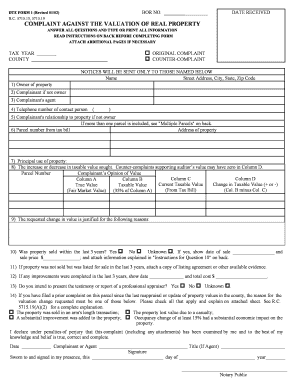

Dte Form 1

What is the Dte Form 1

The Dte Form 1 is a specific document used in various legal and administrative contexts within the United States. It serves as a formal request or declaration that may be required for different purposes, such as tax filings or regulatory compliance. Understanding the purpose of this form is essential for ensuring that it is filled out correctly and submitted in accordance with applicable laws.

How to use the Dte Form 1

Using the Dte Form 1 involves several steps to ensure proper completion and submission. First, gather all necessary information and documents required to fill out the form accurately. Next, complete each section of the form, paying close attention to detail. Once the form is filled out, review it for accuracy before submitting it through the appropriate channels, whether online, by mail, or in person.

Steps to complete the Dte Form 1

Completing the Dte Form 1 requires a systematic approach:

- Gather necessary information, including personal details and supporting documents.

- Carefully read the instructions that accompany the form to understand specific requirements.

- Fill out the form completely, ensuring all fields are addressed.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified method, ensuring it is sent to the correct authority.

Legal use of the Dte Form 1

The Dte Form 1 holds legal significance, meaning it must be completed and submitted in compliance with relevant laws and regulations. This includes adhering to any deadlines and ensuring that all information provided is accurate and truthful. Failure to comply with legal requirements can result in penalties or rejection of the form.

Key elements of the Dte Form 1

Several key elements are crucial when filling out the Dte Form 1:

- Personal Information: This includes the name, address, and other identifying details of the individual or entity submitting the form.

- Purpose of Submission: Clearly state the reason for submitting the form, as this can affect processing times and requirements.

- Signature: A valid signature is often required to authenticate the form and confirm the information provided.

Form Submission Methods

The Dte Form 1 can typically be submitted through various methods, including:

- Online Submission: Many jurisdictions allow digital submission of the form through official websites.

- Mail: The form can be printed and mailed to the appropriate office, following the guidelines for postage and delivery.

- In-Person: Some situations may require the form to be submitted in person at designated offices.

Quick guide on how to complete dte form 1

Complete Dte Form 1 effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Dte Form 1 seamlessly on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Dte Form 1 effortlessly

- Obtain Dte Form 1 and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Dte Form 1 and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dte form 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Dte Form 1 and how can airSlate SignNow assist with it?

The Dte Form 1 is a crucial document often required for various administrative purposes. airSlate SignNow streamlines the process of filling out and electronically signing the Dte Form 1, making it easy for businesses to stay compliant and manage their paperwork efficiently.

-

Is airSlate SignNow suitable for completing the Dte Form 1?

Yes, airSlate SignNow is perfectly suited for completing the Dte Form 1. Its user-friendly platform allows users to fill out the form quickly and securely, ensuring that all legal requirements are met with ease.

-

What are the pricing options for using airSlate SignNow for the Dte Form 1?

airSlate SignNow offers a variety of pricing plans to cater to different business needs. Users can choose a plan that fits their budget while getting access to all the features necessary for easy management of the Dte Form 1.

-

What features does airSlate SignNow provide for handling the Dte Form 1?

airSlate SignNow includes features that enhance the management of the Dte Form 1, such as customizable templates, automated workflows, and secure eSignature capabilities. These features simplify document handling, reduce errors, and improve overall efficiency.

-

Can I integrate airSlate SignNow with other tools when managing the Dte Form 1?

Absolutely! airSlate SignNow offers integrations with various third-party applications, making it easier for users to incorporate Dte Form 1 processes into their existing workflows. Integrations with tools like Google Drive and Salesforce help optimize document management.

-

What are the benefits of using airSlate SignNow for the Dte Form 1?

Using airSlate SignNow for the Dte Form 1 offers numerous benefits such as time savings, reduced paper usage, and enhanced security for sensitive documents. This electronic solution not only simplifies the sign-off process but also increases overall productivity.

-

Is airSlate SignNow compliant with regulations when using the Dte Form 1?

Yes, airSlate SignNow is designed to comply with various electronic signature regulations, including those pertinent to the Dte Form 1. This compliance ensures that all signed documents are legally enforceable and meet industry standards.

Get more for Dte Form 1

- Agreement sale equipment form

- Application to join security association 497330216 form

- Sample demand payment form

- Letter documents form

- Transfer assets form

- Contract hair form

- Waiver and release from liability for using indoor softball and baseball batting cage form

- Waiver and release from liability for using indoor softball and baseball batting cage minor form

Find out other Dte Form 1

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now