Tax Registration Cancellation Notification Form

What is the Tax Registration Cancellation Notification

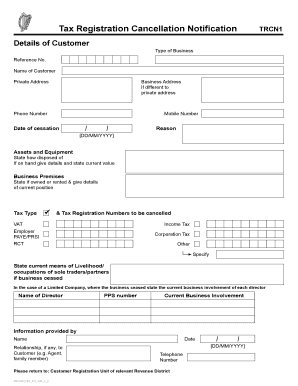

The tax registration cancellation notification is a formal document used to inform tax authorities that a business or individual is no longer required to maintain their tax registration. This notification is essential for ensuring that the tax records are updated and that no further tax obligations are mistakenly incurred. It is particularly relevant for businesses that have ceased operations, changed their business structure, or have moved to a different jurisdiction.

Steps to Complete the Tax Registration Cancellation Notification

Completing the tax registration cancellation notification involves several key steps to ensure accuracy and compliance. First, gather all relevant information, including your tax identification number, business details, and the reason for cancellation. Next, fill out the notification form accurately, providing all required details. It is crucial to review the form for any errors before submission. Finally, submit the completed form to the appropriate tax authority, either electronically or by mail, depending on the requirements of your state.

Legal Use of the Tax Registration Cancellation Notification

The legal use of the tax registration cancellation notification is governed by state and federal regulations. This form must be executed in accordance with the laws applicable to your jurisdiction to ensure its validity. Proper execution includes obtaining necessary signatures and ensuring that the notification is submitted within any specified timeframes. Failure to comply with these legal requirements may result in continued tax liabilities or penalties.

Who Issues the Form

The tax registration cancellation notification is typically issued by state tax authorities. Each state may have its own specific form and requirements for cancellation. It is essential to check with your local tax office to obtain the correct form and understand the submission process. In some cases, the IRS may also provide guidelines for federal tax registrations that require cancellation.

Required Documents

When submitting the tax registration cancellation notification, certain documents may be required to support your request. These may include proof of business closure, a copy of your tax registration certificate, or any relevant correspondence with tax authorities. Ensuring that you have all necessary documentation can facilitate a smoother cancellation process and help prevent delays.

Filing Deadlines / Important Dates

Filing deadlines for the tax registration cancellation notification can vary by state and the specific circumstances surrounding your cancellation. It is important to be aware of any deadlines to avoid penalties or continued tax obligations. Generally, it is advisable to submit the notification as soon as the decision to cancel is made to ensure compliance with local regulations.

Quick guide on how to complete tax registration cancellation notification

Effortlessly Prepare Tax Registration Cancellation Notification on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed documents, as you can access the required format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Tax Registration Cancellation Notification on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Easily Modify and eSign Tax Registration Cancellation Notification without Difficulty

- Find Tax Registration Cancellation Notification and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Registration Cancellation Notification to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax registration cancellation notification

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax registration cancellation notification?

A tax registration cancellation notification is an official document that notifies relevant tax authorities about the cancellation of a business's tax registration. It is essential for companies that are closing or no longer require their tax ID number. airSlate SignNow facilitates this process by allowing you to eSign and send documents securely.

-

How can airSlate SignNow help with tax registration cancellation notifications?

airSlate SignNow provides a user-friendly platform that allows businesses to quickly create, send, and eSign tax registration cancellation notifications. Our service ensures that your documents are securely stored and easily accessible, streamlining the cancellation process with minimal hassle.

-

Is there a cost associated with using airSlate SignNow for tax registration cancellation notifications?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. Each plan includes features to assist with eSigning tax registration cancellation notifications, and our competitive pricing makes it affordable for everyone looking for efficient document management.

-

Can airSlate SignNow integrate with other software for managing tax registration cancellation notifications?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM systems and accounting software. This helps streamline your workflow by enabling you to manage tax registration cancellation notifications alongside your other business processes.

-

What are the benefits of using airSlate SignNow for sending tax registration cancellation notifications?

Using airSlate SignNow for your tax registration cancellation notifications offers numerous benefits, including enhanced security, speed, and convenience. Our platform simplifies the documentation process, ensuring compliance while saving you time and reducing paperwork.

-

How secure is airSlate SignNow when handling tax registration cancellation notifications?

Security is a priority at airSlate SignNow. We employ state-of-the-art encryption and comply with industry standards to ensure that your tax registration cancellation notifications are safe from unauthorized access or bsignNowes. We prioritize the confidentiality and integrity of your documents.

-

What features does airSlate SignNow offer for managing tax registration cancellation notifications?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for your tax registration cancellation notifications. These tools help ensure that your documents are managed efficiently, resulting in a smoother cancellation process.

Get more for Tax Registration Cancellation Notification

Find out other Tax Registration Cancellation Notification

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online