T2151 PDF Form

What is the T2151 PDF Form

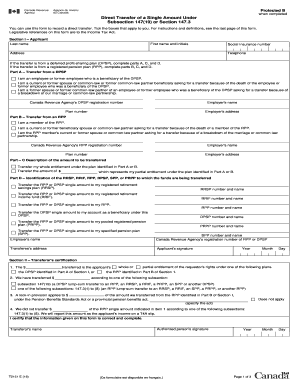

The T2151 form, officially known as the Canada Form T2151, is a document used primarily for tax purposes in Canada. This form is essential for individuals and businesses that need to report specific financial information to the Canada Revenue Agency (CRA). It is commonly utilized for various tax-related applications and submissions, helping taxpayers ensure compliance with Canadian tax laws. Understanding the purpose and requirements of the T2151 form is crucial for accurate reporting and avoiding potential penalties.

How to Obtain the T2151 PDF Form

Obtaining the T2151 PDF form is a straightforward process. Individuals can access the form through the official Canada Revenue Agency website, where it is available for download. The form can be found in the forms and publications section, allowing users to download and print it as needed. Alternatively, individuals may request a physical copy by contacting the CRA directly. Ensuring that you have the correct version of the form is important, as updates may occur periodically.

Steps to Complete the T2151 PDF Form

Completing the T2151 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents and information relevant to the form. This may include income statements, receipts, and other supporting documentation. Next, carefully fill out each section of the form, ensuring that all required fields are completed. It is essential to double-check the information for accuracy before submission. Finally, sign and date the form, and choose your preferred method for submission, whether online, by mail, or in person.

Legal Use of the T2151 PDF Form

The T2151 form holds legal significance in the context of Canadian tax law. When properly completed and submitted, it serves as a formal declaration of financial information to the CRA. This form must be filled out accurately to comply with legal requirements, as any discrepancies or omissions could lead to penalties or audits. Understanding the legal implications of submitting the T2151 form is vital for individuals and businesses to maintain compliance with tax regulations.

Key Elements of the T2151 PDF Form

The T2151 form includes several key elements that users must be aware of when completing it. These elements typically consist of personal identification information, details regarding income sources, and any applicable deductions or credits. Additionally, the form may require users to provide specific financial figures and calculations. Familiarity with these key components helps ensure that the form is filled out correctly, minimizing the risk of errors that could affect tax obligations.

Form Submission Methods

There are various methods available for submitting the T2151 form, allowing flexibility based on individual preferences. Users can submit the form online through the CRA's secure portal, which offers a convenient and efficient way to file. Alternatively, the form can be mailed to the appropriate CRA office, ensuring that it is sent to the correct address. For those who prefer in-person submissions, visiting a local CRA office is also an option. Each method has its own processing times, so users should consider their deadlines when choosing a submission method.

Quick guide on how to complete t2151 pdf form

Effortlessly Prepare T2151 Pdf Form on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents rapidly without any holdups. Manage T2151 Pdf Form on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

The simplest way to modify and eSign T2151 Pdf Form with ease

- Obtain T2151 Pdf Form and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign T2151 Pdf Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t2151 pdf form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are T2151 forms and why do I need them?

T2151 forms are important documents required for certain administrative processes. Understanding how can I order T2151 forms is crucial for ensuring you meet your obligations accurately and timely. These forms are often necessary for tax or compliance purposes, making them essential for businesses and individuals alike.

-

How can I order T2151 forms online?

Ordering T2151 forms online is straightforward with airSlate SignNow. Simply visit our website and navigate to the forms section where you can find detailed steps on how can I order T2151 forms. Our platform makes it easy to fill out and send documents securely, ensuring a hassle-free experience.

-

What is the cost of ordering T2151 forms through airSlate SignNow?

The cost of ordering T2151 forms with airSlate SignNow is designed to be budget-friendly while offering high-quality service. You might find different pricing tiers depending on your needs, making it affordable for both individuals and businesses. For detailed pricing, please check our website’s pricing page.

-

Are there any features that enhance the ordering process for T2151 forms?

Yes, airSlate SignNow offers several features that enhance the ordering process for T2151 forms. With our intuitive interface, you can easily fill out and eSign documents in seconds. Additionally, our tracking and notification features keep you updated on your form's status, addressing the question of how can I order T2151 forms efficiently.

-

Can I integrate airSlate SignNow with other software for ordering T2151 forms?

Absolutely! airSlate SignNow provides seamless integration with various software applications to simplify how can I order T2151 forms. This integration allows you to streamline your workflow and manage your documents without disruptions, making the entire process more efficient.

-

What are the benefits of using airSlate SignNow to order T2151 forms?

Using airSlate SignNow to order T2151 forms comes with several advantages. You gain access to an easy-to-use platform that saves time and reduces errors, enhancing your overall productivity. Additionally, our secure cloud storage ensures your documents are safe and easily accessible whenever you need them.

-

Is customer support available if I have trouble ordering T2151 forms?

Yes, airSlate SignNow provides robust customer support for users who need assistance navigating how can I order T2151 forms. Our support team is ready to guide you through any challenges you may encounter during the ordering process. You can signNow out via chat, email, or phone for prompt assistance.

Get more for T2151 Pdf Form

Find out other T2151 Pdf Form

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer