Ca Tax Return 2020-2026

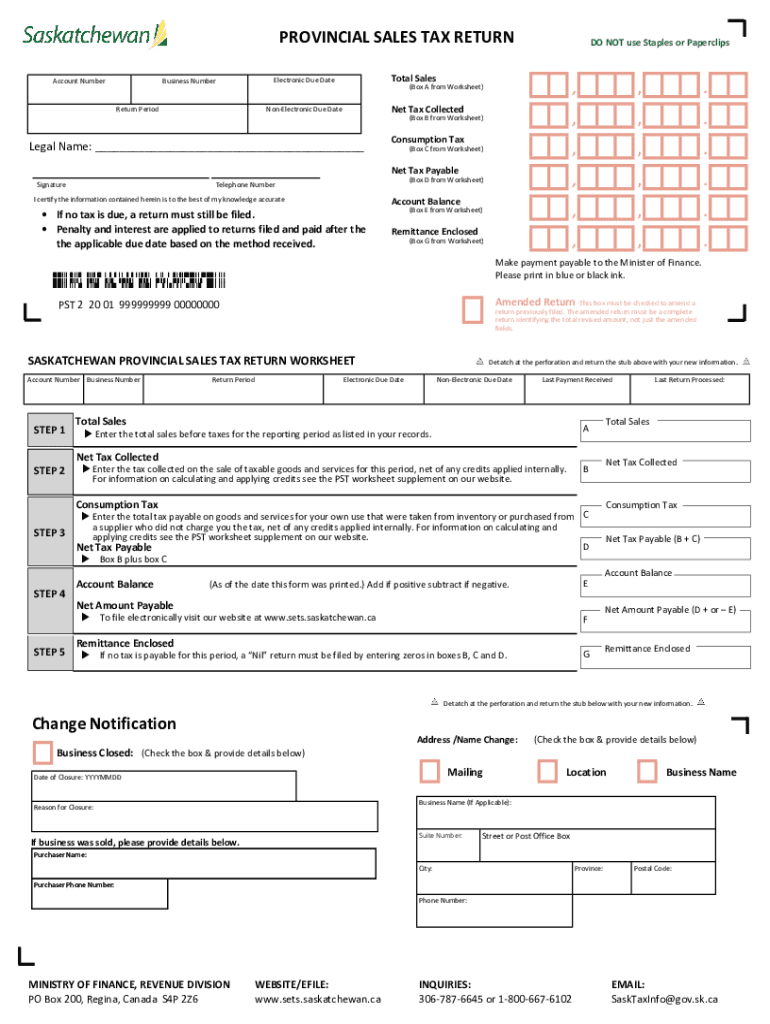

What is the PST Tax Return?

The PST tax return is a document that businesses in certain states, including Saskatchewan, must file to report and remit provincial sales tax. This tax is levied on the sale of goods and services, and the return provides a summary of taxable sales and the amount of tax collected during a specific period. Understanding the PST tax return is essential for compliance with state tax laws and for maintaining accurate financial records.

Steps to Complete the PST Tax Return

Completing the PST tax return involves several key steps:

- Gather necessary documentation, including sales records and receipts.

- Calculate the total taxable sales for the reporting period.

- Determine the amount of PST collected from customers.

- Fill out the PST tax return form with the calculated figures.

- Submit the completed form to the appropriate tax authority, either electronically or by mail.

Required Documents for the PST Tax Return

To successfully file a PST tax return, businesses should prepare the following documents:

- Sales invoices and receipts that detail taxable sales.

- Records of exempt sales, if applicable.

- Previous PST tax returns for reference.

- Any correspondence with tax authorities regarding sales tax matters.

Filing Deadlines / Important Dates

Timely filing of the PST tax return is crucial to avoid penalties. Key deadlines include:

- Monthly filers must submit their returns by the last day of the month following the reporting period.

- Quarterly filers have a deadline of the last day of the month following the end of the quarter.

- Annual filers must submit their returns by January 31 of the following year.

Legal Use of the PST Tax Return

The PST tax return serves as a legal document that ensures compliance with provincial tax regulations. It is important for businesses to accurately report their sales and tax collected to avoid legal repercussions. Filing the return on time and maintaining proper records can protect businesses from audits and penalties.

Form Submission Methods

Businesses can submit their PST tax return through various methods:

- Online submission via the state’s tax authority website, which often provides a streamlined process.

- Mailing a paper form to the designated tax office.

- In-person submission at local tax offices, if available.

Quick guide on how to complete ca tax return 618853393

Complete Ca Tax Return effortlessly across any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your paperwork quickly and without interruptions. Manage Ca Tax Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to modify and eSign Ca Tax Return effortlessly

- Obtain Ca Tax Return and select Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Mark important sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Ca Tax Return to ensure smooth communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca tax return 618853393

Create this form in 5 minutes!

How to create an eSignature for the ca tax return 618853393

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PST tax return and why is it important?

A PST tax return is a declaration of sales tax collected by businesses on taxable sales. Filing this return is essential for compliance with tax regulations, ensuring that your business avoids penalties and maintains good standing. Accurate filings also enhance your financial reporting and credibility.

-

How can airSlate SignNow help with PST tax returns?

airSlate SignNow streamlines the process of gathering signatures for PST tax returns and related documents. By using our platform, you can securely send, receive, and eSign documents, simplifying your tax preparation. This efficiency helps you stay organized and allows for timely submissions to tax authorities.

-

What are the costs associated with using airSlate SignNow for PST tax returns?

airSlate SignNow offers flexible pricing plans tailored to businesses of all sizes, ensuring that you can find a cost-effective solution for managing your PST tax returns. Subscription plans typically include comprehensive features like unlimited document sends and electronic signatures. Consider starting with a free trial to see how our platform can save you time and money.

-

Are there any features specifically designed for handling PST tax returns?

Yes, airSlate SignNow incorporates features facilitating the handling of PST tax returns, such as customizable templates and automated reminders for filing deadlines. These innovations help ensure all necessary documents are completed on time. Additionally, our secure cloud storage keeps your tax information safe and accessible.

-

Can I integrate airSlate SignNow with my accounting software for PST tax returns?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing for seamless data transfer when handling PST tax returns. This integration helps streamline your workflow, reduces data entry errors, and enhances your overall productivity during tax season.

-

Is airSlate SignNow secure for filing PST tax returns?

Yes, airSlate SignNow prioritizes security with advanced encryption protocols and compliance with industry regulations. Your PST tax return documents are protected, ensuring that sensitive information is kept confidential and secure. You can trust our platform to handle your tax-related documents safely.

-

What benefits will I gain from using airSlate SignNow for PST tax return management?

Using airSlate SignNow for PST tax return management offers numerous benefits, including improved efficiency, reduced paperwork, and a hassle-free signing process. Our platform's user-friendly interface helps simplify the document workflow. Ultimately, this saves you time and allows you to focus more on your business.

Get more for Ca Tax Return

Find out other Ca Tax Return

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free