Nd Lease Tax Worksheet Form

What is the Nd Lease Tax Worksheet

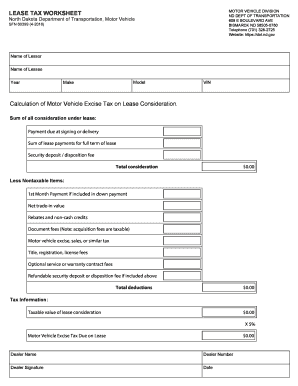

The Nd Lease Tax Worksheet is a crucial form used by individuals and businesses in North Dakota to calculate and report leasehold property taxes. This worksheet provides a structured format for taxpayers to detail their lease agreements and the associated financial obligations. It ensures compliance with state tax regulations and helps in accurately determining the amount owed to the state.

How to use the Nd Lease Tax Worksheet

Using the Nd Lease Tax Worksheet involves several steps to ensure accurate completion. First, gather all relevant information regarding the lease agreements, including property details, rental amounts, and any additional fees. Next, fill out the worksheet by entering the required data in the designated sections. It is essential to double-check all entries for accuracy before submission. Once completed, the worksheet can be submitted online or through traditional mail, as per the guidelines provided by the state tax authority.

Steps to complete the Nd Lease Tax Worksheet

Completing the Nd Lease Tax Worksheet requires careful attention to detail. Follow these steps for a successful submission:

- Collect all necessary documentation related to your lease agreements.

- Fill in the property information, including location and type of property.

- Enter the total rental income and any deductions applicable to your lease.

- Review the calculations for accuracy, ensuring all figures are correct.

- Submit the completed worksheet by the specified deadline.

Legal use of the Nd Lease Tax Worksheet

The Nd Lease Tax Worksheet is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or legal issues. Utilizing a reliable electronic signing solution can enhance the legal validity of the document, ensuring compliance with eSignature laws such as ESIGN and UETA.

Key elements of the Nd Lease Tax Worksheet

Several key elements are integral to the Nd Lease Tax Worksheet. These include:

- Property identification details, including address and type.

- Lease terms, including duration and rental amounts.

- Applicable deductions that can affect tax calculations.

- Signature lines for verification and legal acknowledgment.

Filing Deadlines / Important Dates

Filing deadlines for the Nd Lease Tax Worksheet are critical to avoid penalties. Taxpayers should be aware of the specific dates for submission, typically aligned with the annual tax filing season. It is advisable to check the North Dakota tax authority's official calendar for the most accurate and up-to-date information regarding deadlines.

Quick guide on how to complete nd lease tax worksheet

Accomplish Nd Lease Tax Worksheet effortlessly on any gadget

Managing documents online has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents rapidly without delay. Handle Nd Lease Tax Worksheet on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Nd Lease Tax Worksheet with ease

- Obtain Nd Lease Tax Worksheet and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight essential sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Nd Lease Tax Worksheet to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nd lease tax worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ND lease tax worksheet?

An ND lease tax worksheet is a document used to calculate and report lease tax liabilities in North Dakota. It helps businesses ensure compliance with state tax regulations by providing a structured format for reporting. Utilizing a digital solution like airSlate SignNow can streamline this process, making it simple and efficient.

-

How can airSlate SignNow help with ND lease tax worksheets?

airSlate SignNow allows you to create, send, and electronically sign ND lease tax worksheets easily. With its intuitive interface, businesses can quickly prepare and distribute these essential documents, saving time and reducing errors. Plus, eSigning features ensure quick turnaround times for approvals.

-

Is airSlate SignNow cost-effective for managing ND lease tax worksheets?

Yes, airSlate SignNow is a cost-effective solution for managing ND lease tax worksheets. The platform offers affordable pricing plans tailored to businesses of all sizes, ensuring that everyone can access the tools needed for efficient tax document management. You'll save money on paper, printing, and shipping costs too.

-

What are the key features for ND lease tax worksheets in airSlate SignNow?

Key features for ND lease tax worksheets in airSlate SignNow include customizable templates, electronic signatures, and real-time collaboration tools. These tools help streamline your document workflow and ensure that all parties can easily access and modify the ND lease tax worksheet as needed. Additionally, you can track document status in real-time.

-

Can I integrate airSlate SignNow with other software for ND lease tax worksheets?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow for ND lease tax worksheets. Whether you're using accounting software or project management tools, these integrations ensure that your documents sync efficiently, saving you time and effort.

-

Is it easy to access ND lease tax worksheets in airSlate SignNow?

Yes, accessing ND lease tax worksheets in airSlate SignNow is incredibly easy. You can store documents securely in the cloud, making them accessible from anywhere at any time. This convenience ensures that you have the necessary tools at your fingertips to manage and submit your lease tax documents on schedule.

-

What benefits does eSigning ND lease tax worksheets provide?

ESigning ND lease tax worksheets provides numerous benefits, including increased efficiency and faster processing times. With airSlate SignNow, parties can sign documents remotely, eliminating the need for physical meetings or delays. This not only accelerates the approval process but also enhances the overall user experience.

Get more for Nd Lease Tax Worksheet

- Agreement of book form

- Letter notifying form

- Application for license 497328913 form

- Theft 497328914 form

- Notice that use of website is subject to guidelines form

- Letter notifying 497328916 form

- Disclaimer providing instructions in the event a website contains materials that may infringe a copyright form

- Theft table form

Find out other Nd Lease Tax Worksheet

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile