Form 4804

What is the Form 4804

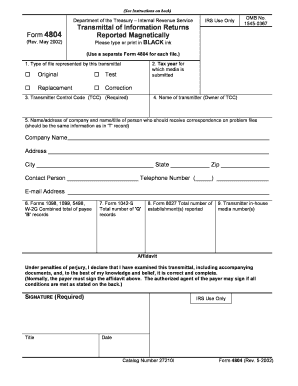

The Form 4804, officially known as the federal form 4804, is a tax document utilized primarily in the United States. It is designed to assist businesses in reporting specific financial information to the Internal Revenue Service (IRS). This form is particularly relevant for entities that are required to disclose certain tax-related details, ensuring compliance with federal regulations. Understanding the purpose and requirements of Form 4804 is crucial for accurate tax reporting and minimizing potential penalties.

How to use the Form 4804

Using the Form 4804 involves a series of steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and expense reports. Next, complete the form by entering the required data in the designated fields. It is important to review the form for accuracy before submission, as errors can lead to delays or penalties. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements set forth by the IRS.

Steps to complete the Form 4804

Completing the Form 4804 requires careful attention to detail. Follow these steps for a smooth process:

- Gather all necessary financial documentation.

- Fill out the form with accurate information, ensuring that all fields are completed.

- Double-check entries for accuracy and completeness.

- Sign and date the form, if required.

- Submit the form according to IRS guidelines, either online or by mail.

Legal use of the Form 4804

The legal use of Form 4804 is governed by IRS regulations, which stipulate that the form must be filled out accurately and submitted on time to avoid penalties. The form serves as an official record of financial information, and incorrect submissions can lead to legal repercussions. It is essential for businesses to understand their obligations under federal law when using this form, ensuring compliance with all relevant tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4804 are critical to ensure compliance with IRS requirements. Typically, the form must be submitted by a specific date each year, often coinciding with the overall tax filing deadline for businesses. It is advisable to check the IRS website or consult a tax professional for the most current deadlines, as they can vary based on the type of entity and other factors.

Key elements of the Form 4804

The Form 4804 includes several key elements that must be accurately completed to ensure proper filing. These elements typically include:

- Business identification information, such as name and tax identification number.

- Details regarding income and expenses.

- Signatures of authorized individuals, if required.

- Any additional schedules or attachments that may be necessary.

Examples of using the Form 4804

Form 4804 can be used in various scenarios, particularly by businesses that need to report specific financial information to the IRS. For example, a small business may use this form to report income generated from sales, while a corporation might utilize it to disclose expenses related to operational costs. Each use case highlights the importance of accurate reporting and compliance with federal tax laws.

Quick guide on how to complete form 4804

Prepare Form 4804 effortlessly on any device

Managing documents online has gained traction among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and without delays. Handle Form 4804 from any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Form 4804 without hassle

- Find Form 4804 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight crucial sections of your documents or mask sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 4804 and ensure excellent collaboration at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4804

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4804 and why is it important?

Form 4804 is a crucial document used for tax purposes in certain states. It helps businesses ensure compliance with state tax regulations by accurately reporting income and deductions. Understanding how to properly fill out and submit form 4804 can save your business from potential penalties.

-

How can airSlate SignNow help with my form 4804 submissions?

airSlate SignNow provides a streamlined platform for sending and signing form 4804 electronically. Our solution allows you to upload, edit, and gather signatures on the form without the hassle of printing or mailing. This not only saves time but also ensures that your form 4804 is submitted accurately and on schedule.

-

What features does airSlate SignNow offer for form 4804?

airSlate SignNow offers several features specifically designed for handling documents like form 4804, such as templates for faster preparation, advanced editing tools, and secure cloud storage. Additionally, our user-friendly interface allows for easy navigation, making it simple to manage and send multiple copies of form 4804. You'll appreciate the efficiency and convenience we provide.

-

Is airSlate SignNow cost-effective for managing form 4804?

Yes, airSlate SignNow is a cost-effective solution for managing your form 4804 needs. We offer various pricing plans suitable for businesses of all sizes, ensuring you can find an option that fits your budget. By minimizing paperwork and streamlining the signing process, you'll ultimately reduce administrative costs.

-

Can I integrate airSlate SignNow with other software for form 4804?

Absolutely! airSlate SignNow offers integration capabilities with various platforms and applications that you may already be using for accounting and tax purposes. This feature ensures that you can seamlessly connect your existing systems with our sign and document management solutions, making it easier to manage form 4804 directly from your preferred tools.

-

How secure is airSlate SignNow for submitting form 4804?

Security is a top priority with airSlate SignNow, especially when dealing with sensitive documents like form 4804. Our platform uses advanced encryption and secure access protocols to protect your data. We also comply with industry standards to ensure your electronic signatures and documents are legally binding and safe.

-

What supports are available if I have questions about form 4804?

airSlate SignNow provides comprehensive customer support to assist with any questions regarding form 4804. Whether you need help with document preparation, signing processes, or troubleshooting, our support team is ready to assist you via chat, email, or phone. We're here to ensure you navigate your form 4804 needs with confidence.

Get more for Form 4804

- Lease subordination agreement vermont form

- Apartment rules and regulations vermont form

- Agreed cancellation of lease vermont form

- Amendment of residential lease vermont form

- Agreement for payment of unpaid rent vermont form

- Commercial lease assignment from tenant to new tenant vermont form

- Tenant consent to background and reference check vermont form

- Residential lease or rental agreement for month to month vermont form

Find out other Form 4804

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney