13614c Form

What is the 13614c

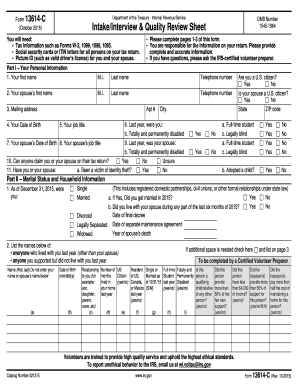

The 13614c form is a critical document used in the tax preparation process, specifically designed for taxpayers to provide necessary information to tax professionals. It serves as a comprehensive intake form that collects personal and financial details essential for accurate tax filing. This form is particularly relevant for individuals seeking assistance with their tax returns, ensuring that all pertinent information is captured effectively. Understanding the purpose of the 13614c form helps taxpayers navigate their tax obligations more efficiently.

How to use the 13614c

Using the 13614c form involves several straightforward steps. First, gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with accurate personal information, such as your name, address, and Social Security number. It's important to provide detailed information regarding your income, deductions, and credits. Once completed, review the form for accuracy before submitting it to your tax preparer. This ensures that your tax professional has all the necessary information to prepare your return accurately.

Steps to complete the 13614c

Completing the 13614c form can be simplified by following these steps:

- Collect all necessary documents, including income statements and previous tax returns.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your income sources, such as wages, self-employment income, and interest.

- List any deductions and credits you plan to claim, such as mortgage interest or education credits.

- Review the completed form for any errors or omissions.

- Submit the form to your tax preparer for further processing.

Legal use of the 13614c

The 13614c form is legally recognized as a valid document for tax preparation purposes. It complies with IRS regulations, ensuring that the information provided is used solely for tax filing. By accurately completing this form, taxpayers can ensure that their tax returns are filed correctly and that they meet their legal obligations. It is essential to maintain the confidentiality of the information shared on the form, as it contains sensitive personal and financial data.

IRS Guidelines

The IRS provides specific guidelines regarding the use and completion of the 13614c form. Taxpayers should ensure that all information is accurate and complete to avoid any delays in processing their tax returns. The IRS emphasizes the importance of providing truthful information, as discrepancies can lead to penalties or audits. Familiarizing oneself with IRS guidelines can help taxpayers understand their responsibilities and the implications of the information they provide on the form.

Required Documents

To successfully complete the 13614c form, several documents are required. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as rental income or dividends

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Any previous tax returns for reference

Having these documents ready will streamline the process of filling out the 13614c form and ensure that all necessary information is captured.

Quick guide on how to complete 13614c

Effortlessly Prepare 13614c on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle 13614c on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Method to Edit and eSign 13614c Without Stress

- Locate 13614c and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, laborious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign 13614c and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 13614c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 13614c and how does airSlate SignNow use it?

13614c is a crucial technology that enables efficient electronic signatures and document management. AirSlate SignNow utilizes 13614c to streamline the signing process, ensuring your documents are signed quickly and securely, enhancing overall productivity.

-

What are the pricing options for airSlate SignNow related to 13614c?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to leverage 13614c technology. These plans are designed to provide cost-effective solutions while ensuring you have access to all necessary features for document signing and management.

-

What features does airSlate SignNow provide that incorporate 13614c?

The 13614c integration in airSlate SignNow includes advanced features like customizable document templates, real-time tracking of signatures, and secure cloud storage. These features allow users to manage their documents efficiently while ensuring compliance and security.

-

What are the benefits of using airSlate SignNow with 13614c?

Using airSlate SignNow with 13614c signNowly increases efficiency by reducing the time taken for document signing. It not only accelerates workflow but also minimizes errors, ensuring that your business transactions are smooth and reliable.

-

Can airSlate SignNow with 13614c integrate with other software?

Yes, airSlate SignNow supports a variety of integrations with other software to enhance its functionality. By integrating with platforms like CRM systems and document management tools, 13614c can help businesses maintain coherence in their operations.

-

How secure is airSlate SignNow when using 13614c technology?

AirSlate SignNow prioritizes security, utilizing 13614c technology to encrypt sensitive documents and ensure that your information is protected. The platform complies with industry standards for data security, giving you peace of mind while managing your documents.

-

Is airSlate SignNow suitable for small businesses utilizing 13614c?

Absolutely! AirSlate SignNow's features, enhanced by 13614c technology, are specifically designed to meet the needs of small businesses. The platform provides affordable solutions that can grow with your business, making it ideal for startups and smaller teams.

Get more for 13614c

- Kick ass karaoke contest rules form

- Guest contract for prom form

- Statement of educational purpose kheaa form

- Change of address kuukpik form

- Hafhperadwildapricotorgresourcesdocumentsscholarship application form applicants personal data name

- College sa further works forms

- Unisa complaints form

- Rc01 form

Find out other 13614c

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document