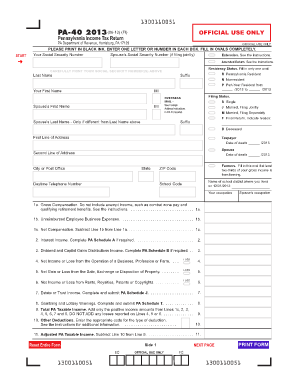

Pennsylvania Income Tax Return PA 40 Department of Form

What is the Pennsylvania Income Tax Return PA 40 Department Of

The Pennsylvania Income Tax Return PA 40 is a form used by residents of Pennsylvania to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, allowing them to report wages, salaries, and other sources of income. The PA 40 form is submitted to the Pennsylvania Department of Revenue, which oversees the collection of state income taxes. Understanding the purpose and requirements of this form is crucial for compliance with state tax laws.

Steps to complete the Pennsylvania Income Tax Return PA 40 Department Of

Completing the Pennsylvania Income Tax Return PA 40 involves several key steps:

- Gather Required Documents: Collect all necessary documents, including W-2 forms, 1099 forms, and any other income statements.

- Fill Out the Form: Accurately enter your personal information, income details, and any deductions or credits you may qualify for.

- Calculate Your Tax Liability: Use the provided tax tables or software to determine the amount of tax owed or refund due.

- Review Your Information: Double-check all entries for accuracy to avoid delays or penalties.

- Submit the Form: File your completed PA 40 form either electronically or via mail to the Pennsylvania Department of Revenue.

Legal use of the Pennsylvania Income Tax Return PA 40 Department Of

The Pennsylvania Income Tax Return PA 40 is a legally recognized document that must be completed accurately to comply with state tax laws. Filing this form is not only a legal obligation but also a means to ensure that taxpayers fulfill their civic duties. Failure to submit the PA 40 can result in penalties, interest on unpaid taxes, and potential legal action from the state. It is important to maintain records of your submission and any correspondence with the Department of Revenue for future reference.

Filing Deadlines / Important Dates

Taxpayers in Pennsylvania must adhere to specific deadlines when filing the PA 40 form. The standard deadline for filing is April 15 of each year, aligning with federal tax filing dates. If the deadline falls on a weekend or holiday, it is typically extended to the next business day. Taxpayers should also be aware of any extensions available and the implications of filing late, which may include penalties and interest charges.

Form Submission Methods (Online / Mail / In-Person)

The Pennsylvania Income Tax Return PA 40 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can file electronically using approved e-filing software, which often simplifies the process and speeds up refunds.

- Mail: The completed form can be printed and mailed to the Pennsylvania Department of Revenue at the designated address.

- In-Person: Some individuals may choose to deliver their forms in person at local Department of Revenue offices, although this method is less common.

Required Documents

To successfully complete the Pennsylvania Income Tax Return PA 40, taxpayers must gather several key documents, including:

- W-2 forms from employers detailing annual wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest, dividends, or rental income.

- Documentation for any deductions or credits claimed, such as receipts for charitable contributions or educational expenses.

Quick guide on how to complete pennsylvania income tax return pa 40 department of

Easily Prepare Pennsylvania Income Tax Return PA 40 Department Of on Any Device

Digital document organization has gained signNow traction among companies and individuals. It serves as an ideal eco-conscious substitute for conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary resources to create, modify, and electronically sign your documents swiftly and without complications. Handle Pennsylvania Income Tax Return PA 40 Department Of on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Edit and Electronically Sign Pennsylvania Income Tax Return PA 40 Department Of with Ease

- Locate Pennsylvania Income Tax Return PA 40 Department Of and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize pertinent portions of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Formulate your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review the details and click the Done button to apply your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Pennsylvania Income Tax Return PA 40 Department Of and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pennsylvania income tax return pa 40 department of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Pennsylvania Income Tax Return PA 40 Department Of?

The Pennsylvania Income Tax Return PA 40 Department Of is a form used by residents of Pennsylvania to report their income and calculate their state tax liability. It is essential for ensuring compliance with state tax regulations and can be filed electronically or via paper form.

-

How can airSlate SignNow assist with the Pennsylvania Income Tax Return PA 40 Department Of?

airSlate SignNow allows users to securely send and eSign their Pennsylvania Income Tax Return PA 40 Department Of documents. This streamlines the filing process, making it more efficient and easier to manage all necessary signatures and approvals.

-

Is airSlate SignNow cost-effective for filing the Pennsylvania Income Tax Return PA 40 Department Of?

Yes, airSlate SignNow offers an affordable solution for businesses and individuals needing to file the Pennsylvania Income Tax Return PA 40 Department Of. Its pricing plans are designed to provide value without compromising on essential features like eSigning and document management.

-

What features does airSlate SignNow offer for managing Pennsylvania Income Tax Return PA 40 Department Of?

airSlate SignNow features include customizable templates for the Pennsylvania Income Tax Return PA 40 Department Of, automated workflows, and real-time tracking. These tools enhance productivity and reduce the risk of errors in your taxation processes.

-

Can I integrate airSlate SignNow with accounting software for filing the Pennsylvania Income Tax Return PA 40 Department Of?

Absolutely, airSlate SignNow offers integrations with various accounting software to facilitate seamless management of your Pennsylvania Income Tax Return PA 40 Department Of. This ensures that all financial data is synchronized and easily accessible.

-

What are the benefits of using airSlate SignNow for my Pennsylvania Income Tax Return PA 40 Department Of?

Using airSlate SignNow for your Pennsylvania Income Tax Return PA 40 Department Of provides benefits such as enhanced security, reduced processing time, and improved accuracy. This enables you to focus on your business while ensuring compliance.

-

Is airSlate SignNow user-friendly for filing the Pennsylvania Income Tax Return PA 40 Department Of?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to file their Pennsylvania Income Tax Return PA 40 Department Of. The intuitive interface guides users through the process, ensuring a smooth experience.

Get more for Pennsylvania Income Tax Return PA 40 Department Of

Find out other Pennsylvania Income Tax Return PA 40 Department Of

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT