Anti Steering Loan Options Disclosure InterBank Form

What is the Anti Steering Loan Options Disclosure?

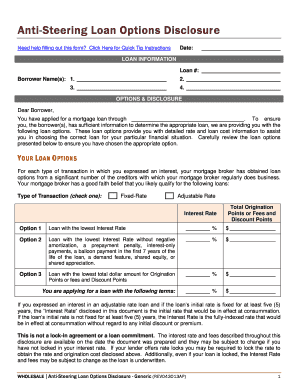

The Anti Steering Loan Options Disclosure is a legal document that aims to protect consumers by ensuring they receive clear information about their loan options. It requires lenders to present various loan products available to borrowers without steering them toward a specific option that may not be in their best interest. This disclosure is essential for maintaining transparency in the lending process and helps consumers make informed decisions about their financial commitments.

Key Elements of the Anti Steering Loan Options Disclosure

Understanding the key elements of the Anti Steering Loan Options Disclosure is crucial for both lenders and borrowers. This disclosure typically includes:

- A comprehensive list of loan options available to the borrower.

- Clear explanations of the terms and conditions associated with each loan product.

- Disclosure of any potential fees or penalties related to the loans.

- Information about the lender’s compensation structure to ensure no conflicts of interest.

These elements work together to provide a complete picture of the borrowing landscape, allowing consumers to compare their options effectively.

Steps to Complete the Anti Steering Loan Options Disclosure

Completing the Anti Steering Loan Options Disclosure involves several key steps to ensure compliance and clarity:

- Gather all necessary information regarding the borrower’s financial situation.

- List all loan options available to the borrower, including interest rates and terms.

- Clearly outline any fees or costs associated with each option.

- Ensure that the disclosure is presented in a clear and understandable format.

- Provide the borrower with the completed disclosure for review and signature.

Following these steps helps ensure that the disclosure is both legally compliant and user-friendly.

Legal Use of the Anti Steering Loan Options Disclosure

The legal use of the Anti Steering Loan Options Disclosure is governed by federal and state regulations. Compliance with laws such as the Truth in Lending Act (TILA) is essential, as it mandates that lenders provide accurate and comprehensive information about loan products. Failure to comply can result in penalties, including fines and legal action. Therefore, it is vital for lenders to understand the legal framework surrounding this disclosure and ensure it is used appropriately in their lending practices.

How to Obtain the Anti Steering Loan Options Disclosure

Obtaining the Anti Steering Loan Options Disclosure can be done through various channels. Typically, lenders are required to provide this disclosure as part of the loan application process. Borrowers can request a copy directly from their lender or financial institution. Additionally, many lenders offer digital access to these disclosures through their websites or customer service portals, making it easier for borrowers to review their options at any time.

Quick guide on how to complete anti steering loan options disclosure interbank

Effortlessly Prepare Anti Steering Loan Options Disclosure InterBank on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute to conventional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle Anti Steering Loan Options Disclosure InterBank on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Simple Steps to Edit and eSign Anti Steering Loan Options Disclosure InterBank with Ease

- Find Anti Steering Loan Options Disclosure InterBank and click on Get Form to start.

- Make use of the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Anti Steering Loan Options Disclosure InterBank and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the anti steering loan options disclosure interbank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the anti steering loan options disclosure?

The anti steering loan options disclosure is a critical document that ensures consumers are informed about their loan options without undue influence from lenders. It promotes transparency by outlining various loan options available, helping borrowers make informed decisions based on their best interests.

-

How does airSlate SignNow support the anti steering loan options disclosure?

airSlate SignNow provides a streamlined platform for eSigning and sending documents, including the anti steering loan options disclosure. Our solution allows businesses to efficiently manage and share these important documents, ensuring compliance and enhancing customer experience.

-

Are there any costs associated with implementing the anti steering loan options disclosure using airSlate SignNow?

There are affordable pricing plans available with airSlate SignNow that can suit businesses of all sizes. By leveraging our software, you can reduce operational costs while ensuring that the anti steering loan options disclosure is correctly completed and delivered.

-

What features does airSlate SignNow offer for handling anti steering loan options disclosures?

airSlate SignNow offers a range of features for handling the anti steering loan options disclosure, including templates, automated reminders, and secure storage. These features help ensure that documents are completed accurately and efficiently, saving time and reducing errors.

-

Can airSlate SignNow integrate with other tools for managing loan disclosures?

Yes, airSlate SignNow provides seamless integrations with various tools and platforms commonly used in the financial sector. This functionality enhances your workflow for managing the anti steering loan options disclosure and other related documents.

-

What are the benefits of using airSlate SignNow for the anti steering loan options disclosure?

Using airSlate SignNow for the anti steering loan options disclosure streamlines the eSigning process, accelerates turnaround times, and improves document tracking. This leads to enhanced compliance with industry regulations and better customer satisfaction.

-

Is it easy to create an anti steering loan options disclosure with airSlate SignNow?

Absolutely! airSlate SignNow allows you to easily create and customize the anti steering loan options disclosure using our intuitive platform. With drag-and-drop features, it is user-friendly for anyone, regardless of technical expertise.

Get more for Anti Steering Loan Options Disclosure InterBank

- Insulation contract for contractor wyoming form

- Paving contract for contractor wyoming form

- Site work contract for contractor wyoming form

- Siding contract for contractor wyoming form

- Refrigeration contract for contractor wyoming form

- Drainage contract for contractor wyoming form

- Foundation contract for contractor wyoming form

- Plumbing contract for contractor wyoming form

Find out other Anti Steering Loan Options Disclosure InterBank

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation