Invesco 403b Distribution Form

What is the Invesco 403b Distribution Form

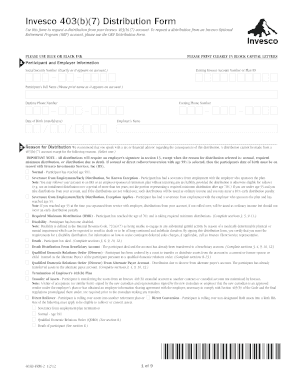

The Invesco 403b Distribution Form is a necessary document for individuals who wish to withdraw funds from their Invesco 403b retirement account. This form facilitates the process of accessing retirement savings, which is typically reserved for specific circumstances such as retirement, disability, or other qualifying events. Completing this form accurately ensures compliance with IRS regulations and helps avoid potential penalties associated with premature withdrawals.

How to use the Invesco 403b Distribution Form

Using the Invesco 403b Distribution Form involves several key steps. First, download the form from the Invesco website or request a physical copy from your plan administrator. Next, fill out the required information, including personal details and the type of distribution you are requesting. It is essential to review the form for accuracy and completeness before submission. Once completed, you can submit the form according to the instructions provided, which may include options for online submission, mailing, or in-person delivery.

Steps to complete the Invesco 403b Distribution Form

Completing the Invesco 403b Distribution Form requires careful attention to detail. Begin by entering your personal information, including your name, address, and Social Security number. Next, specify the type of distribution you are requesting, such as a lump-sum payment or periodic withdrawals. Provide any additional information required, such as your account number and the reason for the distribution. After ensuring all sections are filled out correctly, sign and date the form. Finally, submit the form through the designated method outlined by Invesco.

Legal use of the Invesco 403b Distribution Form

The legal use of the Invesco 403b Distribution Form is governed by IRS regulations, which dictate the conditions under which funds can be withdrawn from a 403b account. This form must be used in accordance with these regulations to ensure that distributions are processed legally. It is important to understand the implications of withdrawing funds, including potential tax liabilities and penalties for early withdrawal. Utilizing the form correctly helps safeguard your retirement savings while ensuring compliance with applicable laws.

Required Documents

When submitting the Invesco 403b Distribution Form, certain documents may be required to process your request efficiently. Typically, you will need to provide proof of identity, such as a government-issued ID, and any supporting documentation that justifies the distribution, like medical records for disability claims or retirement letters. Having these documents ready can expedite the processing of your distribution request and help avoid delays.

Form Submission Methods

The Invesco 403b Distribution Form can be submitted through various methods, depending on the options provided by Invesco. Common submission methods include online submission through the Invesco portal, mailing the completed form to the designated address, or delivering it in person to a local Invesco office. Each method has its own processing times, so it's advisable to choose the one that best fits your needs and timeline.

Quick guide on how to complete invesco 403b distribution form

Effortlessly Prepare Invesco 403b Distribution Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly, without any delays. Manage Invesco 403b Distribution Form on any device using the airSlate SignNow apps available for Android or iOS, and enhance your document-related processes today.

Steps to Modify and eSign Invesco 403b Distribution Form with Ease

- Find Invesco 403b Distribution Form and click Get Form to begin.

- Use the tools provided to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Invesco 403b Distribution Form while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the invesco 403b distribution form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Invesco 403b plan?

An Invesco 403b plan is a retirement savings plan specifically designed for employees of non-profit organizations, public schools, and other tax-exempt entities. It allows participants to save for retirement by making pre-tax contributions to their accounts, which can grow tax-deferred until withdrawal. By utilizing airSlate SignNow, you can easily manage and eSign necessary documents related to your Invesco 403b.

-

What are the benefits of using an Invesco 403b?

The primary benefits of an Invesco 403b include potential tax savings, investment growth, and employer matching contributions. Additionally, the plan offers a variety of investment options to help employees tailor their retirement strategy. airSlate SignNow provides a streamlined process to eSign enrollment forms and other related documentation for your Invesco 403b.

-

How much does an Invesco 403b cost?

The costs associated with an Invesco 403b can vary based on investment options and administrative fees. Generally, there may be management fees and possible advisor fees, but these are typically lower compared to commercial retirement plans. Using airSlate SignNow can help you track and manage these costs efficiently with easily accessible documents.

-

How do I enroll in an Invesco 403b plan?

To enroll in an Invesco 403b plan, you will need to fill out enrollment forms provided by your employer or your chosen investment advisor. This process often requires eSigning several documents, which can be efficiently handled through airSlate SignNow's user-friendly platform. Make sure to review the investment options available within the Invesco 403b to make informed decisions.

-

What types of investment options are available in an Invesco 403b?

An Invesco 403b plan typically offers a diverse range of investment options, including mutual funds, annuities, and fixed income investments to cater to various risk tolerances. It's essential to assess these options in light of your retirement goals. Utilizing airSlate SignNow can simplify the documentation for changing or reviewing your investment choices in your Invesco 403b.

-

Can I transfer my existing retirement funds into an Invesco 403b?

Yes, you can typically transfer existing retirement funds into an Invesco 403b through a process called a rollover. The rules for rollovers may vary, so it's best to consult with your financial advisor for specific guidance. The airSlate SignNow platform can facilitate the eSigning of necessary rollover documents for your Invesco 403b seamlessly.

-

What happens to my Invesco 403b when I change jobs?

When changing jobs, you have several options regarding your Invesco 403b, including leaving the funds in the plan, rolling them over to a new employer's plan, or transferring them to an IRA. Each option has its implications for growth and access to funds, so consider these carefully. airSlate SignNow can assist you in electronically signing any related documentation needed for these transitions.

Get more for Invesco 403b Distribution Form

Find out other Invesco 403b Distribution Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT