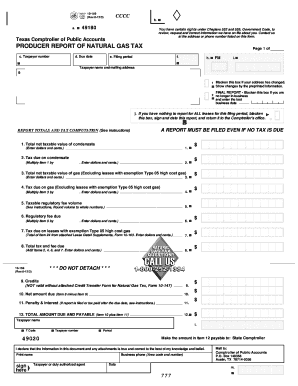

10 159 Producer Report of Natural Gas Tax Form

What is the 10 159 Producer Report of Natural Gas Tax

The 10 159 Producer Report of Natural Gas Tax is a tax form used by natural gas producers in the United States to report their production and pay the associated taxes. This form is essential for ensuring compliance with federal and state tax regulations. It captures critical information about the volume of natural gas produced, the revenue generated, and other relevant financial data that authorities require for tax assessment purposes.

How to Use the 10 159 Producer Report of Natural Gas Tax

Using the 10 159 Producer Report of Natural Gas Tax involves several key steps. First, gather all necessary production and financial data for the reporting period. This includes the total volume of natural gas produced and the corresponding revenue. Next, accurately fill out the form, ensuring that all fields are completed as required. Once completed, the form can be submitted electronically or via traditional mail, depending on the preferred submission method.

Steps to Complete the 10 159 Producer Report of Natural Gas Tax

Completing the 10 159 Producer Report of Natural Gas Tax requires attention to detail. Follow these steps for accurate completion:

- Collect production data for the reporting period.

- Calculate total revenue from natural gas sales.

- Fill out the form with accurate figures in each required section.

- Review the form for any errors or omissions.

- Submit the completed form by the designated deadline.

Legal Use of the 10 159 Producer Report of Natural Gas Tax

The legal use of the 10 159 Producer Report of Natural Gas Tax is governed by various regulations at both the federal and state levels. To ensure that the form is legally binding, it must be completed accurately and submitted on time. Additionally, using a reliable electronic signature solution can enhance the legal validity of the form by providing a secure method for signing and submitting documents.

Filing Deadlines / Important Dates

Filing deadlines for the 10 159 Producer Report of Natural Gas Tax are crucial for compliance. Typically, these deadlines align with the end of the tax year or specific quarterly reporting periods. It is essential to stay informed about these dates to avoid penalties. Mark your calendar with the relevant deadlines to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The 10 159 Producer Report of Natural Gas Tax can be submitted through various methods. Producers may choose to file online, which is often the quickest and most efficient option. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated offices. Each method has its own advantages, so select the one that best fits your needs and circumstances.

Quick guide on how to complete 10 159 producer report of natural gas tax

Effortlessly Prepare 10 159 Producer Report Of Natural Gas Tax on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow offers all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage 10 159 Producer Report Of Natural Gas Tax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign 10 159 Producer Report Of Natural Gas Tax with Ease

- Locate 10 159 Producer Report Of Natural Gas Tax and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, time-consuming form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign 10 159 Producer Report Of Natural Gas Tax to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 10 159 producer report of natural gas tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 10 159 producer report of natural gas tax and why is it important?

The 10 159 producer report of natural gas tax is a documentation requirement for natural gas producers to report their production and corresponding tax obligations. It's essential for compliance with regulatory standards and helps ensure accurate tax reporting. By efficiently managing this report, businesses can avoid penalties and streamline their tax processes.

-

How can airSlate SignNow assist in completing the 10 159 producer report of natural gas tax?

airSlate SignNow simplifies the process of completing the 10 159 producer report of natural gas tax with its user-friendly document management tools. You can create, send, and eSign documents digitally, ensuring that your reports are completed accurately and submitted on time. This helps reduce the administrative burden associated with tax filings.

-

What are the pricing plans available for using airSlate SignNow for the 10 159 producer report of natural gas tax?

airSlate SignNow offers various pricing plans tailored to fit the needs of different businesses when dealing with the 10 159 producer report of natural gas tax. Each plan includes essential features for document management and eSigning, ensuring you have the tools required for compliance. You can choose from monthly or annual subscriptions based on your usage and budget.

-

What features does airSlate SignNow provide to manage my 10 159 producer report of natural gas tax effectively?

With airSlate SignNow, you gain access to features like templates, automated reminders, and secure eSigning, specifically designed for the 10 159 producer report of natural gas tax. These tools enhance your workflow efficiency and ensure that your documents are always organized and ready for submission. The platform also allows for easy tracking of document status.

-

Are there any integrations available to streamline the completion of the 10 159 producer report of natural gas tax?

Yes, airSlate SignNow supports various integrations with popular business applications, making it easier to complete the 10 159 producer report of natural gas tax. These integrations can help you pull necessary data directly from your systems, reducing manual entry. This functionality enhances accuracy and speeds up the overall process.

-

How does airSlate SignNow ensure the security of the 10 159 producer report of natural gas tax?

Security is a priority at airSlate SignNow, especially for sensitive documents like the 10 159 producer report of natural gas tax. The platform provides robust encryption and compliance with industry standards to protect your data. You can trust that your information is safe from unauthorized access while using our secure eSigning capabilities.

-

Can I access the 10 159 producer report of natural gas tax from any device using airSlate SignNow?

Absolutely! airSlate SignNow is designed to be accessible from any device, including desktops, tablets, and smartphones. This flexibility allows you to manage your 10 159 producer report of natural gas tax on the go, ensuring that you can eSign and submit documents anytime, anywhere. Convenience is key for busy professionals.

Get more for 10 159 Producer Report Of Natural Gas Tax

Find out other 10 159 Producer Report Of Natural Gas Tax

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney