The 3 Credit Bureau Form

Understanding the Three Credit Bureaus

The three major credit bureaus in the United States are Equifax, Experian, and TransUnion. These organizations collect and maintain consumer credit information, which they use to generate credit reports. Each bureau may have slightly different information based on the data they collect from creditors, lenders, and public records. Understanding the role of each bureau is essential for managing your credit effectively.

How to Use the Three Credit Bureaus

To effectively use the information provided by the three credit bureaus, individuals should regularly check their credit reports for accuracy. This can help identify any discrepancies or fraudulent activities. Consumers can obtain free annual credit reports from each bureau through AnnualCreditReport.com. Additionally, monitoring your credit score from these bureaus can give insights into your credit health and help in making informed financial decisions.

Obtaining Your Credit Report from the Three Bureaus

To obtain your credit report, visit the official website that allows access to free annual reports. You will need to provide personal information such as your name, address, Social Security number, and date of birth. After verifying your identity, you can request your reports from Equifax, Experian, and TransUnion. It is advisable to review each report thoroughly to ensure the information is accurate and up to date.

Steps to Complete Your Credit Report

Completing your credit report involves several key steps. First, gather necessary personal information, including your Social Security number and addresses for the past few years. Next, visit the credit bureau's website to request your report. Follow the prompts to enter your information. Once you receive your report, review it for accuracy, noting any errors or unfamiliar accounts. If discrepancies are found, you can dispute them directly with the bureau.

Legal Use of Credit Reports

Credit reports are used for various legal and financial purposes, including loan applications, rental agreements, and employment background checks. Under the Fair Credit Reporting Act (FCRA), consumers have the right to know what information is in their credit reports and to dispute inaccuracies. It's important to understand your rights when it comes to the use of your credit report to ensure compliance with legal standards.

Key Elements of a Credit Report

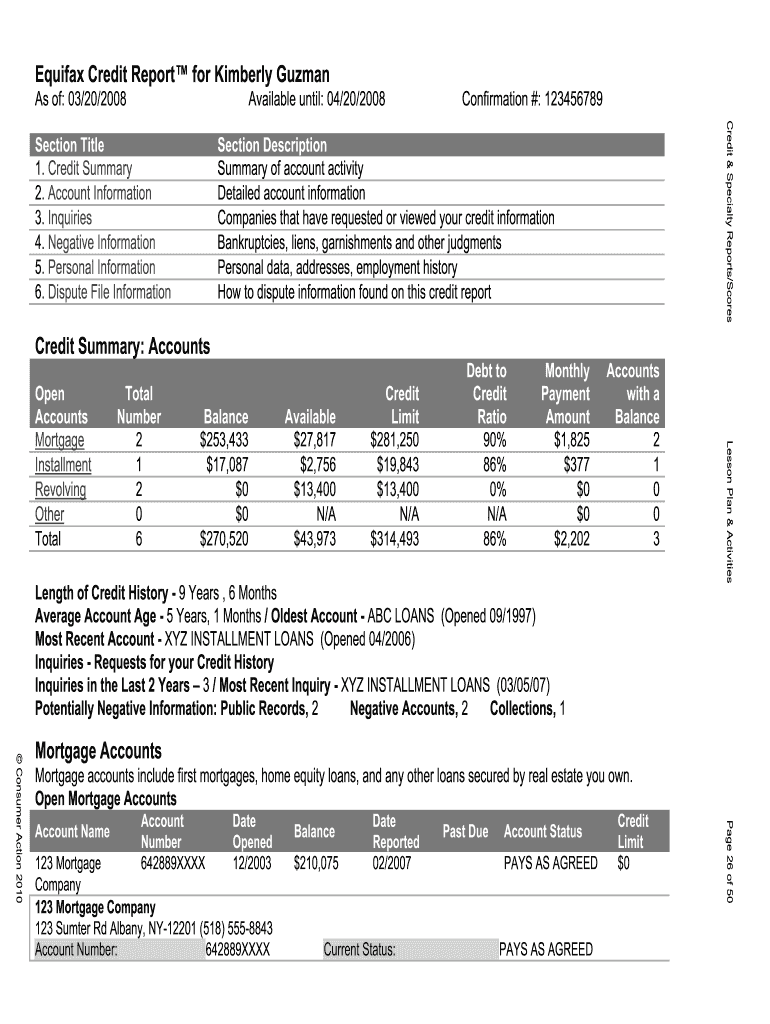

A typical credit report includes several key elements: personal information, credit accounts, payment history, inquiries, and public records. Personal information details your identity, while credit accounts provide a history of your credit usage. Payment history shows how timely you have been with payments. Inquiries list who has accessed your credit report, and public records may include bankruptcies or liens. Understanding these elements can help you better manage your credit profile.

Examples of Credit Reports

When reviewing credit reports, it can be helpful to look at examples. A sample credit report may show different sections, including account summaries, payment histories, and credit inquiries. Familiarizing yourself with these examples can help you understand what to expect and how to interpret the information on your own reports. Various resources provide printable credit report templates to assist in this process.

Quick guide on how to complete sample credit reports from the three credit bureaus kkarnokcom

Prepare The 3 Credit Bureau effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without complications. Manage The 3 Credit Bureau on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign The 3 Credit Bureau with ease

- Locate The 3 Credit Bureau and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to store your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, cumbersome form navigation, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign The 3 Credit Bureau and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Is it possible to opt out completely from the three major credit bureaus?

You can't opt out any more than you can from being in lots of government databases. The only way to avoid having updated information added to the credit bureaus databases is to live a strictly cash-based existence. No car loans, no “buy now, pay later” offers, don't rent from a landlord that does credit checks, no mortgages.

-

What is the best way to get negative information off my credit report from all three bureaus to fix my credit score?

Hi,To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.Submit a dispute to the credit bureau.The Fair Credit Reporting Act is a Federal law that defines the type of information that can be listed on your credit report and for how long (generally seven years). The FCRA says that you have the right to an accurate credit report and because of that provision, you can dispute errors with the credit bureau.Credit report disputes are easiest when made online or via mail. To make a dispute online, you must have recently ordered a copy of your credit report. You can submit a dispute with the credit bureau who provided the credit report.To dispute via mail, write a letter describing the credit report and submit copies of any proof you have.The credit bureau investigates your dispute with the business that provided the information and removes the entry if they find that is indeed an error.You can dispute with the business that reported to the credit bureau.Now, you can completely bypass the credit bureau and dispute directly with the business that reported the error to the credit bureau, e.g. the credit card issuer, bank, or debt collector.You can make the dispute in writing and the business is required to do an investigation just like the credit bureau. When the business determines that there’s indeed an error on your credit report, they must notify all the credit bureaus of that error so your credit reports can be corrected.Send a pay for delete offer to your creditor.You have to approach accurately reported negative information differently. Credit bureaus won’t remove accurate, verifiable information even if you dispute it (because the investigation will verify the accuracy of this information), so you may have to negotiate to have some items removed from your credit report.A pay for delete offer is a technique you can use with delinquent, or past due, accounts. In a pay for delete negotiation, you offer to pay the account in full in exchange for having the negative details removed from your credit report. Some creditors will take you up on the offer.Make a goodwill request for deletion.With pay for delete, you can use money as the bargaining chip for getting negative information removed from your credit report. If you’ve already paid the account, however, you don’t have much negotiating power. At this point, you can ask for mercy by requesting a goodwill deletion.In a letter to the creditor, you might describe why you were late, state how you’ve since been a good paying customer, and ask that the accounts be reported more favorably. Again, creditors don’t have to comply and some won’t. On the other hand, some creditors will make these deletions if you talk to the right person.Wait out the credit reporting time limit.If all else fails, your only choice is to wait for those negative items to fall off your credit report. Fortunately, the law only allows most negative information to be reported for seven years. The exception is bankruptcy, which can be reported for up to 10 years. The other good news is that negative information affects your credit score less as it gets older and as you replace it with positive information. The wait may not be as difficult as you’d think.In the meantime, you can improve your credit by making timely payments on accounts you still have open and active.( thanks to LaToya Irby from The Balance)

-

How do sites that can actively update your credit like Credit Karma work, if you can only get one free report from the three credit bureaus per year?

Although by Federal law, you are entitled to one free credit report per year from each credit bureau, the credit bureaus are generally happy to provide you more frequent access, if you are willing to pay the fees they ask.What we can infer is Credit Karma has entered into an agreement with Equifax and TransUnion to provide the credit reports of consumers who agree to this.We don’t necessarily know about the details of this arrangement. They could be paying for this access on a per-user basis, they could be getting a percentage of the revenues that Credit Karma gets when people apply for credit cards through Credit Karma.What we can reasonably expect is that the compensation that the credit bureaus are receiving from Credit Karma is a small fraction of what the credit bureaus would charge the end consumer, because the credit bureaus are really just concerned with monetizing this data for the maximum possible value, and when individual consumers have to pay for it, only a tiny fraction will do so, while Credit Karma will have orders of magnitude more people accessing this information, because of the fact that they’re getting it for free.

-

Is it true paying my rent on time can improve my credit score? I heard that from a professional, but how can my landlord report to the bureaus?

In the law! And the law shows no mercy. But the law is the not the judge. The man cries out for mercy. “Your Honor, Have mercy on me!! I’m guilty, I know it, but I ask you to please forgive me!! I will not do it again! ‘The judge looks on the man, and at his prosecutor who smiled assuredly. And the judge says to the man, ‘ I have forgiven you of your sins, now your record is clean, GO, AND DO NOT SIN AGAIN. “ but the law demand that the penalty for murder is death. So, who will die in your place? False teachers will not escape the judgment of the God. He will judge very man with heavy hand, in truth and in righteousness, and he will judge a just judgement. No teacher will escape demnation. There are some that seduce you. They say to you that it is okay to sin, because Jesus died for sin. They say to you, “ You will always be a sinner. “They encourage rivalry and debate. They entice one to sin through temptation. They are slaves of satan used to seduce you into hell. The false teachers psignNow peace to sinners in their sin, just as those wicked men stood in the Israel, enticing Israel to go back into Egypt, and afterwards the earth sucked them up. False teachers seduce the flesh, and lure the soul into hell.Many people end up in hell because of their lies. They are full of offense and wickedness, and cannot do good, because they don’t know Jesus. These are those who confess him as Lord, but don’t obey him as Lord. They are servants of sin, and so they don’t desire righteousness. They psignNow whole lies, and no truth, because they truth is not in them. How can a slave make a slave free? Jesus Christ did not die to to keep the captives bound, but to set the captives FREE!!! The Lord has pronounce judgment against all who entice his people to sin. He will destroy them with the breath of his mouth.Flee these seducers who seek to devour your soul. Follow Jesus, obey HIM! Don’t allow those who don’t desire to be free to keep you in bondage to sin. Jesus will first, wipe away your sin,because he is merciful, and then he will give you NEW desires, and a clean heart. Sure, satan will not let you go that easily, and this is that fight of faith.Once Jesus sets you free you are free

-

Will I get my tax return if my federal student loans are no longer on my credit report? For years my unpaid student loans had been reported to the three main credit bureaus. In 2018 they vanished from my credit reports even though I still owe.

There are two seperate things going on here. Negative information can only remain on your credit reports for 7 to 7.5 years (except for some bankruptcies, which can remain for 10 years). So, in your case, the accounts may have been too old, and aged off your reports.However, you still owe the debt. Federal student loans, if unpaid, can lead to tax offsets or wage garnishment, without filing a lawsuit. There’s really no statute of limitations on these loans either. So, it is quite likely that your tax refund may once again be seized, if money is still owed on your federal student loans, and you are not in any kind of payment plan.To prevent this, you may want to consider rehabilitating the loan. Visit the Department of Education website for more information.

-

How can I report rent payments from 2013 to 2015 to credit bureaus? Most of the services seem to go back only 2 years.

Unfortunately you are limited to whatever the “Rent Reporter” services have to offer. The major credit bureaus limit them to reporting the previous 24 months typically.

-

How can I cash out money from the entropay.com virtual credit card to bank?

You can do this by entering your bank account details.Follow the instructions given at How do I withdraw money into my bank acc...

-

I had a hard inquiry to a credit reporting agency that I did not generate in anyway shape or form. How do I contact the credit reporting agency and company where credit was requested to find out what was applied for and who applied?

You challenge the hard inquiry in writing with the agencies that are reporting it.Your credit report will show the name of the firms that placed the hard inquiry and the date of the inquiry. Most of the time that is sufficient to jog your memory but if it isn't, the credit reporting agencies will provide additional information about inquiry in response to your challenge.

-

How do you report gym owners who are taking money out of your bank from your credit cards without your approval if you’re trying to cancel your membership at the gym?

There are a couple of gyms (franchises) that do such a thing, and based on how much people are affected by it, it does sound as if it’s their actual business model.You should obtain a copy of the original agreement and follow the instructions on the cancellation - be it call, mail (registered with signature required) or some other means - and present a record of it to the government authority that granted them a business license.Hope you’re not shy about contacting everyone under the sun - from the president of that company, to their legal department (with a carefully crafted letter for them to cease and desist), to the franchise, to numerous review boards that I am sure exist in all geographies.Your bank will need to receive that information as well - a proof that you have actually followed the rules on cancellation (trying to cancel is not the same, as you imagine).In US, there is a Better Business Bureau and various online channels - your geography is UK, and I am not familiar with the laws of the land there.

Create this form in 5 minutes!

How to create an eSignature for the sample credit reports from the three credit bureaus kkarnokcom

How to make an eSignature for your Sample Credit Reports From The Three Credit Bureaus Kkarnokcom in the online mode

How to make an electronic signature for your Sample Credit Reports From The Three Credit Bureaus Kkarnokcom in Chrome

How to make an electronic signature for signing the Sample Credit Reports From The Three Credit Bureaus Kkarnokcom in Gmail

How to create an eSignature for the Sample Credit Reports From The Three Credit Bureaus Kkarnokcom from your smart phone

How to generate an eSignature for the Sample Credit Reports From The Three Credit Bureaus Kkarnokcom on iOS devices

How to generate an eSignature for the Sample Credit Reports From The Three Credit Bureaus Kkarnokcom on Android devices

People also ask

-

What is a credit report template?

A credit report template is a structured document that outlines an individual's credit history, including credit accounts, payment history, and outstanding debts. It is designed to help users create personalized reports efficiently. Using a credit report template can save time and ensure all necessary information is included for accurate assessments.

-

How can airSlate SignNow help with credit report templates?

airSlate SignNow provides an easy-to-use platform for creating and managing credit report templates. You can easily customize the templates to fit your specific needs and securely send them for eSignatures. This streamlines the process of obtaining verified credit reports and enhances workflow efficiency.

-

Is there a cost associated with using credit report templates on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to credit report templates and other document management tools. The cost is competitive, making it a cost-effective solution for businesses looking to streamline their documentation processes. For detailed pricing information, visit our pricing page.

-

What features does airSlate SignNow offer for credit report templates?

airSlate SignNow features an intuitive template builder, collaboration tools, and automated workflows to enhance the use of credit report templates. Users can easily create, edit, and send templates for eSignature, all in one platform. These features ensure that managing credit reports is both efficient and secure.

-

Can I customize my credit report template in airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize your credit report template. You can add, remove, or modify fields according to your requirements, ensuring that all important data is captured. Customization makes your reports more relevant and tailored to specific situations.

-

Are there integrations available for credit report templates?

Yes, airSlate SignNow offers various integrations that allow you to connect your credit report templates with other apps like CRM systems, document storage solutions, and more. This seamless integration streamlines data management and enhances your overall workflow. Check our integrations page for a complete list of compatible tools.

-

What are the benefits of using credit report templates?

Using credit report templates streamlines the creation process, increases accuracy, and ensures compliance with industry standards. They help you present information clearly and professionally, which can positively influence your business dealings. Also, leveraging templates saves time and improves efficiency in generating necessary documents.

Get more for The 3 Credit Bureau

Find out other The 3 Credit Bureau

- Can I Sign Louisiana Affidavit of Heirship

- How To Sign New Jersey Affidavit of Heirship

- Sign Oklahoma Affidavit of Heirship Myself

- Sign Washington Affidavit of Death Easy

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement