Bpi Ms Insurance Form

What is the BPI MS Insurance Form

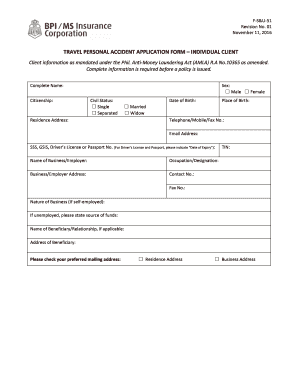

The BPI MS Insurance Form is a crucial document used for various insurance-related processes within the BPI MS Insurance framework. This form typically serves to initiate or manage insurance policies, claims, or other related transactions. It is designed to capture essential information about the policyholder, the type of insurance, and the specific details of the coverage being requested or modified.

How to Use the BPI MS Insurance Form

Using the BPI MS Insurance Form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal details, policy numbers, and any relevant documentation. Next, fill out the form carefully, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions before submitting it to the appropriate BPI MS Insurance office or through their designated online platform.

Steps to Complete the BPI MS Insurance Form

Completing the BPI MS Insurance Form requires attention to detail. Here are the key steps:

- Begin by reading the instructions provided with the form to understand what information is required.

- Fill in your personal information, including your name, address, and contact details.

- Provide information about the insurance coverage you are applying for or modifying.

- Attach any necessary supporting documents, such as identification or previous policy information.

- Review the completed form to ensure all information is accurate and complete.

- Submit the form as directed, either online or via mail, based on your preference.

Legal Use of the BPI MS Insurance Form

The BPI MS Insurance Form holds legal significance as it serves as a binding agreement between the policyholder and the insurance provider. To ensure its legal validity, the form must be completed accurately and submitted according to the established guidelines. Additionally, compliance with relevant insurance regulations and laws is essential to uphold the integrity of the document.

Key Elements of the BPI MS Insurance Form

Several key elements are crucial for the BPI MS Insurance Form to serve its purpose effectively:

- Personal Information: Accurate details about the policyholder, including name and contact information.

- Insurance Details: Specifics about the type of insurance being requested or modified.

- Signatures: Required signatures of the policyholder to validate the form.

- Date: The date of completion, which is important for record-keeping and compliance.

Form Submission Methods

The BPI MS Insurance Form can be submitted through various methods, ensuring flexibility for users. Options typically include:

- Online Submission: Many users prefer to submit the form electronically through the BPI MS Insurance website, which often provides a streamlined process.

- Mail: The form can be printed and mailed to the designated office, ensuring that all documents are sent securely.

- In-Person: For those who prefer direct interaction, submitting the form in person at a local BPI MS Insurance office is also an option.

Quick guide on how to complete bpi ms insurance form

Complete Bpi Ms Insurance Form smoothly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and efficiently. Manage Bpi Ms Insurance Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Bpi Ms Insurance Form effortlessly

- Find Bpi Ms Insurance Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select relevant portions of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Bpi Ms Insurance Form to guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bpi ms insurance form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bpi ms insurance form?

The bpi ms insurance form is a crucial document required for managing your insurance applications and claims processes. airSlate SignNow simplifies the completion and submission of the bpi ms insurance form through its convenient eSigning features, ensuring a faster and more efficient workflow.

-

How can airSlate SignNow help with the bpi ms insurance form?

Using airSlate SignNow, you can easily create, send, and eSign the bpi ms insurance form online, eliminating the need for paper documents. Our platform ensures that your forms are securely signed and saved, allowing you to streamline your insurance processes effectively.

-

Is there a cost associated with using airSlate SignNow for the bpi ms insurance form?

airSlate SignNow offers flexible pricing plans that cater to different needs, including access to features for managing the bpi ms insurance form. You can choose a plan that fits your business size and budget, ensuring that you get the best value for your document signing needs.

-

What features does airSlate SignNow offer for the bpi ms insurance form?

To enhance your experience with the bpi ms insurance form, airSlate SignNow provides features such as template creation, real-time notifications, and cloud storage integration. These features make it easy to manage your documents and keep track of signing progress.

-

Can I integrate airSlate SignNow with other applications for the bpi ms insurance form?

Yes, airSlate SignNow allows seamless integration with popular applications and tools you may already use for managing the bpi ms insurance form. This integration helps improve your workflow by connecting your eSigning process with other business applications, making it more efficient.

-

What are the benefits of using airSlate SignNow for my bpi ms insurance form?

By using airSlate SignNow for your bpi ms insurance form, you benefit from enhanced security, reduced paperwork, and faster processing times. This digital approach mitigates the risks associated with paper documents while ensuring that your forms are always accessible and easy to track.

-

Is airSlate SignNow user-friendly for filling out the bpi ms insurance form?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it simple for anyone to fill out the bpi ms insurance form without extensive training. The intuitive interface allows you to complete and eSign forms quickly, making your experience efficient and hassle-free.

Get more for Bpi Ms Insurance Form

- Mn business form

- Letter from tenant to landlord containing request for permission to sublease minnesota form

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages 497312061 form

- Minnesota uniform conveyancing blanks 497312062

- Landlord rent paid form

- Release of land from lien in marriage dissolution divorce judgment and decree ucbc form 811 minnesota

- Letter tenant landlord mn form

- Mn deed form 497312066

Find out other Bpi Ms Insurance Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors