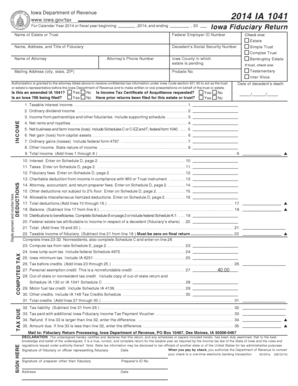

IA 1041 Fiduciary Return Form

What is the IA 1041 Fiduciary Return

The IA 1041 Fiduciary Return is a tax form used in the United States for reporting income, deductions, gains, and losses of estates and trusts. This form is essential for fiduciaries, who are responsible for managing the financial affairs of a deceased person's estate or a trust. By filing the IA 1041, fiduciaries ensure compliance with federal and state tax laws, facilitating the proper distribution of assets to beneficiaries. Understanding the purpose and requirements of this form is crucial for anyone involved in estate management or trust administration.

Steps to complete the IA 1041 Fiduciary Return

Completing the IA 1041 Fiduciary Return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense records, and any relevant tax documents. Next, carefully fill out the form, providing detailed information about the estate or trust's income, deductions, and distributions. It is important to double-check all entries for accuracy. Once completed, the form should be signed by the fiduciary and submitted to the appropriate tax authority. Depending on the situation, additional documentation may be required to support the information provided.

Legal use of the IA 1041 Fiduciary Return

The IA 1041 Fiduciary Return serves a legal purpose by documenting the financial activities of an estate or trust. Properly filing this form ensures that the fiduciary meets their legal obligations and protects them from potential liabilities. The information reported on the IA 1041 is used by tax authorities to assess tax liabilities and ensure compliance with tax laws. Failure to file the IA 1041 accurately and on time can result in penalties, making it essential for fiduciaries to understand the legal implications of this form.

Filing Deadlines / Important Dates

Filing deadlines for the IA 1041 Fiduciary Return are critical for ensuring compliance with tax regulations. Typically, the form must be filed by the 15th day of the fourth month following the end of the estate or trust's tax year. For estates or trusts operating on a calendar year, this means the deadline is April 15. It is important for fiduciaries to be aware of these dates to avoid penalties and interest on unpaid taxes. Extensions may be available, but they require timely submission of a request to the tax authority.

Required Documents

To complete the IA 1041 Fiduciary Return accurately, several documents are necessary. These include income statements from various sources, such as bank interest, dividends, and rental income. Additionally, records of deductions, such as funeral expenses, administrative fees, and charitable contributions, should be gathered. Any documents that support the reported income or deductions, such as receipts or bank statements, should also be included. Having all required documents ready will streamline the filing process and enhance accuracy.

Form Submission Methods (Online / Mail / In-Person)

The IA 1041 Fiduciary Return can be submitted through various methods, providing flexibility for fiduciaries. Online submission is available through authorized e-filing services, offering a quick and efficient way to file. Alternatively, the form can be mailed directly to the appropriate tax authority, ensuring that it is sent with sufficient time to meet deadlines. In-person submission may also be an option, depending on local tax office policies. Each method has its advantages, and fiduciaries should choose the one that best suits their needs.

Penalties for Non-Compliance

Non-compliance with the IA 1041 Fiduciary Return can lead to significant penalties. These may include monetary fines for late filing or failure to file, as well as interest on any unpaid taxes. Additionally, fiduciaries may face legal repercussions if they do not fulfill their responsibilities in managing the estate or trust. Understanding the potential penalties associated with non-compliance emphasizes the importance of timely and accurate filing of the IA 1041.

Quick guide on how to complete ia 1041 fiduciary return

Complete IA 1041 Fiduciary Return effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your paperwork quickly and efficiently. Manage IA 1041 Fiduciary Return on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-based process today.

The simplest way to edit and electronically sign IA 1041 Fiduciary Return with ease

- Obtain IA 1041 Fiduciary Return and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method of sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign IA 1041 Fiduciary Return and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia 1041 fiduciary return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IA 1041 Fiduciary Return?

The IA 1041 Fiduciary Return is a tax form used by estates and trusts in Iowa to report income and calculate tax obligations. It is essential for fiduciaries managing assets on behalf of beneficiaries. Understanding this form helps ensure compliance with state tax laws.

-

How does airSlate SignNow assist with the IA 1041 Fiduciary Return?

airSlate SignNow simplifies the process of preparing and submitting the IA 1041 Fiduciary Return by allowing users to eSign and securely send necessary documents. Our platform enhances document management with templates specifically tailored for fiduciary returns. This streamlines your workflow and reduces the risk of errors.

-

What features does airSlate SignNow offer for handling the IA 1041 Fiduciary Return?

Our platform offers features such as customizable templates and easy document sharing, specifically designed for the IA 1041 Fiduciary Return. You can also track document status in real-time and automate reminders for signatures. These features improve efficiency in managing fiduciary duties.

-

Is there a cost associated with using airSlate SignNow for the IA 1041 Fiduciary Return?

Yes, airSlate SignNow offers several pricing plans that cater to various business needs. The cost-effective solution ensures that you only pay for the features necessary for efficiently managing your IA 1041 Fiduciary Return. Explore our pricing page for more details and choose a plan that suits you best.

-

Can airSlate SignNow integrate with accounting software for the IA 1041 Fiduciary Return?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software to streamline the process of completing the IA 1041 Fiduciary Return. This allows for a cohesive experience where financial data is easily accessible and organized, facilitating quicker completion of tax obligations.

-

What are the benefits of using airSlate SignNow for the IA 1041 Fiduciary Return?

Using airSlate SignNow for the IA 1041 Fiduciary Return provides numerous benefits, such as enhanced efficiency, reduced paper use, and easier collaboration with stakeholders. The platform's user-friendly interface helps eliminate confusion and speeds up the overall process. It also ensures that documents are secure and legally binding.

-

How secure is airSlate SignNow for the IA 1041 Fiduciary Return?

airSlate SignNow prioritizes security to protect sensitive information related to the IA 1041 Fiduciary Return. We use advanced encryption and authentication protocols to safeguard your documents. Our platform complies with industry standards, giving you peace of mind when handling fiduciary returns.

Get more for IA 1041 Fiduciary Return

- Limited liability company llc operating agreement north dakota form

- Single member limited liability company llc operating agreement north dakota form

- North dakota will form

- North dakota lien form

- Quitclaim deed from individual to husband and wife north dakota form

- Warranty deed from individual to husband and wife north dakota form

- Quitclaim deed from corporation to husband and wife north dakota form

- Warranty deed from corporation to husband and wife north dakota form

Find out other IA 1041 Fiduciary Return

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization