Business Structures Key Tax Obligations 2022-2026

Understanding the Business Structures Key Tax Obligations

The Business Structures Key Tax Obligations encompass various responsibilities that businesses must adhere to in order to remain compliant with federal and state tax regulations. These obligations vary depending on the type of business entity, such as sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each structure has its unique tax implications, including income tax, payroll tax, and sales tax obligations. Understanding these requirements is crucial for effective financial management and avoiding potential penalties.

Steps to Complete the Business Structures Key Tax Obligations

To ensure compliance with the Business Structures Key Tax Obligations, businesses should follow a systematic approach:

- Identify the business structure: Determine whether your business is a sole proprietorship, partnership, LLC, or corporation.

- Understand tax requirements: Research the specific tax obligations associated with your chosen business structure.

- Gather necessary documentation: Collect all relevant financial records, including income statements, expense reports, and previous tax returns.

- Complete required forms: Fill out the necessary tax forms accurately, ensuring that all information is up to date.

- Submit forms: File your tax returns by the designated deadlines, either electronically or by mail, depending on your preference.

Legal Use of the Business Structures Key Tax Obligations

The legal use of the Business Structures Key Tax Obligations involves adhering to the tax laws set forth by the Internal Revenue Service (IRS) and state tax authorities. Compliance not only protects your business from legal repercussions but also ensures that you take advantage of available deductions and credits. It is essential to stay informed about any changes in tax legislation that may affect your obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Business Structures Key Tax Obligations can vary based on the business entity type. Generally, the IRS requires businesses to file their federal tax returns by April 15 of each year. However, corporations may have different deadlines, such as March 15 for S Corporations. It is important to maintain a calendar of these dates to avoid late fees and penalties.

Required Documents

To fulfill the Business Structures Key Tax Obligations, businesses must prepare several key documents. These typically include:

- Tax returns: Complete federal and state tax returns for the relevant tax year.

- Financial statements: Provide income statements, balance sheets, and cash flow statements.

- Supporting documentation: Include receipts, invoices, and records of expenses to substantiate deductions.

Eligibility Criteria

Eligibility for specific tax obligations under the Business Structures Key Tax Obligations often depends on the business structure and the nature of the business activities. For instance, certain deductions may only be available to LLCs or corporations. Understanding these criteria helps ensure that your business complies with tax laws and maximizes available benefits.

Quick guide on how to complete business structures key tax obligations

Effortlessly Prepare Business Structures Key Tax Obligations on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, enabling you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without delays. Manage Business Structures Key Tax Obligations on any platform using airSlate SignNow's Android or iOS applications and simplify your document-based tasks today.

How to Modify and eSign Business Structures Key Tax Obligations with Ease

- Find Business Structures Key Tax Obligations and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Business Structures Key Tax Obligations to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business structures key tax obligations

Create this form in 5 minutes!

How to create an eSignature for the business structures key tax obligations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

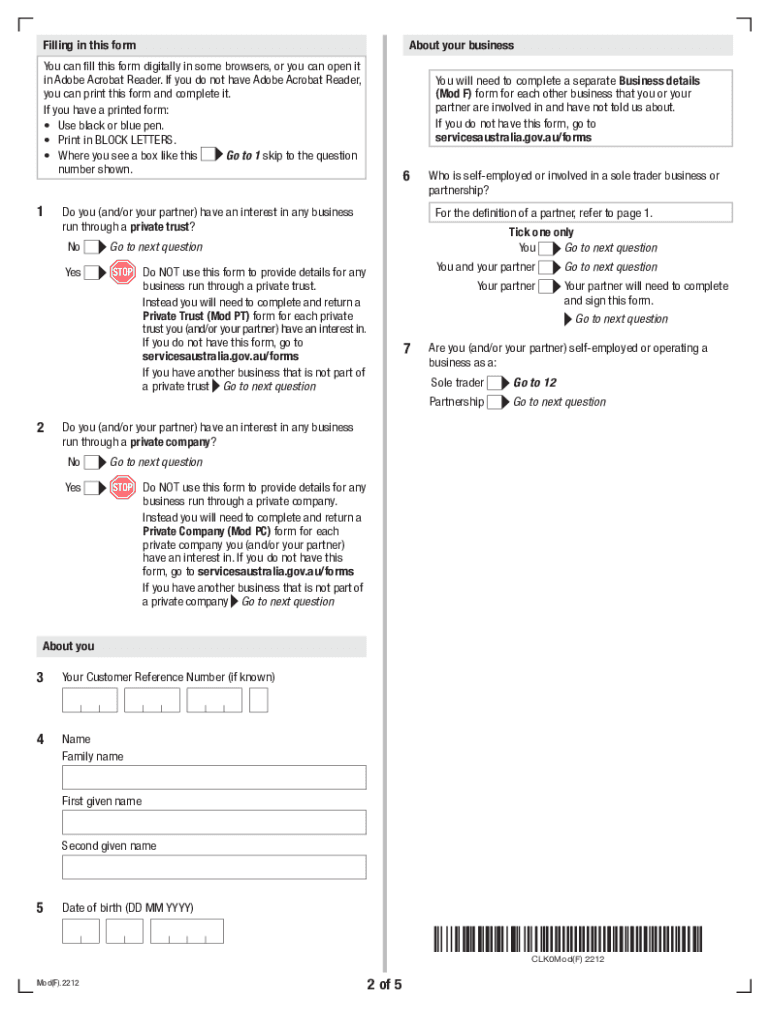

What is the mod f form and why is it important?

The mod f form is a crucial document used for various business processes, especially in transactions that require electronic signing. Understanding its significance can streamline workflows, ensuring both compliance and efficiency in your operations.

-

How does airSlate SignNow help with filling out the mod f form?

airSlate SignNow simplifies the process of filling out the mod f form by providing an intuitive interface for electronic signing and document management. This means you can easily customize your form, add necessary fields, and have multiple parties eSign with convenience.

-

What are the pricing options for using airSlate SignNow with the mod f form?

airSlate SignNow offers various pricing plans tailored to different business needs for managing documents like the mod f form. Our competitive pricing ensures you can access all the essential features at a cost-effective rate, with scalable options as your business grows.

-

Can I integrate the mod f form with other tools using airSlate SignNow?

Yes, airSlate SignNow provides integration capabilities with numerous applications, allowing you to manage the mod f form alongside your existing tools. This flexibility enhances productivity by ensuring seamless workflows across different platforms and systems.

-

What features does airSlate SignNow offer for handling the mod f form?

With airSlate SignNow, you get features like customizable templates for the mod f form, real-time tracking of document status, and secure storage options. These tools enable you to manage your documents efficiently while ensuring compliance and data security.

-

Is airSlate SignNow user-friendly for signing the mod f form?

Absolutely, airSlate SignNow is designed with user experience in mind, making it easy for anyone to eSign the mod f form. Even users with minimal technical knowledge can navigate the platform smoothly and complete their tasks without hassle.

-

What are the security measures in place when using the mod f form with airSlate SignNow?

airSlate SignNow takes security seriously by employing advanced encryption methods to protect your mod f form and other sensitive documents. Additionally, we comply with industry standards, ensuring that your data remains secure throughout the signing process.

Get more for Business Structures Key Tax Obligations

Find out other Business Structures Key Tax Obligations

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors