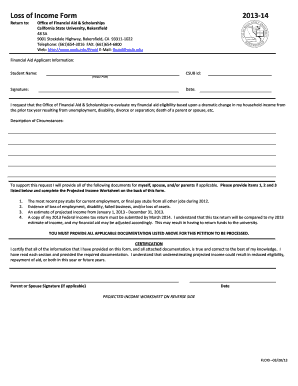

Csub Loss of Income Form

Understanding the loss of income letter

A loss of income letter is a formal document used to communicate a decrease in earnings due to specific circumstances, such as job loss, business closure, or health issues. This letter serves as a critical tool for individuals seeking financial assistance, insurance claims, or legal protections. It outlines the reasons for the income loss, the duration of the impact, and any supporting evidence that may be required, such as pay stubs or termination notices.

How to use the loss of income letter

Utilizing a loss of income letter involves several key steps. First, clearly state the purpose of the letter, whether it is for an insurance claim, loan application, or other financial assistance. Next, provide a detailed account of the circumstances leading to the income loss, including dates and relevant details. Attach any necessary documentation to support your claims. Finally, ensure that the letter is signed and dated to confirm its authenticity.

Key elements of the loss of income letter

Several essential components should be included in a loss of income letter to ensure it is effective. These elements include:

- Sender's Information: Include your name, address, phone number, and email.

- Recipient's Information: Clearly state the name and address of the individual or organization receiving the letter.

- Date: Include the date the letter is written.

- Subject Line: A brief statement indicating the purpose of the letter.

- Detailed Explanation: A thorough account of the reasons for the income loss.

- Supporting Documentation: Mention any documents attached to substantiate your claims.

- Closing Statement: A polite conclusion thanking the recipient for their attention.

Steps to complete the loss of income letter

To effectively complete a loss of income letter, follow these steps:

- Gather Information: Collect all relevant details regarding your income loss.

- Draft the Letter: Start with the sender's and recipient's information, followed by the date and subject line.

- Provide Details: Clearly explain the circumstances surrounding the loss of income.

- Attach Documentation: Include any necessary evidence to support your claims.

- Review and Edit: Proofread the letter for clarity and correctness.

- Sign and Date: Ensure the letter is signed and dated before sending.

Legal use of the loss of income letter

The loss of income letter can be used in various legal contexts, such as applying for unemployment benefits, filing insurance claims, or providing evidence in court cases. It is essential to ensure that the letter adheres to any legal requirements specific to your situation. This may include the need for notarization or specific formatting dictated by the receiving party.

Examples of using the loss of income letter

There are several scenarios in which a loss of income letter may be utilized:

- Insurance Claims: Individuals may submit this letter to their insurance provider when claiming benefits due to income loss.

- Loan Applications: Borrowers may need to provide this letter to lenders when applying for loans to demonstrate their financial situation.

- Legal Proceedings: In cases of wrongful termination or disability claims, this letter can serve as evidence of lost wages.

Quick guide on how to complete csub loss of income form

Complete Csub Loss Of Income Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Csub Loss Of Income Form on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Csub Loss Of Income Form with ease

- Obtain Csub Loss Of Income Form and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Highlight essential portions of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Csub Loss Of Income Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the csub loss of income form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loss of income letter?

A loss of income letter is a formal document that outlines the financial impact of an unexpected event, such as illness or job loss. It serves as proof for insurance companies or lenders when claiming compensation or financial assistance. Creating a professional loss of income letter is crucial for ensuring your claims are taken seriously.

-

How can airSlate SignNow help with my loss of income letter?

AirSlate SignNow provides a user-friendly platform for drafting and eSigning your loss of income letter. You can easily create a professional document tailored to your needs, while ensuring secure transmission and legal compliance. Our service simplifies the process, allowing you to focus on your primary concerns during difficult times.

-

Is there a cost associated with using airSlate SignNow for my loss of income letter?

Yes, airSlate SignNow offers affordable pricing plans tailored to different user needs. Whether you're a solo entrepreneur or part of a larger business, our plans provide value by enabling efficient document management, including loss of income letters. Visit our pricing page to find the plan that's right for you.

-

Can I customize my loss of income letter using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to customize your loss of income letter with ease. You can add specific details, adjust the layout, and include essential information to suit your unique situation. This personalization helps in making your letter more effective.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow offers a variety of features that streamline document management, including eSigning, templates, and secure storage. With these tools, you can create, send, and manage your loss of income letter effortlessly. Our platform ensures that your documents are well-organized and accessible whenever you need them.

-

Is airSlate SignNow secure for sensitive documents like a loss of income letter?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption methods and security protocols to protect your sensitive documents, including loss of income letters. Your information remains confidential and secure throughout the document signing process.

-

Does airSlate SignNow integrate with other applications for sending my loss of income letter?

Yes, airSlate SignNow offers seamless integration with various applications, enhancing your workflow when sending your loss of income letter. Connect with popular platforms like Google Drive, Dropbox, and more to easily access and manage your documents. This integration makes the process more efficient.

Get more for Csub Loss Of Income Form

Find out other Csub Loss Of Income Form

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney