Aetna Life Insurance Company Designation of Beneficiary Form

What is the Aetna Life Insurance Company Designation Of Beneficiary

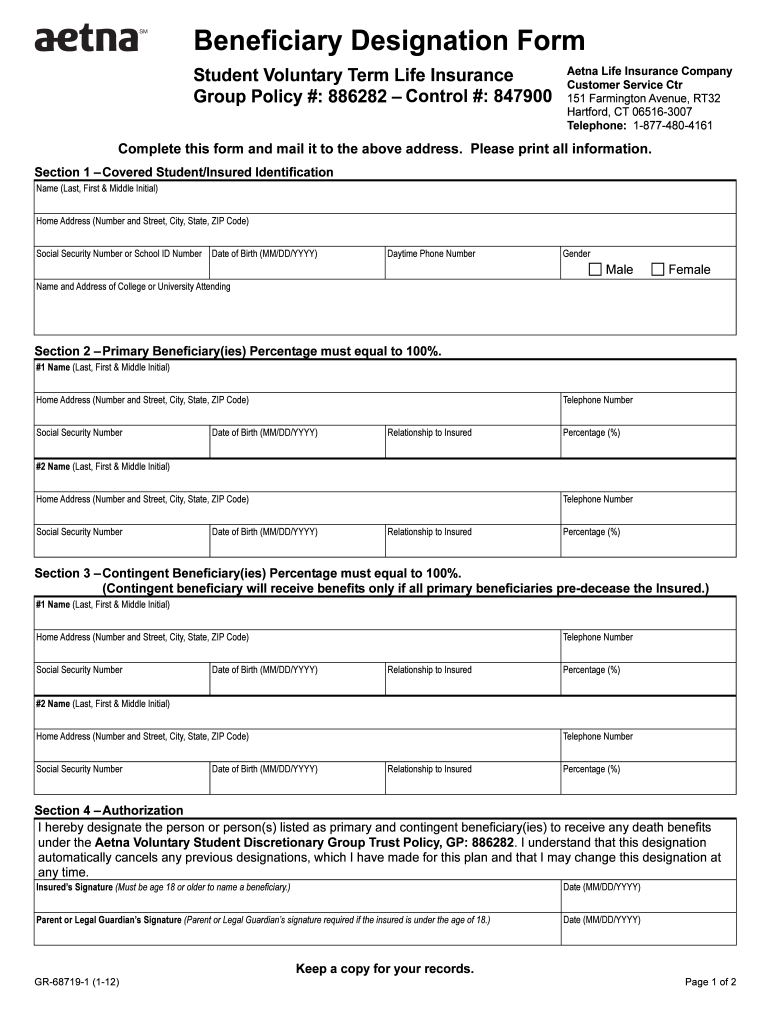

The Aetna Life Insurance Company designation of beneficiary form is a crucial document that allows policyholders to specify who will receive the benefits from their life insurance policy upon their passing. This form plays a vital role in estate planning, ensuring that the intended beneficiaries receive the financial support they need. By clearly identifying beneficiaries, policyholders can avoid potential disputes and ensure that their wishes are honored. The designation can include individuals, trusts, or organizations, providing flexibility in how benefits are distributed.

How to use the Aetna Life Insurance Company Designation Of Beneficiary

Using the Aetna Life Insurance Company designation of beneficiary form involves several straightforward steps. First, obtain the form from Aetna's official website or customer service. Next, fill out the required fields, including the names and contact information of the beneficiaries. It is essential to double-check the accuracy of this information to prevent any issues later. After completing the form, sign and date it, and ensure that it is submitted according to Aetna's guidelines, whether online or by mail. Keeping a copy for personal records is also advisable.

Steps to complete the Aetna Life Insurance Company Designation Of Beneficiary

Completing the Aetna Life Insurance Company designation of beneficiary form involves a series of clear steps:

- Obtain the form from Aetna.

- Provide your personal information, including your policy number.

- List the beneficiaries, including their full names and relationships to you.

- Indicate the percentage of benefits each beneficiary will receive.

- Sign and date the form to validate it.

- Submit the form as instructed, keeping a copy for your records.

Legal use of the Aetna Life Insurance Company Designation Of Beneficiary

The legal use of the Aetna Life Insurance Company designation of beneficiary form is governed by state laws and regulations. To be considered valid, the form must be completed accurately and signed by the policyholder. It is important to ensure that the form complies with the requirements set forth by Aetna and applicable state laws, as this can affect the enforceability of the designation. Additionally, keeping the form updated is crucial, especially after major life events such as marriage, divorce, or the birth of a child, to reflect current intentions.

Key elements of the Aetna Life Insurance Company Designation Of Beneficiary

Several key elements are essential for the Aetna Life Insurance Company designation of beneficiary form:

- Policyholder Information: This includes the name, address, and policy number of the individual completing the form.

- Beneficiary Details: Full names, relationships, and contact information of all designated beneficiaries.

- Percentage Allocation: Clear specification of how benefits will be divided among beneficiaries.

- Signature and Date: The policyholder's signature and the date of signing to validate the form.

Form Submission Methods

The Aetna Life Insurance Company designation of beneficiary form can typically be submitted through various methods, depending on the preferences of the policyholder. Common submission methods include:

- Online Submission: Many policyholders choose to complete and submit the form electronically through Aetna's secure online portal.

- Mail: The completed form can be printed and sent via postal mail to Aetna's designated address.

- In-Person: Some policyholders may prefer to deliver the form in person at an Aetna office or authorized agent location.

Quick guide on how to complete aetna life insurance company designation of beneficiary

Complete Aetna Life Insurance Company Designation Of Beneficiary effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate forms and securely store them online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Aetna Life Insurance Company Designation Of Beneficiary on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Aetna Life Insurance Company Designation Of Beneficiary without difficulty

- Locate Aetna Life Insurance Company Designation Of Beneficiary and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Modify and electronically sign Aetna Life Insurance Company Designation Of Beneficiary and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aetna life insurance company designation of beneficiary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Aetna Life Insurance Company designation of beneficiary process?

The Aetna Life Insurance Company designation of beneficiary process involves selecting individuals or entities to receive benefits upon your passing. This designation can be completed through forms provided by Aetna, ensuring that your intentions are clearly communicated. Properly designating beneficiaries helps streamline the claim process for loved ones during a difficult time.

-

How do I update my Aetna Life Insurance Company designation of beneficiary?

To update your Aetna Life Insurance Company designation of beneficiary, you will need to complete a beneficiary change form provided by Aetna. This form can often be found on their official website or requested through customer service. Making timely updates ensures that your benefits are granted according to your current wishes.

-

What happens if I don’t designate a beneficiary with Aetna Life Insurance?

If you do not designate a beneficiary with Aetna Life Insurance, your benefits may be paid out according to the default rules of your state or policy. This could mean that the funds are distributed to your estate, potentially leading to delays and legal complications. It’s crucial to complete the designation of beneficiary to avoid these issues.

-

Can I name multiple beneficiaries with the Aetna Life Insurance Company designation of beneficiary?

Yes, you can name multiple beneficiaries with the Aetna Life Insurance Company designation of beneficiary. When filling out the beneficiary form, you can specify how the benefits should be divided among your chosen beneficiaries. This flexibility allows you to provide support to various individuals or causes in your life.

-

Are there any fees associated with the Aetna Life Insurance Company designation of beneficiary?

Generally, there are no fees associated with the Aetna Life Insurance Company designation of beneficiary process itself. However, it’s important to review your policy details, as some administrative charges may apply for additional services. Checking your policy can help you avoid unexpected costs.

-

What benefits does designating a beneficiary offer with Aetna Life Insurance?

Designating a beneficiary with Aetna Life Insurance ensures that the benefits go directly to your chosen individual or organization, bypassing probate. This means quicker access to funds for your loved ones in a time of need. Additionally, it provides peace of mind knowing your wishes will be honored.

-

How often should I review my Aetna Life Insurance Company designation of beneficiary?

It is advisable to review your Aetna Life Insurance Company designation of beneficiary regularly, especially after major life events such as marriage, divorce, or the birth of a child. Keeping your beneficiary designations updated ensures they reflect your current wishes. Regular reviews can prevent unwanted complications for your beneficiaries later on.

Get more for Aetna Life Insurance Company Designation Of Beneficiary

- Letter notifying social security administration of identity theft of minor form

- Letter to other entities notifying them of identity theft of minor form

- Sales agency agreement form

- Identity theft checklist for minors form

- License to operate a kiosk booth rentals or renters for vending farmers markets or flea markets form

- Sample letter new application form

- Letter request credit application form

- Grant of right to photography and release to use photographic likeness on greeting cards form

Find out other Aetna Life Insurance Company Designation Of Beneficiary

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple