Dvat 3233 Form

What is the Dvat 3233 Form

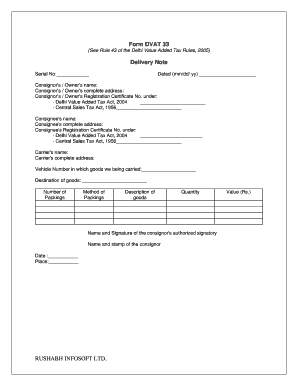

The Dvat 3233 Form is a specific document used for tax reporting purposes in the United States. This form is essential for individuals and businesses to accurately report their tax obligations related to value-added tax (VAT). It serves as a formal declaration of VAT collected and paid, ensuring compliance with federal and state tax regulations. Understanding the purpose and requirements of the Dvat 3233 Form is crucial for maintaining proper tax records and avoiding potential penalties.

How to use the Dvat 3233 Form

Using the Dvat 3233 Form involves several key steps. First, gather all necessary financial documents, including sales records and previous tax filings. Next, accurately fill out the form by entering the required information, such as total sales, VAT collected, and any applicable deductions. Once completed, review the form for accuracy to prevent errors that could lead to complications with tax authorities. Finally, submit the form through the appropriate channels, whether online or by mail, to ensure timely processing.

Steps to complete the Dvat 3233 Form

Completing the Dvat 3233 Form requires careful attention to detail. Follow these steps for a smooth process:

- Collect all relevant financial documentation, including invoices and receipts.

- Access the Dvat 3233 Form from the appropriate source, ensuring you have the latest version.

- Fill in personal or business information, including name, address, and taxpayer identification number.

- Report total sales and calculate the VAT due based on applicable rates.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to certify its accuracy.

- Submit the completed form according to the specified submission method.

Legal use of the Dvat 3233 Form

The legal use of the Dvat 3233 Form is governed by various tax laws and regulations. To ensure compliance, it is important to adhere to the guidelines set forth by the Internal Revenue Service (IRS) and state tax authorities. The form must be completed accurately, and all information provided should reflect true financial data. Failure to comply with legal requirements may result in penalties, including fines or audits. Therefore, understanding the legal implications of the Dvat 3233 Form is essential for all filers.

Key elements of the Dvat 3233 Form

Several key elements must be included in the Dvat 3233 Form to ensure its validity:

- Taxpayer Information: Name, address, and taxpayer identification number.

- Sales Information: Total sales amount and breakdown of VAT collected.

- Deductions: Any applicable deductions or exemptions that may reduce tax liability.

- Signature: The form must be signed and dated by the taxpayer or authorized representative.

Form Submission Methods

The Dvat 3233 Form can be submitted through various methods, depending on the preferences of the filer and the requirements of the tax authority. Common submission methods include:

- Online Submission: Many tax authorities offer electronic filing options for convenience.

- Mail: The form can be printed and sent via postal service to the appropriate tax office.

- In-Person: Some individuals may choose to submit the form directly at local tax offices.

Quick guide on how to complete dvat 3233 form

Manage Dvat 3233 Form seamlessly on any device

Digital document handling has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Handle Dvat 3233 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Dvat 3233 Form effortlessly

- Obtain Dvat 3233 Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Alter and eSign Dvat 3233 Form to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dvat 3233 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Dvat 3233 Form and how is it used?

The Dvat 3233 Form is a crucial document that businesses in certain regions must submit to report their sales and taxes. It helps ensure compliance with tax regulations, making it essential for proper bookkeeping. With airSlate SignNow, you can easily manage and eSign your Dvat 3233 Form online, streamlining the submission process.

-

How can airSlate SignNow help with the Dvat 3233 Form?

airSlate SignNow provides a user-friendly platform for businesses to prepare, send, and eSign their Dvat 3233 Form digitally. This not only saves time but also reduces the risk of errors associated with manual paperwork. Our solution ensures your documents remain secure while meeting all compliance requirements.

-

Is there a cost associated with using airSlate SignNow for the Dvat 3233 Form?

Yes, while airSlate SignNow offers various pricing plans, the cost is designed to be cost-effective for businesses of all sizes. You can select a plan that fits your budget and access premium features to manage your Dvat 3233 Form efficiently. Consider the benefits of increased productivity and reduced administrative overhead.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features tailored for efficient document management, including customizable templates for the Dvat 3233 Form, secure eSigning, and automated workflows. These features streamline the process, making it easier to collect signatures and track document statuses. This enhances overall organizational efficiency.

-

Can the Dvat 3233 Form be integrated with other software using airSlate SignNow?

Yes, airSlate SignNow allows seamless integration with various CRM and accounting software, making it convenient to manage your Dvat 3233 Form alongside other essential business functions. This integration enhances workflow automation, reduces manual input, and ensures that all your data is connected and accessible.

-

What are the benefits of eSigning the Dvat 3233 Form with airSlate SignNow?

By eSigning the Dvat 3233 Form with airSlate SignNow, businesses can expedite the approval process, eliminate paperwork, and enhance security. The digital signature is legally binding and complies with regulations, allowing you to submit your forms faster and with confidence. This ultimately leads to improved operational efficiency.

-

How secure is the Dvat 3233 Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Your Dvat 3233 Form and all associated documents are protected with advanced encryption and secure storage measures. We adhere to industry-leading security protocols, ensuring that your sensitive information remains confidential and safe from unauthorized access.

Get more for Dvat 3233 Form

- Ancq past papers form

- Student profile form

- Unit 8 quadratic functions test review form

- Certificate of enrollment form

- To prevent other people from seeing what you enter form

- Ch 109 notice of court hearing civil harassment prevention form

- Superior court of los angeles judicial district form

- Statement regarding criminal pleaconviction form

Find out other Dvat 3233 Form

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now