Lowest Income Form

Understanding the Concept of Lowest Income

The term "lowest income" refers to the minimum amount of earnings that a person or household receives, which can affect eligibility for various financial programs and benefits. In the United States, understanding your lowest income is crucial for tax purposes, as it can influence your tax liability and eligibility for credits or deductions. Accurate reporting of your income ensures compliance with IRS guidelines and can help you avoid penalties associated with incorrect filings.

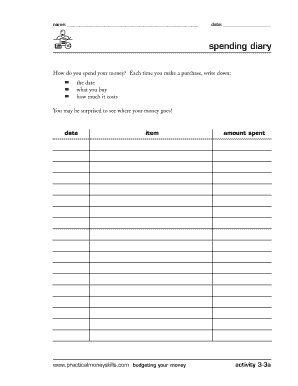

Steps to Complete the Spending Diary

Completing a spending diary involves several straightforward steps that help track your financial activities effectively. Begin by gathering all your financial documents, including bank statements, receipts, and invoices. Next, categorize your expenses into groups such as housing, transportation, food, and entertainment. Record each expense daily, noting the date, amount, and category. Regularly reviewing your spending diary can provide insights into your financial habits and help identify areas for improvement. Ensure that your entries are accurate and consistent to maintain the integrity of your financial tracking.

Legal Use of the Spending Diary

A spending diary can serve as a valuable tool for legal and financial documentation. In the context of tax filings, maintaining a detailed record of your income and expenses can support claims for deductions and credits. It is important to ensure that your spending diary complies with relevant regulations, including IRS guidelines on record-keeping. This documentation can also be useful in legal situations, such as divorce proceedings or disputes over financial matters, where proof of income and expenses is required.

Key Elements of a Spending Diary

To create an effective spending diary, certain key elements should be included. These elements consist of:

- Date: The date when the expense was incurred.

- Description: A brief description of the expense.

- Category: The category to which the expense belongs, such as groceries or utilities.

- Amount: The total amount spent.

- Payment Method: The method used to pay for the expense, such as cash, credit card, or debit card.

Incorporating these elements will enhance the clarity and usefulness of your spending diary, making it easier to analyze your financial habits.

Examples of Using a Spending Diary

Utilizing a spending diary can manifest in various practical scenarios. For instance, if you are a student managing a limited budget, a spending diary can help track your monthly expenses against your income from part-time work or allowances. Similarly, families can use a spending diary to monitor household expenses and identify areas where they can cut back, such as dining out or entertainment. Business owners may also benefit from maintaining a spending diary to track operational costs, ensuring they stay within budget and maximize profitability.

Filing Deadlines and Important Dates

When using a spending diary for tax purposes, it is essential to be aware of filing deadlines and important dates. For individual taxpayers, the deadline for filing federal income tax returns is typically April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. Keeping your spending diary updated throughout the year can simplify the process of preparing your tax return and ensure that you meet all necessary deadlines. Additionally, being mindful of state-specific filing dates is crucial, as they may differ from federal deadlines.

Quick guide on how to complete lowest income

Complete Lowest Income effortlessly on any device

Managing documents online has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your papers quickly without delays. Manage Lowest Income on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Lowest Income effortlessly

- Find Lowest Income and click on Get Form to initiate.

- Use the tools at your disposal to complete your document.

- Highlight important parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for such purposes.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious searches for forms, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Lowest Income and ensure clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lowest income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a spending diary and how can it help me manage my finances?

A spending diary is a tool that allows you to track and categorize your daily expenses. By documenting your spending habits, you can identify patterns, cut unnecessary costs, and improve your overall financial health. Using a spending diary helps you stay accountable and make informed budgeting decisions.

-

Does airSlate SignNow offer features specific to maintaining a spending diary?

Yes, airSlate SignNow includes features that enable users to effortlessly track their spending and manage expenses digitally. You can create and send documents related to your spending diary, ensuring accurate record-keeping. Additionally, its user-friendly interface makes it easy to update your spending diary on-the-go.

-

Is there a cost associated with using airSlate SignNow for my spending diary?

AirSlate SignNow offers a variety of pricing plans to suit different budgets, ensuring that managing your spending diary is accessible to everyone. The cost-effective solution scales with your needs, whether you're an individual or part of a larger organization. You can choose from free trials to premium subscription plans for greater features.

-

Can I integrate my spending diary with other financial tools?

Absolutely! AirSlate SignNow provides seamless integrations with popular financial management tools. This means you can easily sync your spending diary data with your preferred budgeting apps, enhancing your financial oversight and helping you maintain a comprehensive view of your expenses.

-

How secure is my data when using airSlate SignNow for my spending diary?

Data security is a top priority for airSlate SignNow, and your spending diary information is protected with advanced encryption protocols. We ensure that any documents related to your spending diary are safely stored and accessible only by authorized users. You can manage your finances with confidence and peace of mind.

-

Can airSlate SignNow help me analyze my spending diary data?

Yes, airSlate SignNow can assist in analyzing your spending diary data by allowing you to create custom reports and visualizations. This feature helps you see trends in your spending habits and identify areas where you can save money. With in-depth analysis, you can make more informed financial decisions.

-

Is there customer support available for users of the spending diary feature?

Yes, airSlate SignNow offers comprehensive customer support for all users, including those utilizing the spending diary feature. Our dedicated support team is available to assist you with any inquiries or technical issues. Whether you need help getting started or optimizing your spending diary, we've got you covered.

Get more for Lowest Income

Find out other Lowest Income

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple