing. Most states have specific periods during which applications must be submitted, often aligning with the beginning of the fiscal year or tax season. Check with your state’s Department of Revenue for the most accurate and current deadlines to ensure timely submission.

Legal Use of the State Tax Exemption Form

Using the state tax exemption form legally requires adherence to specific guidelines set forth by both state and federal authorities. Organizations must ensure they meet the eligibility criteria for tax exemption and use the form solely for its intended purpose. Misuse of the form, such as using it for personal purchases or failing to maintain the required status, can lead to penalties and revocation of tax-exempt status. It is advisable to keep thorough records of all transactions made under this exemption to support compliance during audits.

Application Process and Approval Time

The application process for the state tax exemption form can vary in complexity depending on the state and the type of organization. Generally, once the form is submitted, it undergoes a review process by the state’s tax authority. Approval times can range from a few weeks to several months. During this period, the state may request additional documentation or clarification regarding the application. It is important to monitor the status of your application and respond promptly to any inquiries to facilitate a smooth approval process.

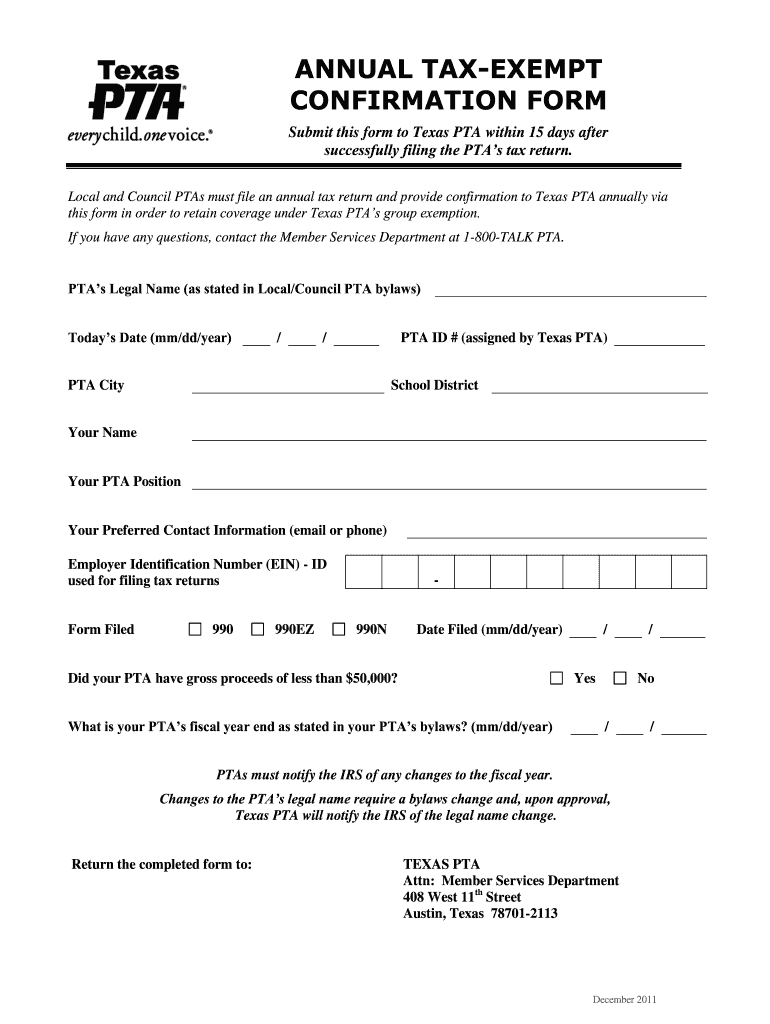

Quick guide on how to complete annual tax exempt confirmation form

Your assistance manual on how to prepare your How To Get A State Tax Exemption Form If You Have Your Number

If you’re looking to understand how to complete and submit your How To Get A State Tax Exemption Form If You Have Your Number, below are a few straightforward instructions on how to simplify the tax declaration process.

To start, all you need to do is register your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is a highly intuitive and robust document solution that allows you to modify, draft, and finalize your income tax forms effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to adjust responses as necessary. Simplify your tax administration with advanced PDF editing, eSigning, and convenient sharing options.

Follow the steps below to complete your How To Get A State Tax Exemption Form If You Have Your Number in just a few minutes:

- Register your account and start working on PDFs quickly.

- Access our catalog to find any IRS tax form; browse through various versions and schedules.

- Click Get form to load your How To Get A State Tax Exemption Form If You Have Your Number in our editor.

- Populate the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding eSignature (if needed).

- Review your document and correct any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it onto your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting in paper form can lead to increased return errors and delayed refunds. Be sure to check the IRS website for filing guidelines pertinent to your state before e-filing your taxes.

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

Create this form in 5 minutes!

How to create an eSignature for the annual tax exempt confirmation form

How to make an eSignature for the Annual Tax Exempt Confirmation Form online

How to generate an eSignature for your Annual Tax Exempt Confirmation Form in Chrome

How to create an electronic signature for putting it on the Annual Tax Exempt Confirmation Form in Gmail

How to create an electronic signature for the Annual Tax Exempt Confirmation Form from your mobile device

How to make an eSignature for the Annual Tax Exempt Confirmation Form on iOS

How to create an electronic signature for the Annual Tax Exempt Confirmation Form on Android

People also ask

-

What is the process for How To Get A State Tax Exemption Form If You Have Your Number?

To get a state tax exemption form, you'll need to visit your state's tax authority website. Typically, you can download the form directly and follow the instructions provided. If you’re unsure of the steps, our platform can guide you through the process of completing and submitting the necessary documentation.

-

Can airSlate SignNow help me with the eSigning of my state tax exemption form?

Yes, airSlate SignNow is designed to simplify the eSigning process for all types of documents, including your state tax exemption form. With our user-friendly interface, you can easily upload, sign, and send your form securely. This ensures that you have a quick and efficient way to manage your tax documents.

-

Are there any costs associated with using airSlate SignNow for tax exemption forms?

airSlate SignNow offers various pricing plans, starting with a free trial that allows you to explore our features. Once you decide to upgrade, our pricing is competitive and designed to be cost-effective for businesses looking to streamline their document signing processes, including How To Get A State Tax Exemption Form If You Have Your Number.

-

What features does airSlate SignNow provide that assist in obtaining state tax exemption forms?

Our platform offers features like customizable templates, secure cloud storage, and collaborative signing, all of which help you manage your state tax exemption forms more efficiently. Additionally, you can track the status of your documents in real-time, ensuring that you never miss a deadline.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage state tax exemption forms. This integration allows you to streamline your workflow, ensuring that obtaining a state tax exemption form is a hassle-free experience.

-

What benefits can I expect from using airSlate SignNow for my tax documents?

Using airSlate SignNow provides numerous benefits, including time savings, reduced paperwork, and enhanced security for your documents. You’ll find that learning How To Get A State Tax Exemption Form If You Have Your Number becomes much simpler with our automated processes and user-friendly tools.

-

Is airSlate SignNow secure for submitting sensitive tax documents?

Yes, airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with industry standards. You can confidently use our platform for all your sensitive tax documents, including your state tax exemption form, knowing that your data is protected.

Get more for How To Get A State Tax Exemption Form If You Have Your Number

- Carifate form

- Daily language review grade 6 pdf 50996885 form

- Respirator medical clearance approval form

- Take care by wageworks flexible spending account take care by wageworks flexible spending account form

- Multiplying amp dividing within 100 form

- Wccp chassis fill and sign printable template online form

- Conservaton program application conservation program application form

- Va form 29 389 veterans benefits administration

Find out other How To Get A State Tax Exemption Form If You Have Your Number

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile