Flexible Spending Account Claim Form

What is the Flexible Spending Account Claim Form

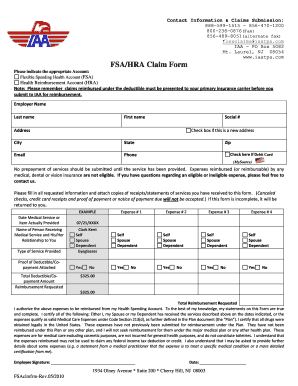

The Flexible Spending Account Claim Form is a crucial document that allows employees to request reimbursement for eligible medical expenses paid out of pocket. This form is typically used in conjunction with a flexible spending account (FSA), which is a pre-tax benefit account that helps employees manage healthcare costs. By submitting this form, individuals can claim funds for various expenses, including copayments, prescription medications, and certain medical supplies. Understanding the purpose and function of this form is essential for maximizing the benefits of an FSA.

How to use the Flexible Spending Account Claim Form

Using the Flexible Spending Account Claim Form involves several straightforward steps. First, gather all necessary documentation, such as receipts or invoices for eligible expenses. Next, accurately fill out the form, ensuring that all required fields are completed, including your personal information and details about the expenses being claimed. After completing the form, attach the supporting documents and submit it according to your employer's guidelines, which may include online submission or mailing the form. It is important to keep copies of all submitted documents for your records.

Steps to complete the Flexible Spending Account Claim Form

Completing the Flexible Spending Account Claim Form requires careful attention to detail. Follow these steps for successful submission:

- Gather necessary receipts and invoices for eligible expenses.

- Fill in your personal details, including name, address, and employee identification number.

- List each expense, including the date incurred, description, and amount.

- Attach copies of receipts or other relevant documentation.

- Review the form for accuracy and completeness.

- Submit the form as directed by your employer, either online or via mail.

Legal use of the Flexible Spending Account Claim Form

The legal validity of the Flexible Spending Account Claim Form hinges on compliance with federal regulations and employer policies. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated timeframes set by your employer. Additionally, the form should be used solely for eligible expenses as defined by the Internal Revenue Service (IRS) guidelines. Understanding these legal requirements can help prevent issues with reimbursement and ensure that claims are processed smoothly.

Required Documents

When submitting the Flexible Spending Account Claim Form, specific documentation is necessary to support your claim. Required documents typically include:

- Itemized receipts or invoices that detail the services provided.

- Proof of payment, such as credit card statements or bank statements.

- Any additional forms or information requested by your employer or FSA administrator.

Ensuring that all required documents are included with your claim can expedite the reimbursement process and reduce the likelihood of delays.

Filing Deadlines / Important Dates

Filing deadlines for the Flexible Spending Account Claim Form are essential to ensure timely reimbursement. Most employers set specific deadlines for submitting claims, often within a certain period after the end of the plan year. It is crucial to be aware of these dates to avoid losing the ability to claim eligible expenses. Some employers may also allow a grace period or a run-out period, during which claims can still be submitted for expenses incurred during the previous plan year. Always check with your employer for the exact deadlines applicable to your FSA plan.

Examples of using the Flexible Spending Account Claim Form

Understanding practical applications of the Flexible Spending Account Claim Form can provide clarity on its use. Common examples include:

- Submitting a claim for a doctor's visit copayment.

- Requesting reimbursement for prescription medications purchased at a pharmacy.

- Claiming costs associated with medical supplies, such as bandages or diabetic testing strips.

These examples illustrate the types of expenses that can be claimed and the importance of maintaining accurate records to support your claims.

Quick guide on how to complete flexible spending account claim form

Complete Flexible Spending Account Claim Form effortlessly on any device

Digital document management has become popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without interruptions. Manage Flexible Spending Account Claim Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to alter and eSign Flexible Spending Account Claim Form effortlessly

- Obtain Flexible Spending Account Claim Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important parts of your documents or cover sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Modify and eSign Flexible Spending Account Claim Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the flexible spending account claim form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Flexible Spending Account Claim Form?

A Flexible Spending Account Claim Form is a document that allows employees to request reimbursement for eligible out-of-pocket medical expenses. The form must be completed accurately and submitted to your employer's benefits administrator for processing. Using airSlate SignNow, you can easily fill out and eSign your Flexible Spending Account Claim Form, making the process efficient and hassle-free.

-

How can airSlate SignNow help with my Flexible Spending Account Claim Form?

airSlate SignNow provides a streamlined platform for completing and signing your Flexible Spending Account Claim Form digitally. With user-friendly features, you can fill out the form, add signatures, and securely send it to your HR department or benefits administrator. This saves you time, reduces paperwork, and ensures your claim is processed promptly.

-

Is there a cost associated with using airSlate SignNow for the Flexible Spending Account Claim Form?

Yes, airSlate SignNow operates on a subscription model with various pricing options to fit your needs. While there may be a cost involved, the value of quickly managing your Flexible Spending Account Claim Form and reducing administrative burdens can outweigh the expense. Check our pricing page for the best plan that suits your requirements.

-

Can I integrate airSlate SignNow with other applications for my Flexible Spending Account Claim Form?

Absolutely! airSlate SignNow offers numerous integrations with popular applications such as Google Drive, Dropbox, and HR management tools. This helps streamline the process of managing your Flexible Spending Account Claim Form alongside your other business operations. Integration enhances workflow efficiency and enables seamless document management.

-

What advantages does airSlate SignNow offer for processing Flexible Spending Account Claim Forms?

Using airSlate SignNow for your Flexible Spending Account Claim Form provides multiple advantages, including reduced turnaround time, enhanced tracking capabilities, and improved security features. Digital signing ensures that your documents are legally binding and compliant. Plus, the platform's ease of use makes for a hassle-free experience.

-

How secure is my information when using the Flexible Spending Account Claim Form with airSlate SignNow?

At airSlate SignNow, security is a top priority. When filling out and submitting your Flexible Spending Account Claim Form, your data is protected with industry-standard encryption and secure servers. We comply with all regulations to ensure that your personal and financial information remains confidential and secure.

-

Can I access my Flexible Spending Account Claim Form from multiple devices?

Yes, airSlate SignNow is cloud-based, which means you can access your Flexible Spending Account Claim Form from any device with internet connectivity. This flexibility allows you to complete and submit your claim from your computer, tablet, or smartphone anytime, anywhere, making the process convenient and adaptable to your schedule.

Get more for Flexible Spending Account Claim Form

- Mississippi wife form

- Warranty deed from husband to himself and wife mississippi form

- Quitclaim deed from husband to himself and wife mississippi form

- Mississippi affidavit form

- Ms petition form

- Order authorizing the closing of the estate and the discharge of the executor mississippi form

- Petition letters administration form

- Letter administration form

Find out other Flexible Spending Account Claim Form

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free