Form 593 Real Estate Withholding Statement Form 593 Real Estate Withholding Statement

What is the Form 593 Real Estate Withholding Statement

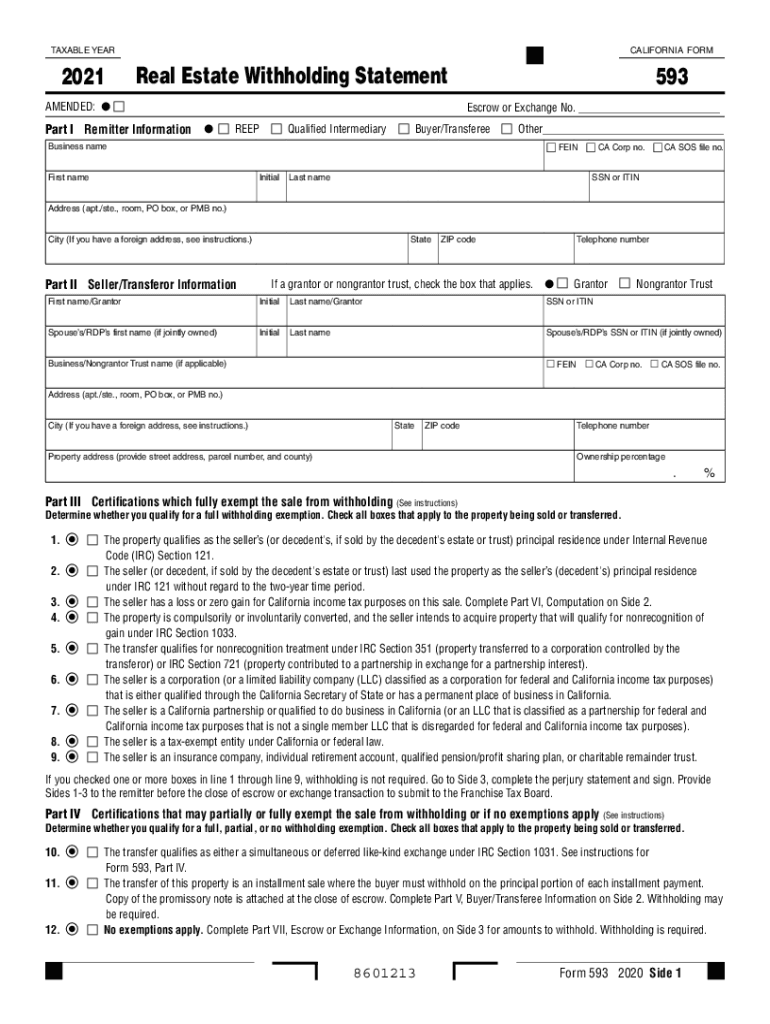

The Form 593 Real Estate Withholding Statement is a document required by the state of California for the withholding of state income tax on the sale of real estate. This form is typically used when a seller of real property is a non-resident of California. The purpose of the form is to ensure that the state collects taxes owed on the gain from the sale of real estate. It is essential for both buyers and sellers to understand the implications of this form to comply with California tax laws.

Steps to Complete the Form 593 Real Estate Withholding Statement

Completing the Form 593 requires careful attention to detail. Here are the key steps involved:

- Begin by entering the seller's information, including name, address, and taxpayer identification number.

- Provide details about the property being sold, including the address and the date of sale.

- Indicate the amount realized from the sale and any adjustments that may apply.

- Calculate the withholding amount based on the applicable tax rate.

- Sign and date the form to certify that the information provided is accurate.

How to Obtain the Form 593 Real Estate Withholding Statement

The Form 593 can be obtained from the California Franchise Tax Board's website or through various tax preparation software. It is advisable to ensure that you are using the most current version of the form, as updates may occur. Additionally, physical copies may be available at certain tax offices or through real estate professionals.

Legal Use of the Form 593 Real Estate Withholding Statement

The legal use of the Form 593 is crucial for compliance with California tax regulations. This form must be filled out accurately and submitted to the appropriate tax authority to avoid penalties. It serves as a record of the withholding and ensures that the correct amount of state income tax is remitted on behalf of the seller. Failure to submit this form can lead to significant tax liabilities for both the buyer and seller.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form 593. Generally, the form must be submitted at the time of the sale, and the withholding must be paid to the California Franchise Tax Board. Specific deadlines may vary based on the transaction date, so it is advisable to check the latest guidelines from the tax authority to ensure timely compliance.

Penalties for Non-Compliance

Non-compliance with the requirements related to the Form 593 can result in penalties. If the form is not filed or if the withholding amount is not paid, the California Franchise Tax Board may impose fines or interest on the unpaid taxes. Additionally, both buyers and sellers may face complications during future transactions if tax obligations are not met.

Quick guide on how to complete form 593 real estate withholding statement form 593 real estate withholding statement

Handle Form 593 Real Estate Withholding Statement Form 593 Real Estate Withholding Statement with ease on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Form 593 Real Estate Withholding Statement Form 593 Real Estate Withholding Statement on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest method to alter and electronically sign Form 593 Real Estate Withholding Statement Form 593 Real Estate Withholding Statement effortlessly

- Locate Form 593 Real Estate Withholding Statement Form 593 Real Estate Withholding Statement and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or hide sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Form 593 Real Estate Withholding Statement Form 593 Real Estate Withholding Statement to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 593 real estate withholding statement form 593 real estate withholding statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 593 Real Estate Withholding Statement?

The Form 593 Real Estate Withholding Statement is a document used in California for reporting real estate withholding. It is necessary for sellers who are non-residents to ensure compliance with state tax regulations. Understanding the Form 593 Real Estate Withholding Statement can help streamline your transaction and avoid unnecessary penalties.

-

How do I complete the Form 593 Real Estate Withholding Statement?

To complete the Form 593 Real Estate Withholding Statement, you must provide essential information about the property sale and the parties involved. airSlate SignNow offers a seamless platform to fill out and eSign this form electronically, making the process efficient and straightforward.

-

What are the benefits of using airSlate SignNow for the Form 593 Real Estate Withholding Statement?

Using airSlate SignNow for the Form 593 Real Estate Withholding Statement ensures a quick and simple eSignature process. It allows users to manage their documents securely and track the signing status, enhancing productivity and compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the Form 593 Real Estate Withholding Statement?

airSlate SignNow offers various pricing plans based on your needs, including options for individual users and businesses. These plans provide comprehensive features to efficiently manage documents like the Form 593 Real Estate Withholding Statement while remaining budget-friendly.

-

Can I integrate airSlate SignNow with other tools while filing the Form 593 Real Estate Withholding Statement?

Yes, airSlate SignNow can be integrated with numerous business applications such as CRM systems, cloud storage, and productivity tools. This allows users to manage their documents, including the Form 593 Real Estate Withholding Statement, more effectively within their existing workflows.

-

How secure is the transmission of the Form 593 Real Estate Withholding Statement through airSlate SignNow?

Security is a top priority for airSlate SignNow. When transmitting the Form 593 Real Estate Withholding Statement, all data is encrypted, ensuring that your sensitive information remains protected throughout the signing process.

-

What types of documents can I send for eSigning along with the Form 593 Real Estate Withholding Statement?

In addition to the Form 593 Real Estate Withholding Statement, you can send various types of documents for eSigning, including contracts, agreements, and other tax forms. airSlate SignNow’s versatility allows for comprehensive document management tailored to your business needs.

Get more for Form 593 Real Estate Withholding Statement Form 593 Real Estate Withholding Statement

- Assault 497330789 form

- Contract with independent form

- Subscription user agreement between internet based dating service and customer form

- Request letter for replacement of lost key form

- Sample letter for debtors motion for hardship discharge and notice of motion form

- Non circumvent form

- Agreement author form

- Acknowledgement of debt form

Find out other Form 593 Real Estate Withholding Statement Form 593 Real Estate Withholding Statement

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast