Form 8288

What is the Form 8288

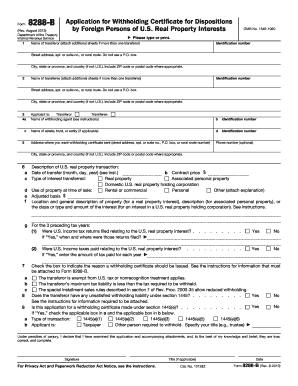

The Form 8288 is a tax document used by the Internal Revenue Service (IRS) in the United States. It is specifically designed for withholding tax on the disposition of U.S. real property interests by foreign persons. This form is crucial for ensuring compliance with U.S. tax laws and helps facilitate the proper collection of taxes on gains realized by foreign sellers of U.S. real estate. Understanding its purpose is essential for both buyers and sellers involved in such transactions.

How to use the Form 8288

Using the Form 8288 involves several steps to ensure accurate completion and submission. First, the foreign seller must fill out the form to report the sale of their U.S. real property interest. This includes providing details such as the seller's name, address, and taxpayer identification number, along with information about the property sold. After completing the form, it must be submitted to the IRS along with the appropriate payment for any withholding tax due. It is important to keep a copy of the completed form for personal records.

Steps to complete the Form 8288

Completing the Form 8288 requires careful attention to detail. Follow these steps:

- Gather necessary information, including the seller's details and property information.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the withholding tax based on the sale price of the property.

- Attach any required documentation that supports the sale and tax calculation.

- Submit the form and payment to the IRS by the specified deadline.

Legal use of the Form 8288

The legal use of the Form 8288 is governed by IRS regulations. It is essential for foreign sellers to use this form to comply with U.S. tax laws when disposing of U.S. real property. Failure to file the form can result in penalties and interest on unpaid taxes. Additionally, proper use of the form helps protect both the seller and the buyer from future tax liabilities and ensures that tax obligations are met in a timely manner.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8288 are critical to avoid penalties. The form must be submitted to the IRS within twenty days of the date of the sale of the property. It is important to keep track of these deadlines to ensure compliance and avoid any unnecessary fees. Marking important dates on a calendar can help manage the timeline effectively.

Required Documents

When completing the Form 8288, certain documents are required to support the information provided. These may include:

- Proof of the sale transaction, such as a closing statement.

- Documentation of the property’s value and sale price.

- Identification documents for the seller, including taxpayer identification numbers.

Having these documents ready can streamline the process and ensure accurate reporting to the IRS.

Penalties for Non-Compliance

Non-compliance with the requirements of the Form 8288 can lead to significant penalties. The IRS may impose fines for failure to file the form on time or for incorrect information provided. Additionally, interest may accrue on any unpaid taxes associated with the property sale. Understanding these potential penalties underscores the importance of timely and accurate completion of the form.

Quick guide on how to complete form 8288

Manage Form 8288 effortlessly on any gadget

Web-based document management has gained traction among organizations and individuals. It presents an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can access the necessary form and safely store it online. airSlate SignNow equips you with all the features required to create, edit, and electronically sign your paperwork swiftly without interruptions. Conduct Form 8288 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

How to edit and electronically sign Form 8288 with ease

- Find Form 8288 and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact confidential data with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Form 8288 while ensuring excellent communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8288

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8288 and why is it important?

Form 8288 is a tax form used by the IRS for withholding tax on dispositions by foreign persons of U.S. real property interests. It is crucial for compliance, as failing to submit this form can lead to penalties and issues with the IRS. Understanding how to correctly fill out and submit Form 8288 helps businesses avoid these potential pitfalls.

-

How does airSlate SignNow assist with Form 8288?

With airSlate SignNow, businesses can easily send and eSign Form 8288, streamlining the process of document management. Our platform's intuitive design ensures that users can complete all necessary signatures quickly and securely. This not only saves time but also ensures compliance with regulatory requirements.

-

What features does airSlate SignNow offer for managing Form 8288?

airSlate SignNow includes features such as customizable templates, automatic reminders, and secure storage for Form 8288. These tools help improve organization and ensure that important tax documents are handled efficiently. Additionally, users can track the status of their Form 8288 submissions in real-time.

-

Is airSlate SignNow cost-effective for businesses handling Form 8288?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to manage Form 8288 and other documents. With competitive pricing plans, organizations can choose the package that best fits their needs without compromising on features. This affordability ensures that all businesses, regardless of size, can stay compliant.

-

Can I integrate airSlate SignNow with other software for Form 8288 processing?

Absolutely! airSlate SignNow offers integrations with various software platforms, enhancing the processing of Form 8288. This interoperability allows users to connect with accounting or document management systems, making it more convenient to handle tax-related responsibilities from one central location.

-

What security measures does airSlate SignNow implement for Form 8288?

airSlate SignNow prioritizes security with features such as encryption, secure cloud storage, and access controls for Form 8288. This ensures that sensitive information remains protected throughout the signing process. Users can have peace of mind knowing their documents are secure and compliant with industry standards.

-

How can I get support for issues related to Form 8288 on airSlate SignNow?

Users can access dedicated customer support for any questions or issues related to Form 8288 on airSlate SignNow. Our support team is available via chat, email, and phone, ready to assist you with compliance concerns or technical difficulties. This commitment to support helps facilitate a smoother experience with our platform.

Get more for Form 8288

Find out other Form 8288

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template