Customer Credit Evaluation Form

What is the Customer Credit Evaluation Form

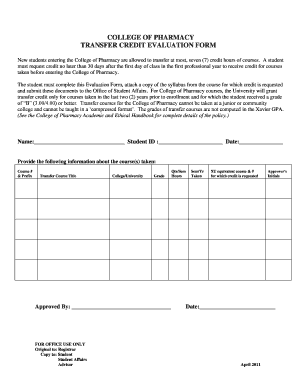

The customer credit evaluation form is a crucial document used by businesses to assess the creditworthiness of potential clients or customers. This form collects essential information regarding the applicant's financial history, including income, existing debts, and credit scores. It serves as a foundational tool for businesses to make informed decisions about extending credit or setting payment terms.

How to Use the Customer Credit Evaluation Form

Using the customer credit evaluation form involves several steps. First, gather all necessary financial information from the applicant. This may include details about their income, employment history, and any outstanding loans. Next, ensure that the form is filled out completely and accurately. Once the form is completed, it should be submitted to the appropriate department for review. The evaluation process will typically involve analyzing the provided data against the company's credit policies.

Steps to Complete the Customer Credit Evaluation Form

Completing the customer credit evaluation form requires careful attention to detail. Follow these steps for successful completion:

- Begin by entering the applicant's personal information, including name, address, and contact details.

- Provide financial information, such as monthly income, employment status, and any other relevant income sources.

- List existing debts and obligations, including loans, credit cards, and other financial commitments.

- Include consent for credit checks, if required by the evaluating institution.

- Review the form for accuracy and completeness before submission.

Legal Use of the Customer Credit Evaluation Form

The customer credit evaluation form must comply with various legal standards to ensure its validity. In the United States, it is essential to adhere to the Fair Credit Reporting Act (FCRA), which governs how credit information is collected and used. Additionally, businesses should ensure that the form includes necessary disclosures regarding the use of the applicant's information and their rights under the law. Compliance with these regulations helps protect both the business and the applicant.

Key Elements of the Customer Credit Evaluation Form

Several key elements should be included in the customer credit evaluation form to ensure comprehensive assessment:

- Personal Information: Full name, address, and contact details.

- Employment Information: Current employer, job title, and length of employment.

- Financial Information: Monthly income, sources of income, and existing debts.

- Credit History: Consent for credit checks and any known credit issues.

Examples of Using the Customer Credit Evaluation Form

Businesses across various industries utilize the customer credit evaluation form to manage risk and make informed credit decisions. For instance, a retail company may use the form to evaluate customers applying for store credit cards. Similarly, a service provider may require the form from clients seeking payment plans for large projects. These examples illustrate the form's versatility in assessing creditworthiness in different contexts.

Quick guide on how to complete customer credit evaluation form

Complete Customer Credit Evaluation Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can obtain the required form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, amend, and eSign your documents swiftly without delays. Manage Customer Credit Evaluation Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Customer Credit Evaluation Form effortlessly

- Locate Customer Credit Evaluation Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and eSign Customer Credit Evaluation Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the customer credit evaluation form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit evaluation form, and how does it work?

A credit evaluation form is a document used to assess an individual's or business's creditworthiness. It gathers necessary information for lenders or service providers to evaluate financial history and make informed decisions. airSlate SignNow allows you to create, send, and eSign credit evaluation forms with ease.

-

How much does it cost to use airSlate SignNow for credit evaluation forms?

airSlate SignNow offers various pricing plans tailored to different business needs. Depending on your requirements, you can choose from affordable options that allow unlimited eSigning and document management, including credit evaluation forms. Check our pricing page for detailed information on plans and features.

-

Are there any features specifically designed for credit evaluation forms?

Yes, airSlate SignNow provides features that enhance the usage of credit evaluation forms. You can customize templates, add fields for essential information, and automate workflows for faster processing. Enhanced security features ensure that your documents are protected while being shared and signed.

-

What are the benefits of using airSlate SignNow for credit evaluation forms?

Using airSlate SignNow for credit evaluation forms streamlines the process of document management and eSigning. It saves time, reduces paperwork, and minimizes errors by allowing you to digitally collect and organize information securely. Additionally, it enhances customer experience through quick and easy access.

-

Can I integrate airSlate SignNow with other tools for handling credit evaluation forms?

Absolutely! airSlate SignNow offers integrations with various third-party applications to optimize the management of credit evaluation forms. By connecting your CRM, accounting software, or other tools, you can automate workflows and improve efficiency across your organization.

-

Is it easy to create a credit evaluation form using airSlate SignNow?

Yes, creating a credit evaluation form with airSlate SignNow is straightforward. The platform provides an intuitive drag-and-drop interface that lets you customize forms according to your specific needs. You can add text fields, checkboxes, and signature areas effortlessly.

-

What security measures does airSlate SignNow have for credit evaluation forms?

Security is a top priority at airSlate SignNow. Our platform ensures that all credit evaluation forms are protected through encryption, secure data storage, and robust authentication methods. You can confidently send sensitive documents knowing your information is secure.

Get more for Customer Credit Evaluation Form

- Form 712 life insurance statement omb no 1545 0022

- Idaho sales tax exemption form st 104

- Adrt v8 form fill in on line

- Waste shipment record bwastecontrolrecyclingbbcomb form

- Football alberta medical form

- Plant technician skills and abilities practice test form

- Choices critical incident report form providers amerigroup

- Energy bus printables form

Find out other Customer Credit Evaluation Form

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast