Pass through Entity Income Tax Voucher Mississippi Department Dor Ms Form

What is the Pass Through Entity Income Tax Voucher Mississippi Department Dor Ms

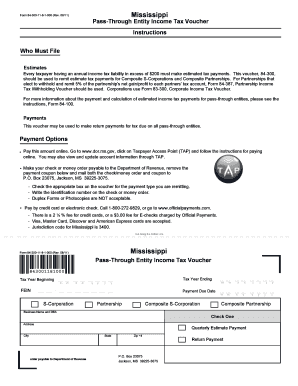

The Pass Through Entity Income Tax Voucher, issued by the Mississippi Department of Revenue (DOR), is a tax form designed for entities that pass income through to their owners or shareholders. This includes partnerships, S corporations, and limited liability companies (LLCs) that elect to be taxed as pass-through entities. The voucher serves as a means for these entities to report and pay their state income tax obligations on behalf of their owners, ensuring compliance with Mississippi tax laws.

How to use the Pass Through Entity Income Tax Voucher Mississippi Department Dor Ms

To use the Pass Through Entity Income Tax Voucher, the entity must first complete the form with accurate financial information, including income details and the amounts owed. After filling out the voucher, it should be submitted along with the payment to the Mississippi Department of Revenue. This process can be done electronically or via mail, depending on the entity's preference and compliance requirements. Proper usage of the voucher helps to avoid penalties and ensures timely payment of taxes owed.

Steps to complete the Pass Through Entity Income Tax Voucher Mississippi Department Dor Ms

Completing the Pass Through Entity Income Tax Voucher involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill out the voucher form with accurate income figures and any applicable deductions.

- Calculate the total tax liability based on the reported income.

- Review the completed voucher for accuracy before submission.

- Submit the voucher along with the payment by the specified deadline.

Legal use of the Pass Through Entity Income Tax Voucher Mississippi Department Dor Ms

The legal use of the Pass Through Entity Income Tax Voucher is governed by Mississippi tax law. It is essential for entities to submit the voucher correctly to fulfill their tax obligations. Failure to do so can result in penalties or interest charges. The form must be filled out in accordance with state regulations, and the payment must be made on time to avoid any legal repercussions. Utilizing a reliable eSignature solution can help ensure that the submission is legally binding and compliant with electronic signature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Pass Through Entity Income Tax Voucher are crucial for compliance. Typically, the voucher must be submitted by the due date of the entity's tax return. For most entities, this date aligns with the federal tax deadline, which is usually April fifteenth. However, entities with fiscal year ends may have different deadlines. It is important to stay informed of any changes to these dates to avoid late fees and penalties.

Required Documents

To complete the Pass Through Entity Income Tax Voucher, certain documents are required:

- Income statements detailing the entity's earnings.

- Previous year’s tax returns for reference.

- Documentation of any deductions or credits being claimed.

- Payment information for the tax owed.

Who Issues the Form

The Pass Through Entity Income Tax Voucher is issued by the Mississippi Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with state tax laws. Entities must refer to the official guidelines provided by the department to ensure they are using the most current version of the voucher and adhering to all filing requirements.

Quick guide on how to complete pass through entity income tax voucher mississippi department dor ms

Complete Pass Through Entity Income Tax Voucher Mississippi Department Dor Ms effortlessly on any device

Web-based document management has become prevalent among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Pass Through Entity Income Tax Voucher Mississippi Department Dor Ms on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign Pass Through Entity Income Tax Voucher Mississippi Department Dor Ms with ease

- Find Pass Through Entity Income Tax Voucher Mississippi Department Dor Ms and click Get Form to initiate.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require reprinting document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Pass Through Entity Income Tax Voucher Mississippi Department Dor Ms and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pass through entity income tax voucher mississippi department dor ms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Pass Through Entity Income Tax Voucher for the Mississippi Department of Revenue?

The Pass Through Entity Income Tax Voucher for the Mississippi Department of Revenue is a form used by entities such as partnerships and S corporations to report and pay income tax on behalf of their owners. This voucher simplifies the tax payment process and ensures compliance with state tax regulations. Understanding its requirements is crucial for business owners.

-

How do I obtain the Pass Through Entity Income Tax Voucher for the Mississippi Department of Revenue?

You can obtain the Pass Through Entity Income Tax Voucher for the Mississippi Department of Revenue by visiting the official Mississippi Department of Revenue website. Additionally, airSlate SignNow offers resources and customizable templates to assist with this process, ensuring that you stay compliant with your tax obligations. Accessing these forms online saves time and effort.

-

What are the benefits of using the Pass Through Entity Income Tax Voucher for the Mississippi Department of Revenue?

Using the Pass Through Entity Income Tax Voucher for the Mississippi Department of Revenue allows businesses to streamline their tax filing process and reduce the risk of errors. This voucher also provides clarity on the amounts owed and deadlines, helping to avoid unnecessary penalties and fees. Proper utilization of this voucher can contribute to better financial management for your business.

-

What features does airSlate SignNow offer for managing tax documents, including the Pass Through Entity Income Tax Voucher?

airSlate SignNow offers features such as easy document creation, secure eSigning, and streamlined workflows that enhance the management of tax documents like the Pass Through Entity Income Tax Voucher for the Mississippi Department of Revenue. With customizable templates and automated reminders, businesses can ensure that their tax documents are processed promptly and accurately.

-

Is there a cost associated with using airSlate SignNow for the Pass Through Entity Income Tax Voucher?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs. Each plan includes access to features that assist with the completion and submission of tax documents, including the Pass Through Entity Income Tax Voucher for the Mississippi Department of Revenue. Potential customers can choose a plan that fits their budget and documentation requirements.

-

Can I integrate airSlate SignNow with my existing accounting software for tax purposes?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software solutions, which enhances the management of tax documents such as the Pass Through Entity Income Tax Voucher for the Mississippi Department of Revenue. These integrations allow for efficient data sharing and streamlined workflows, making tax compliance easier for businesses.

-

How does airSlate SignNow ensure the security of my sensitive tax documents?

airSlate SignNow employs advanced security measures to protect sensitive information associated with tax documents, including the Pass Through Entity Income Tax Voucher for the Mississippi Department of Revenue. With features such as encryption, secure cloud storage, and compliance with industry standards, users can trust that their documents remain confidential and secure.

Get more for Pass Through Entity Income Tax Voucher Mississippi Department Dor Ms

- Motion summons form

- Washington ju 497430070 form

- Order appointing guardian 497430071 form

- Ju 030400 order of dependency orod washington form

- Ju 030410 order of disposition on dependency ord washington form

- Washington guardianship 497430074 form

- Ju 030710 statement and certification of proposed guardian dclr washington form

- Ju 030720 statement of parent waiving presentation of order of guardianship wv washington form

Find out other Pass Through Entity Income Tax Voucher Mississippi Department Dor Ms

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document