Ct 1096 Fillable Form

What is the Ct 1096 Fillable Form

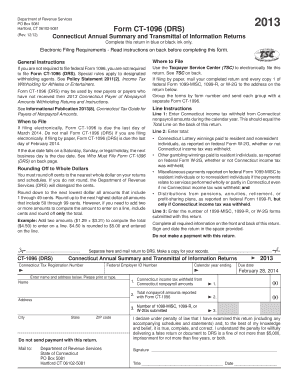

The Ct 1096 Fillable Form is a tax-related document used primarily for reporting certain types of income and tax information to the Connecticut Department of Revenue Services. This form is essential for businesses and individuals who need to report payments made to non-resident contractors or vendors. By accurately completing this form, taxpayers ensure compliance with state tax regulations, helping to avoid potential penalties. The form serves as a summary of various payments made throughout the tax year, providing a clear record for both the payer and the state.

How to use the Ct 1096 Fillable Form

Using the Ct 1096 Fillable Form involves several straightforward steps. First, download the form from the official Connecticut Department of Revenue Services website or a reliable source. Next, fill in the required fields, including your name, address, and taxpayer identification number. Be sure to accurately report the total amount paid to each contractor or vendor. After completing the form, review all entries for accuracy before submitting it to the appropriate state authority. Utilizing digital tools can streamline this process, allowing for easy corrections and electronic submission.

Steps to complete the Ct 1096 Fillable Form

Completing the Ct 1096 Fillable Form involves a series of methodical steps:

- Download the form from a reliable source.

- Enter your personal information, including your name and address.

- Provide your taxpayer identification number.

- List the payments made to each contractor or vendor, ensuring the amounts are accurate.

- Double-check all entries for any errors or omissions.

- Submit the completed form to the Connecticut Department of Revenue Services either electronically or via mail.

Legal use of the Ct 1096 Fillable Form

The legal use of the Ct 1096 Fillable Form is crucial for maintaining compliance with state tax laws. This form must be filed accurately and on time to avoid penalties. It serves as an official record of payments made to non-resident contractors, which is necessary for the state to track income and tax obligations. Failure to file or inaccuracies in reporting can lead to fines or audits. Therefore, understanding the legal implications of this form is essential for both individuals and businesses.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 1096 Fillable Form are typically aligned with the end of the tax year. It is important to submit the form by the specified due date to avoid late fees. Generally, the form must be filed by the last day of February following the end of the tax year. Taxpayers should also be aware of any updates or changes to deadlines announced by the Connecticut Department of Revenue Services, as these can vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The Ct 1096 Fillable Form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form online through the Connecticut Department of Revenue Services website, which often allows for quicker processing. Alternatively, the form can be mailed to the designated address provided on the form. For those who prefer in-person submissions, visiting a local tax office may also be an option, although this may require an appointment. Each submission method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete ct 1096 fillable form

Effortlessly Prepare Ct 1096 Fillable Form on Any Device

The management of online documents has gained signNow traction among both organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Control Ct 1096 Fillable Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Modify and Electronically Sign Ct 1096 Fillable Form with Ease

- Locate Ct 1096 Fillable Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and electronically sign Ct 1096 Fillable Form and guarantee excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 1096 fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Ct 1096 Fillable Form?

The Ct 1096 Fillable Form is a document used to report annual data regarding Connecticut's wage withholding for businesses. It is designed to simplify tax reporting and can be electronically filled out and submitted to ensure accuracy. Utilizing a Ct 1096 Fillable Form can help streamline your payroll process and ensure compliance with state requirements.

-

How do I fill out the Ct 1096 Fillable Form?

To fill out the Ct 1096 Fillable Form, you can download it from the Connecticut Department of Revenue Services website or use an eSignature solution like airSlate SignNow. The form requires specific information, including your business name, employer identification number, and withholding amounts for the year. With airSlate SignNow's platform, you can easily add data directly into the fillable form and sign it electronically.

-

Is there a cost associated with using the Ct 1096 Fillable Form?

Using the Ct 1096 Fillable Form itself is free; however, if you choose to utilize airSlate SignNow for eSigning and sending the form, there will be associated subscription costs. airSlate SignNow offers various pricing plans designed to accommodate different business needs, ensuring that you can find a cost-effective solution. Check our pricing page for detailed information on plans.

-

What are the benefits of using an electronic Ct 1096 Fillable Form?

Using an electronic Ct 1096 Fillable Form offers several benefits, including enhanced accuracy, easier data management, and quicker submission. You can fill out and submit the form from anywhere, reducing the need for physical paperwork and minimizing errors. This not only saves time but also ensures you meet your tax deadlines efficiently.

-

Can I integrate the Ct 1096 Fillable Form with other applications?

Yes, the Ct 1096 Fillable Form can be integrated with various applications when using airSlate SignNow. Our platform allows seamless integration with accounting software and cloud storage systems, enabling better document management and accessibility. This integration simplifies the process of filing and tracking your forms and financial data.

-

Is the Ct 1096 Fillable Form secure for sending sensitive information?

Absolutely! When you use airSlate SignNow to send the Ct 1096 Fillable Form, you benefit from robust security features. Our platform employs industry-standard encryption protocols to protect your sensitive data throughout the signing and submission process, ensuring that your information remains confidential and secure.

-

What is the turnaround time for processing the Ct 1096 Fillable Form?

The turnaround time for processing the Ct 1096 Fillable Form can depend on multiple factors, such as submission method and timing. By utilizing airSlate SignNow, you can submit the form electronically, which generally speeds up the processing time compared to traditional mailing methods. This ensures that your information is timely reviewed and acknowledged by the authorities.

Get more for Ct 1096 Fillable Form

Find out other Ct 1096 Fillable Form

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online