California Resident Income Tax Return Form 540

What is the California Resident Income Tax Return Form 540

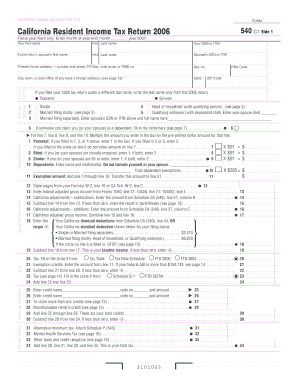

The California Resident Income Tax Return Form 540 is a tax form used by individuals who are residents of California to report their income and calculate their state tax liability. This form is essential for filing state income taxes and is typically required for those earning income within the state. The form captures various types of income, deductions, and credits applicable to California taxpayers, ensuring compliance with state tax laws.

How to use the California Resident Income Tax Return Form 540

Using the California Resident Income Tax Return Form 540 involves several steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any records of deductions or credits. Next, fill out the form by entering your personal information, income details, and any applicable deductions. It is important to review the instructions provided with the form to ensure accurate completion. After filling out the form, you can submit it electronically or via mail, depending on your preference.

Steps to complete the California Resident Income Tax Return Form 540

Completing the California Resident Income Tax Return Form 540 requires a systematic approach:

- Collect all relevant documents, including income statements and receipts for deductions.

- Fill out your personal information at the top of the form.

- Report your total income, including wages, interest, dividends, and other sources.

- Calculate your adjustments, deductions, and credits to determine your taxable income.

- Compute your total tax liability based on the tax tables provided.

- Sign and date the form, ensuring all information is accurate before submission.

Key elements of the California Resident Income Tax Return Form 540

The California Resident Income Tax Return Form 540 includes several key elements that taxpayers must understand. These elements consist of personal identification information, income reporting sections, and areas for claiming deductions and credits. Additionally, the form provides a section for calculating the total tax owed or refund expected. Understanding these components is crucial for accurate tax filing and compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the California Resident Income Tax Return Form 540 are typically aligned with federal tax deadlines. For most taxpayers, the deadline to file is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to the filing schedule each tax year to avoid penalties for late submissions.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the California Resident Income Tax Return Form 540. The form can be filed electronically through the California Franchise Tax Board's e-file system, which is often the fastest method for processing returns. Alternatively, taxpayers can mail a paper copy of the form to the appropriate address indicated in the instructions. In-person submissions may also be available at designated tax assistance centers, providing support for those who prefer face-to-face assistance.

Quick guide on how to complete california resident income tax return form 540

Effortlessly Complete California Resident Income Tax Return Form 540 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and safely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents promptly without delays. Manage California Resident Income Tax Return Form 540 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign California Resident Income Tax Return Form 540 with Ease

- Obtain California Resident Income Tax Return Form 540 and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced papers, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and electronically sign California Resident Income Tax Return Form 540 to ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california resident income tax return form 540

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California Resident Income Tax Return Form 540?

The California Resident Income Tax Return Form 540 is a state tax form used by residents of California to report their income and calculate their state income tax liability. This form is crucial for fulfilling your tax obligations in California and can be filed annually, reflecting your financial activity for the tax year. Understanding this form is essential for any California resident looking to effectively manage their taxes.

-

How can I eSign my California Resident Income Tax Return Form 540?

airSlate SignNow allows you to easily eSign your California Resident Income Tax Return Form 540 online. Simply upload the form, and use the intuitive editing tools to sign it electronically. This provides a secure and efficient way to complete your tax filing process without the need for physical paperwork.

-

What features does airSlate SignNow offer for handling Form 540?

airSlate SignNow provides a range of features designed for managing your California Resident Income Tax Return Form 540. These include customizable templates, eSignature capabilities, and secure cloud storage. These features streamline the filing process and ensure that you can easily access and manage your tax documents.

-

Is there a cost associated with using airSlate SignNow for Form 540?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individual users and businesses. While there may be associated costs, the platform emphasizes cost-effectiveness, providing signNow value for managing your California Resident Income Tax Return Form 540. You can choose a subscription that fits your usage requirements.

-

Can I store my California Resident Income Tax Return Form 540 on airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for your California Resident Income Tax Return Form 540 and other important documents. This ensures you can access your tax forms anytime, anywhere, while maintaining the confidentiality and security of your sensitive information.

-

Does airSlate SignNow integrate with other tax software?

Yes, airSlate SignNow offers integrations with various tax software solutions, making it easier to manage your California Resident Income Tax Return Form 540. This enables users to streamline their workflow by connecting their tax filings with additional tools and applications they may already be using. Check our integration options for more details.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your California Resident Income Tax Return Form 540 provides numerous benefits, including enhanced security, improved efficiency, and ease of use. The platform simplifies the signing process, reduces paperwork, and ensures you stay organized throughout tax season. This ultimately saves you time while avoiding potential errors in your filings.

Get more for California Resident Income Tax Return Form 540

Find out other California Resident Income Tax Return Form 540

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online