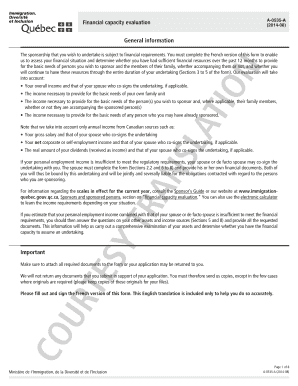

Financial Capacity Assessment Example Form

What is the Financial Capacity Assessment Example

The financial capacity assessment example is a crucial document used to evaluate an individual's or entity's financial ability to meet obligations. This assessment typically includes an analysis of income, assets, liabilities, and overall financial health. It serves various purposes, such as determining eligibility for loans, grants, or other financial assistance. By providing a clear picture of financial standing, this form helps organizations make informed decisions regarding financial support or partnerships.

How to use the Financial Capacity Assessment Example

Using the financial capacity assessment example involves several steps to ensure accurate and comprehensive evaluation. First, gather all necessary financial documents, including income statements, tax returns, and asset documentation. Next, fill out the assessment form by providing detailed information about your financial situation. It is important to be honest and thorough, as inaccuracies can lead to misunderstandings or disqualification from financial opportunities. Once completed, review the form for accuracy before submitting it to the relevant organization or authority.

Steps to complete the Financial Capacity Assessment Example

Completing the financial capacity assessment example requires careful attention to detail. Follow these steps:

- Collect necessary financial documents, such as pay stubs, bank statements, and investment records.

- Begin filling out the assessment form, starting with personal information like name and contact details.

- Provide information on income sources, including salary, bonuses, and any additional earnings.

- List all assets, such as real estate, vehicles, and savings accounts, along with their estimated values.

- Detail liabilities, including loans, credit card debt, and other financial obligations.

- Review all entries for accuracy and completeness.

- Submit the completed form as instructed, ensuring you retain a copy for your records.

Key elements of the Financial Capacity Assessment Example

The financial capacity assessment example includes several key elements that are essential for a thorough evaluation. These elements typically consist of:

- Personal Information: Name, address, and contact details of the individual or entity being assessed.

- Income Details: Comprehensive information on all income sources, including employment and passive income.

- Asset Overview: A detailed list of assets, including their current market values.

- Liabilities: A breakdown of all debts and financial obligations.

- Financial Ratios: Calculations that may include debt-to-income ratios or net worth assessments.

Legal use of the Financial Capacity Assessment Example

The legal use of the financial capacity assessment example is significant in various contexts, particularly when seeking loans or financial assistance. For the document to be legally binding, it must be completed accurately and submitted according to the guidelines set by the requesting organization. Compliance with relevant laws and regulations, such as those pertaining to financial disclosures, is essential. Additionally, using a secure platform for submission can help ensure that the information remains confidential and protected.

Who Issues the Form

The financial capacity assessment example is typically issued by financial institutions, government agencies, or organizations providing grants or loans. These entities require the assessment to evaluate the financial stability of applicants before approving funding or support. It is important to check with the specific organization to understand their requirements and the format of the assessment they accept.

Quick guide on how to complete financial capacity assessment example

Finalize Financial Capacity Assessment Example effortlessly on any device

Digital document management has become favored by businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Financial Capacity Assessment Example on any device with airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to modify and eSign Financial Capacity Assessment Example with ease

- Find Financial Capacity Assessment Example and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Financial Capacity Assessment Example and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the financial capacity assessment example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a financial capacity assessment example?

A financial capacity assessment example evaluates an individual's or an organization's ability to manage financial responsibilities. This assessment typically includes analyzing income, expenses, assets, and liabilities to determine financial health. Using a financial capacity assessment example can guide decision-making for loans, investments, and budgeting.

-

How can airSlate SignNow help with creating financial capacity assessment examples?

airSlate SignNow streamlines the process of creating financial capacity assessment examples by allowing users to create, send, and eSign documents easily. Our platform offers customizable templates that enable you to build tailored assessments. This can signNowly increase efficiency and reduce turnaround time.

-

What features does airSlate SignNow provide for financial capacity assessments?

Key features of airSlate SignNow for financial capacity assessments include customizable templates, real-time collaboration, and secure eSigning. These features facilitate seamless communication and document management for assessments. Additionally, our platform ensures compliance with industry standards and data security.

-

Are there any pricing plans for using airSlate SignNow for financial capacity assessment examples?

Yes, airSlate SignNow offers various pricing plans tailored to meet diverse business needs. Each plan provides access to features that simplify the creation and management of financial capacity assessment examples. A free trial is also available, allowing you to explore functionalities before committing.

-

How can I integrate airSlate SignNow with other tools for financial assessments?

airSlate SignNow can be easily integrated with numerous third-party applications, including CRM systems and financial software. This allows for a streamlined workflow when handling financial capacity assessment examples. Integrations can enhance data sharing and improve overall operational efficiency.

-

What are the benefits of using airSlate SignNow for financial capacity assessments?

Using airSlate SignNow for financial capacity assessments offers numerous benefits, such as enhanced efficiency, reduction in paper waste, and quicker contract turnaround times. The easy-to-use platform empowers teams to focus on core business functions rather than administrative tasks. Additionally, secure eSigning ensures the integrity of financial documents.

-

Can I track the status of my financial capacity assessment examples in airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of financial capacity assessment examples in real-time. You will receive notifications when documents are opened, signed, or completed, ensuring transparency throughout the process. This feature is essential for maintaining oversight and improving follow-up strategies.

Get more for Financial Capacity Assessment Example

Find out other Financial Capacity Assessment Example

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal