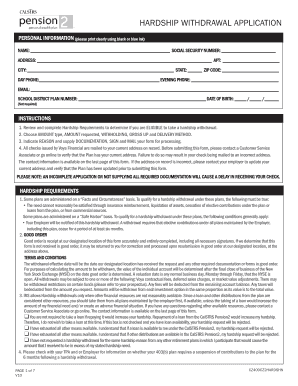

Calstrs Hardship Withdrawal Form

What is the Calstrs Hardship Withdrawal

The Calstrs hardship withdrawal is a provision that allows members of the California State Teachers' Retirement System to access their retirement savings under specific circumstances that demonstrate financial need. This option is designed to provide relief for members facing significant financial difficulties, such as medical emergencies, foreclosure, or other unexpected expenses. To qualify, members must meet certain eligibility criteria and provide documentation that substantiates their hardship claim.

Eligibility Criteria for the Calstrs Hardship Withdrawal

To be eligible for a Calstrs hardship withdrawal, members must satisfy specific requirements. These include:

- Being an active member of Calstrs.

- Demonstrating a financial hardship that meets the defined criteria.

- Providing necessary documentation to support the claim, such as medical bills or foreclosure notices.

It is important to review the detailed criteria set forth by Calstrs to ensure compliance and proper submission of the withdrawal request.

Steps to Complete the Calstrs Hardship Withdrawal

Completing the Calstrs hardship withdrawal involves several key steps:

- Review the eligibility requirements to confirm qualification.

- Gather all required documentation that supports your hardship claim.

- Fill out the hardship withdrawal application form accurately.

- Submit the completed form along with supporting documents to Calstrs.

- Await confirmation and processing of your withdrawal request.

Following these steps carefully will help ensure a smooth application process.

Required Documents for the Calstrs Hardship Withdrawal

When applying for a Calstrs hardship withdrawal, specific documents must be submitted to validate your claim. These typically include:

- Proof of financial hardship, such as medical bills or eviction notices.

- Completed hardship withdrawal application form.

- Any additional documentation requested by Calstrs to support your case.

Ensuring that all documents are complete and accurate will facilitate the review process by Calstrs.

How to Submit the Calstrs Hardship Withdrawal Form

Members can submit their Calstrs hardship withdrawal form through various methods. These include:

- Online submission via the Calstrs member portal.

- Mailing the completed form and documents to the designated Calstrs office.

- In-person submission at a Calstrs office, if preferred.

Choosing the method that best suits your needs can help streamline the submission process.

Legal Use of the Calstrs Hardship Withdrawal

The legal framework surrounding the Calstrs hardship withdrawal ensures that the process is compliant with relevant laws and regulations. Members must adhere to the guidelines set forth by Calstrs, which include providing truthful information and submitting valid documentation. Failure to comply with these legal requirements can result in delays or denial of the withdrawal request.

Quick guide on how to complete calstrs hardship withdrawal

Complete Calstrs Hardship Withdrawal effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and efficiently. Manage Calstrs Hardship Withdrawal on any device with airSlate SignNow’s Android or iOS applications and simplify any document-based workflow today.

The easiest way to edit and eSign Calstrs Hardship Withdrawal with ease

- Find Calstrs Hardship Withdrawal and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Calstrs Hardship Withdrawal and ensure outstanding communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the calstrs hardship withdrawal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CalSTRS hardship withdrawal?

A CalSTRS hardship withdrawal is a provision that allows eligible members to withdraw funds from their CalSTRS retirement account in times of financial difficulty. This option can provide immediate access to necessary funds for those experiencing qualifying hardships, making it an essential resource for many. It's important to understand the application process and eligibility requirements involved in securing a CalSTRS hardship withdrawal.

-

How do I apply for a CalSTRS hardship withdrawal?

To apply for a CalSTRS hardship withdrawal, you must complete a specific application form provided by CalSTRS. This form requires documentation of your hardship situation, which will be reviewed by their team. Ensuring all paperwork is accurate and complete will help expedite the processing of your CalSTRS hardship withdrawal request.

-

What types of hardships qualify for a CalSTRS withdrawal?

Qualifying hardships for a CalSTRS withdrawal include situations such as unexpected medical expenses, foreclosure or eviction notices, and other financial crises impacting your stability. Each case is evaluated individually, and supporting documentation will be needed to substantiate your claims. It's critical to ensure that your hardship fits within the criteria set by CalSTRS to successfully qualify for a hardship withdrawal.

-

Is there a fee associated with the CalSTRS hardship withdrawal?

Typically, there are no direct fees charged for applying for a CalSTRS hardship withdrawal; however, members should be aware of potential tax implications and penalties associated with early withdrawals. It's advisable to consult with a financial advisor to understand the complete financial impact. This way, you can make informed decisions regarding the use of your funds when facing a hardship.

-

How long does it take to process a CalSTRS hardship withdrawal?

The processing time for a CalSTRS hardship withdrawal can vary based on the completeness of your application and the volume of requests being handled. Generally, you can expect a response within a few weeks, but this can be longer if additional documentation is required. Staying proactive and following up can help ensure a smoother process for your CalSTRS hardship withdrawal.

-

Can I use airSlate SignNow to facilitate my CalSTRS withdrawal paperwork?

Yes, you can utilize airSlate SignNow to streamline the preparation and signing of your CalSTRS hardship withdrawal paperwork. With airSlate SignNow’s eSignature features, you can easily send, sign, and manage your documents online, enhancing efficiency and security. This can signNowly shorten the time it takes to complete your application process.

-

What benefits does airSlate SignNow offer for managing my CalSTRS withdrawal process?

airSlate SignNow provides a cost-effective and user-friendly platform for managing your CalSTRS hardship withdrawal documents. The intuitive interface allows for easy document preparation and eSigning, which can help you stay organized and reduce delays. Additionally, the platform enables you to track the status of your applications, ensuring you remain informed throughout the process.

Get more for Calstrs Hardship Withdrawal

- Residential rental lease agreement missouri form

- Tenant welcome letter missouri form

- Warning of default on commercial lease missouri form

- Warning of default on residential lease missouri form

- Landlord tenant closing statement to reconcile security deposit missouri form

- Mo change for form

- Name change notification form missouri

- Commercial building or space lease missouri form

Find out other Calstrs Hardship Withdrawal

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement