Form 8824 Irs 2020

What is the Form 8824 IRS

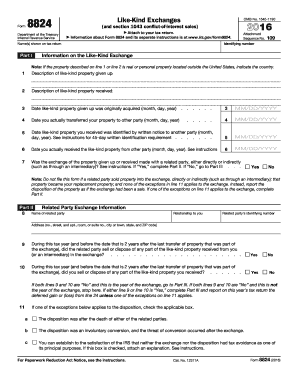

The Form 8824 IRS, also known as the Like-Kind Exchange form, is a tax form used by U.S. taxpayers to report the exchange of like-kind properties. This form is essential for individuals or businesses that want to defer capital gains taxes on the sale of an asset by reinvesting the proceeds into a similar asset. The IRS allows this tax deferral under Section 1031 of the Internal Revenue Code, provided specific criteria are met. The form requires detailed information about the properties involved in the exchange, including their values and the dates of the transactions.

How to use the Form 8824 IRS

Using the Form 8824 IRS involves several key steps. First, gather all necessary documentation related to the properties being exchanged. This includes purchase agreements, closing statements, and any appraisals. Next, complete the form by providing information about both the relinquished and acquired properties, including their fair market values and the dates of the exchanges. It is important to accurately fill out each section to ensure compliance with IRS regulations. Once completed, the form should be submitted along with your annual tax return to the IRS.

Steps to complete the Form 8824 IRS

Completing the Form 8824 IRS requires careful attention to detail. Follow these steps:

- Begin by entering your name, address, and taxpayer identification number at the top of the form.

- Provide information about the relinquished property, including its description, date of transfer, and fair market value.

- Next, detail the acquired property, including similar information regarding its description, date of acquisition, and fair market value.

- Complete any additional sections that apply, such as identifying any boot received during the exchange.

- Finally, review the form for accuracy and completeness before submitting it with your tax return.

Legal use of the Form 8824 IRS

The legal use of the Form 8824 IRS is governed by IRS regulations under Section 1031. To qualify for tax deferral, the exchanged properties must be held for productive use in a trade or business or for investment purposes. The properties must also be like-kind, meaning they are of the same nature or character. Failure to adhere to these guidelines can result in the disqualification of the exchange, leading to potential tax liabilities. It is advisable to consult a tax professional to ensure compliance with all legal requirements.

Filing Deadlines / Important Dates

The filing deadlines for the Form 8824 IRS align with the standard tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of the following year. If you require additional time, you can file for an extension, which typically grants an additional six months. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is crucial to keep track of these dates to ensure timely submission of the form.

Required Documents

To complete the Form 8824 IRS accurately, several documents are required:

- Purchase agreements for both the relinquished and acquired properties.

- Closing statements that detail the transactions.

- Appraisals or valuations of the properties to establish fair market value.

- Any additional documentation that supports the exchange, such as tax assessments or property descriptions.

Examples of using the Form 8824 IRS

Examples of using the Form 8824 IRS can help clarify its application. For instance, if a taxpayer sells a rental property and uses the proceeds to purchase another rental property, they can report this exchange using Form 8824. Another example involves a business owner who trades one commercial building for another. In both cases, if the properties meet the like-kind criteria, the taxpayer can defer capital gains taxes on the sale, allowing for reinvestment into the new property without immediate tax implications.

Quick guide on how to complete 2015 form 8824 irs

Prepare Form 8824 Irs effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides all the necessary tools to create, adjust, and eSign your documents swiftly without delays. Handle Form 8824 Irs on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The most efficient method to adjust and eSign Form 8824 Irs with ease

- Obtain Form 8824 Irs and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs within a few clicks from your device of choice. Edit and eSign Form 8824 Irs to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 8824 irs

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 8824 irs

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is Form 8824 IRS and why is it important?

Form 8824 IRS is used to report like-kind exchanges of real estate, allowing taxpayers to defer capital gains taxes. Understanding how to properly fill out this form is crucial for maximizing tax benefits. Using airSlate SignNow helps streamline the signing process, making it easier to manage your real estate transactions.

-

How can airSlate SignNow assist with filling out Form 8824 IRS?

airSlate SignNow provides an easy-to-use platform where you can fill out and eSign Form 8824 IRS securely. The platform guides you through the necessary fields, reducing the likelihood of errors. This feature ensures that you can efficiently handle all your tax documentation with confidence.

-

What are the pricing plans for using airSlate SignNow?

airSlate SignNow offers various pricing plans designed to fit different business needs. You can choose from a free trial or affordable monthly subscriptions that provide essential features for document signing, including for Form 8824 IRS. This flexibility makes it accessible for both small businesses and large enterprises.

-

Can I integrate airSlate SignNow with other applications for managing Form 8824 IRS?

Yes, airSlate SignNow supports integrations with various applications including CRM and document management systems. This functionality allows you to seamlessly manage Form 8824 IRS alongside other important documents and workflows. Integrating these tools enhances productivity and keeps everything organized.

-

What features does airSlate SignNow offer to enhance the eSigning experience?

airSlate SignNow offers features such as custom workflows, templates, and real-time tracking for all signed documents, including Form 8824 IRS. These tools help streamline the entire signing process, making it more efficient and organized. With airSlate SignNow, you can ensure that all parties can easily access and sign necessary forms.

-

Is airSlate SignNow secure for signing sensitive documents like Form 8824 IRS?

Absolutely, airSlate SignNow utilizes top-tier security measures to protect your sensitive documents, including Form 8824 IRS. With features like encryption and secure access, you can trust that your information is safe during the signing process. Security is a priority to ensure compliance and protect your data.

-

How does airSlate SignNow streamline the process of submitting Form 8824 IRS?

By using airSlate SignNow, you can easily complete and eSign Form 8824 IRS online, reducing the time spent on paperwork. The platform allows for quick sharing and immediate notifications, ensuring all parties are informed and engaged in the process. This efficiency helps you meet deadlines without hassle.

Get more for Form 8824 Irs

- Government of the district of columbia notice washington dc otr cfo dc form

- Nj designation form

- Certificate of deposit assignment agreementdoc form

- Ex parte motion to reinstate complaint for divorce and declaration form

- Fs 48s form

- Isi borang amanah raya form

- Family spending and savings questions form

Find out other Form 8824 Irs

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free