Individual Income Tax Payment Voucher Individual Income Colorado Form

What is the Individual Income Tax Payment Voucher Individual Income Colorado

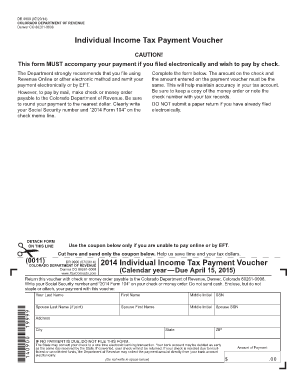

The Individual Income Tax Payment Voucher Individual Income Colorado is a form used by taxpayers in Colorado to submit their income tax payments. This voucher serves as a record of payment and is essential for individuals who need to pay their state income taxes directly. It is particularly useful for those who are self-employed or do not have taxes withheld from their income. By using this voucher, taxpayers can ensure that their payments are processed accurately and timely.

How to use the Individual Income Tax Payment Voucher Individual Income Colorado

To use the Individual Income Tax Payment Voucher Individual Income Colorado, taxpayers should first complete the form with their personal information, including name, address, and Social Security number. Next, they must indicate the amount being paid and the tax year associated with the payment. Once completed, the voucher should be submitted along with the payment, either by mail or electronically, depending on the available options provided by the state. It is important to retain a copy of the voucher for personal records.

Steps to complete the Individual Income Tax Payment Voucher Individual Income Colorado

Completing the Individual Income Tax Payment Voucher Individual Income Colorado involves several straightforward steps:

- Obtain the correct form from the Colorado Department of Revenue website or through authorized sources.

- Fill in your personal details, including your name, address, and Social Security number.

- Specify the payment amount and the tax year for which the payment is being made.

- Review the form for accuracy before submission.

- Choose your payment method: check, money order, or electronic payment.

- Submit the completed voucher along with your payment.

Key elements of the Individual Income Tax Payment Voucher Individual Income Colorado

The Individual Income Tax Payment Voucher Individual Income Colorado includes several key elements that are crucial for proper processing:

- Taxpayer Information: This includes the taxpayer's name, address, and Social Security number.

- Payment Amount: The total amount being paid must be clearly indicated.

- Tax Year: The specific tax year for which the payment applies should be noted.

- Signature: The taxpayer's signature is required to validate the submission.

Filing Deadlines / Important Dates

It is essential for taxpayers to be aware of the filing deadlines associated with the Individual Income Tax Payment Voucher Individual Income Colorado. Generally, payments are due on the same date as the state income tax return, which is typically April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should check the Colorado Department of Revenue for specific dates and any updates regarding extensions or changes.

Form Submission Methods (Online / Mail / In-Person)

The Individual Income Tax Payment Voucher Individual Income Colorado can be submitted through various methods. Taxpayers have the option to file online through the Colorado Department of Revenue's e-filing system, which provides a quick and efficient way to submit payments. Alternatively, the form can be mailed to the appropriate address provided on the voucher, or it can be delivered in person at designated state revenue offices. Each method has its own processing times, so taxpayers should choose the one that best fits their needs.

Quick guide on how to complete individual income tax payment voucher individual income colorado

Prepare Individual Income Tax Payment Voucher Individual Income Colorado effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and electronically sign your documents quickly without hold-ups. Manage Individual Income Tax Payment Voucher Individual Income Colorado on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and eSign Individual Income Tax Payment Voucher Individual Income Colorado with ease

- Locate Individual Income Tax Payment Voucher Individual Income Colorado and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Individual Income Tax Payment Voucher Individual Income Colorado and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the individual income tax payment voucher individual income colorado

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Individual Income Tax Payment Voucher Individual Income Colorado?

The Individual Income Tax Payment Voucher Individual Income Colorado is a form used by individuals to pay their state income tax liabilities. It simplifies the payment process and ensures timely remittance to the Colorado state treasury. Utilizing this voucher can help avoid late fees and penalties.

-

How can airSlate SignNow help with the Individual Income Tax Payment Voucher Individual Income Colorado?

With airSlate SignNow, you can easily send and eSign your Individual Income Tax Payment Voucher Individual Income Colorado securely and efficiently. Our platform automates the document signing process, allowing you to manage your tax forms without the hassle of printing or faxing. This ensures a faster turnaround for tax payment.

-

What are the pricing options for airSlate SignNow when using the Individual Income Tax Payment Voucher Individual Income Colorado?

airSlate SignNow offers various pricing plans that cater to different needs and budgets. Whether you’re an individual or a business, we provide cost-effective solutions to help you manage the Individual Income Tax Payment Voucher Individual Income Colorado and other documents seamlessly. Check our website for the latest pricing details.

-

Are there any features specifically for the Individual Income Tax Payment Voucher Individual Income Colorado?

Yes, airSlate SignNow includes features tailored for the Individual Income Tax Payment Voucher Individual Income Colorado, such as customizable templates and automated reminders. These features enhance your workflow, making it easier to fill out, sign, and submit your tax voucher on time. Simplifying tax compliance is our goal.

-

Can I integrate airSlate SignNow with other software for handling my Individual Income Tax Payment Voucher Individual Income Colorado?

Absolutely! airSlate SignNow offers integrations with various software tools to streamline your workflow for the Individual Income Tax Payment Voucher Individual Income Colorado. By integrating with accounting and tax preparation software, you can manage your financial documents in one place, reducing errors and improving efficiency.

-

What benefits does airSlate SignNow provide for submitting the Individual Income Tax Payment Voucher Individual Income Colorado?

Using airSlate SignNow for your Individual Income Tax Payment Voucher Individual Income Colorado comes with numerous benefits, such as enhanced security and compliance features. Our platform ensures that your information is safely stored and transmitted, providing peace of mind as you manage your tax obligations. Plus, eSigning is quick and convenient.

-

Is airSlate SignNow mobile-friendly for managing the Individual Income Tax Payment Voucher Individual Income Colorado?

Yes, airSlate SignNow is fully mobile-friendly, allowing you to manage the Individual Income Tax Payment Voucher Individual Income Colorado from anywhere. Whether you're using a smartphone or tablet, our platform ensures you can eSign and review documents on the go, making tax season more manageable.

Get more for Individual Income Tax Payment Voucher Individual Income Colorado

Find out other Individual Income Tax Payment Voucher Individual Income Colorado

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later